XRP, the third-largest cryptocurrency by market value, has replaced bitcoin (BTC) as the most-traded digital asset on Coinbase (COIN), the Nasdaq-listed cryptocurrency exchange that’s seen as a proxy for U.S. demand.

Bitcoin retained its position as most-traded crypto asset on Binance, the largest exchange by volume, which is off-limits to U.S. investors.

Volume trends are consistent with the recovery in the U.S. demand for XRP, which is closely linked to blockchain-based payment network Ripple, as presaged by the Coinbase premium indicator a week ago.

Interest in XRP, the biggest gainer following Donald Trump’s election victory in November, increased after Ripple CEO Brad Garlinghouse met the president-elect almost two weeks ago. It’s also been supported by speculation of a spot XRP exchange-traded fund (ETF) being approved in the U.S.

At press time, the XRP/USD pair accounted for 25% of Coinbase’s 24-hour trading volume of $6.86 billion. The BTC/USD pair ranked second, contributing 20% with ETH/USD in third place, according to data source Coingecko. On Binance, XRP was the second-most traded coin.

Since November, the payments-focused cryptocurrency’s price has risen over 600% to $3.33, the highest since 2017. The valuation has increased by a third this week alone, according to CoinDesk and TradingView data.

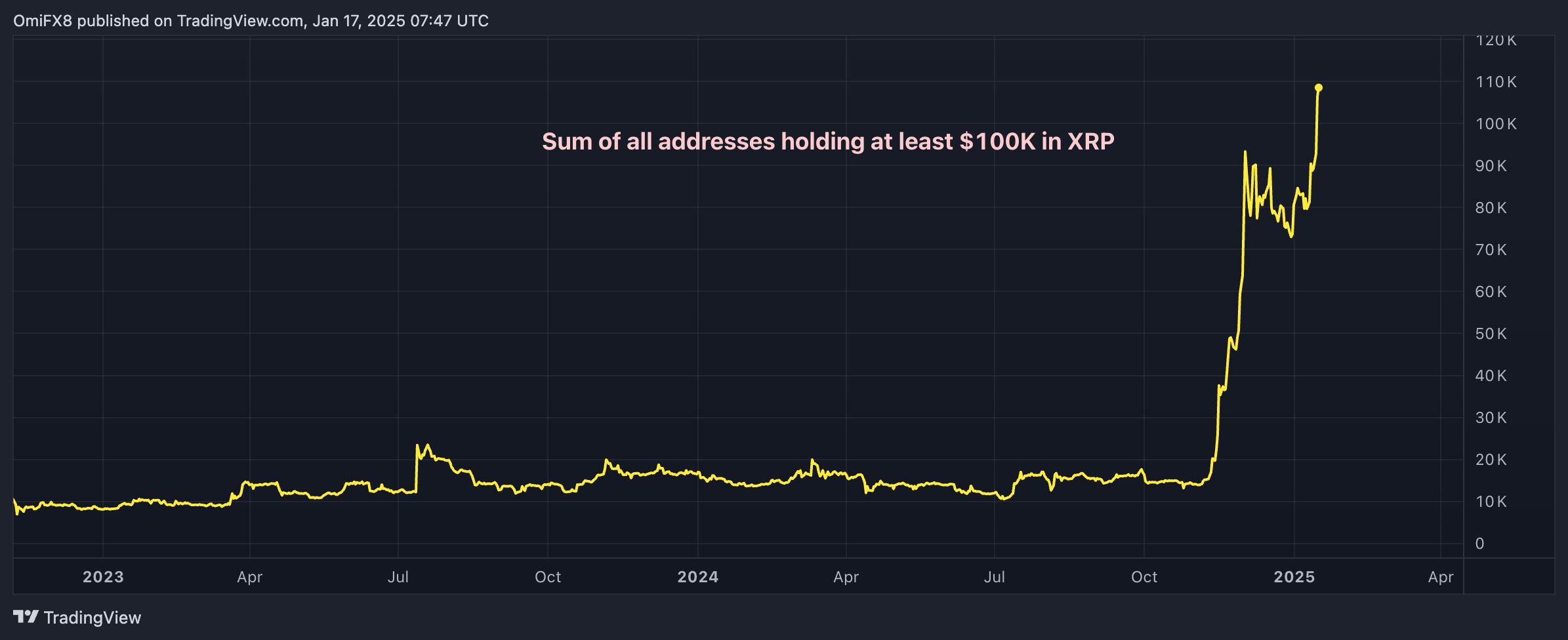

The rally is backed by a record futures open interest and a spike in the number of large holders. Data tracked by TradingView and CoinMetrics show the number of unique addresses holding at least $100,000 worth of cryptocurrency has increased to 108,540.