This week, the crypto market has witnessed a notable positive shift, particularly in prices for major alternative cryptocurrencies XRP, DOGE and XLM.

These tokens are once again priced more or less the same on the Nasdaq-listed Coinbase, considered a proxy for the stateside demand, and the offshore giant Binance, TradingView data shows.

The recovery from the steep discounts on Coinbase observed in the second half of the last month points to renewed participation of stateside investors in these markets.

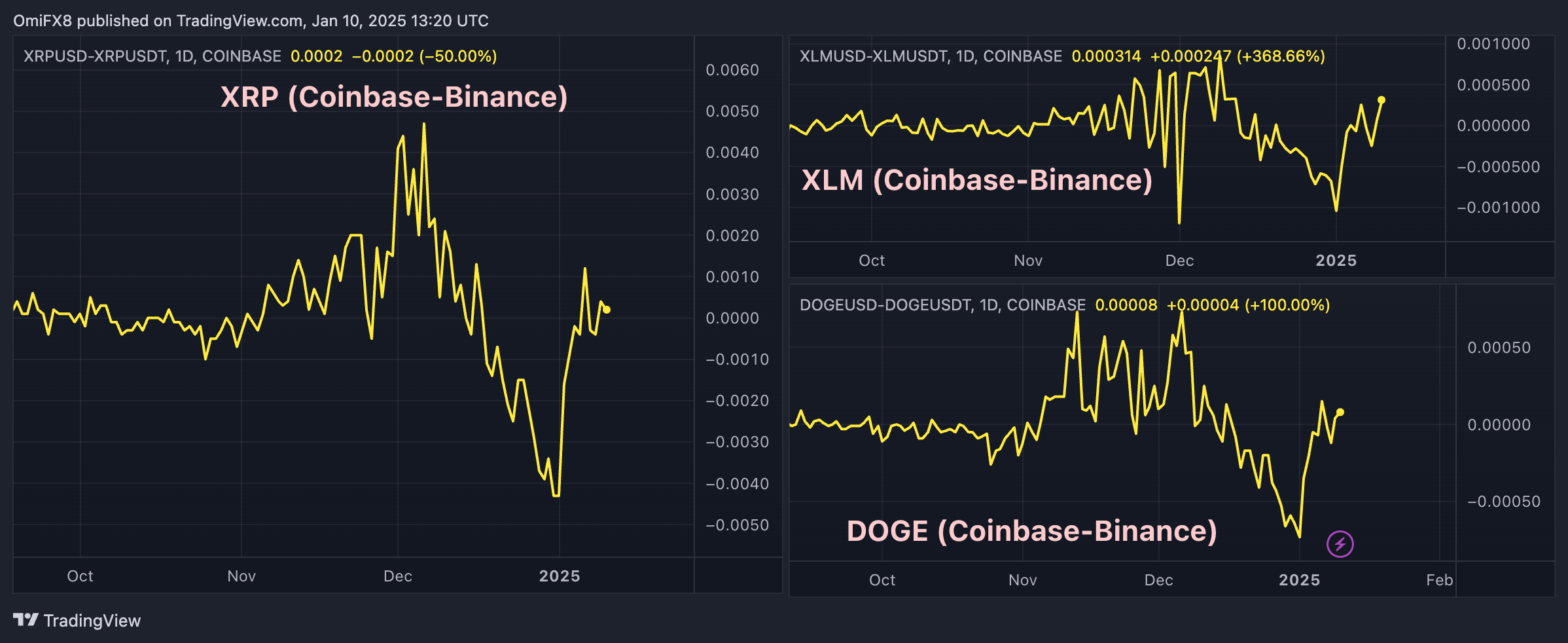

The above charts show the so-called Coinbase premium indicator for XRP, XLM and DOGE. It measures the spread between the dollar-denominated prices on Coinbase versus the tether-denominated prices on Binance. Tether is the world’s largest stablecoin, with a value that is 1:1 to the U.S. dollar.

The Coinbase premium for the three tokens surged in early December as BTC’s move to lifetime highs above $108,000 spurred risk-taking. BTC’s uptrend, however, ran out of steam in the second half of the month as hawkish Fed expectations gripped the market, tempering bullish expectations in the altcoin sector.

The premium, then, quickly turned to a discount.