Bitcoin (BTC) is fast closing on the $100,000 mark as U.S. President Donald Trump teased a major trade deal, with reports suggesting it could be with the U.K.

The upswing in prices is consistent with the cryptocurrency’s broader bullish technical setup and buoyant risk sentiment in traditional markets. As of this writing, the Asian stocks traded higher, with the futures tied to the S&P 500 up by 0.6%.

Still, a couple of factors suggest the $100,000 breakout may not be a smooth ride.

WSJ pours cold water over optimism

Firstly, as per the Wall Street Journal, the big trade deal that Trump teased on Truth Social could be a “framework of an announcement with tariff adjustments.”

In other words, the impending announcement could be a framework of discussions that could lead to a trade deal weeks or months from now. So, the bullish momentum in BTC could slow once the initial optimism fades.

Resistance at $99.9K

As discussed earlier this week, the $99,900 could prove a tough nut to crack due to the potential for increased selling pressure from those who bought coins around these levels early this year and profit taking by long-term holders.

Coinbase premium

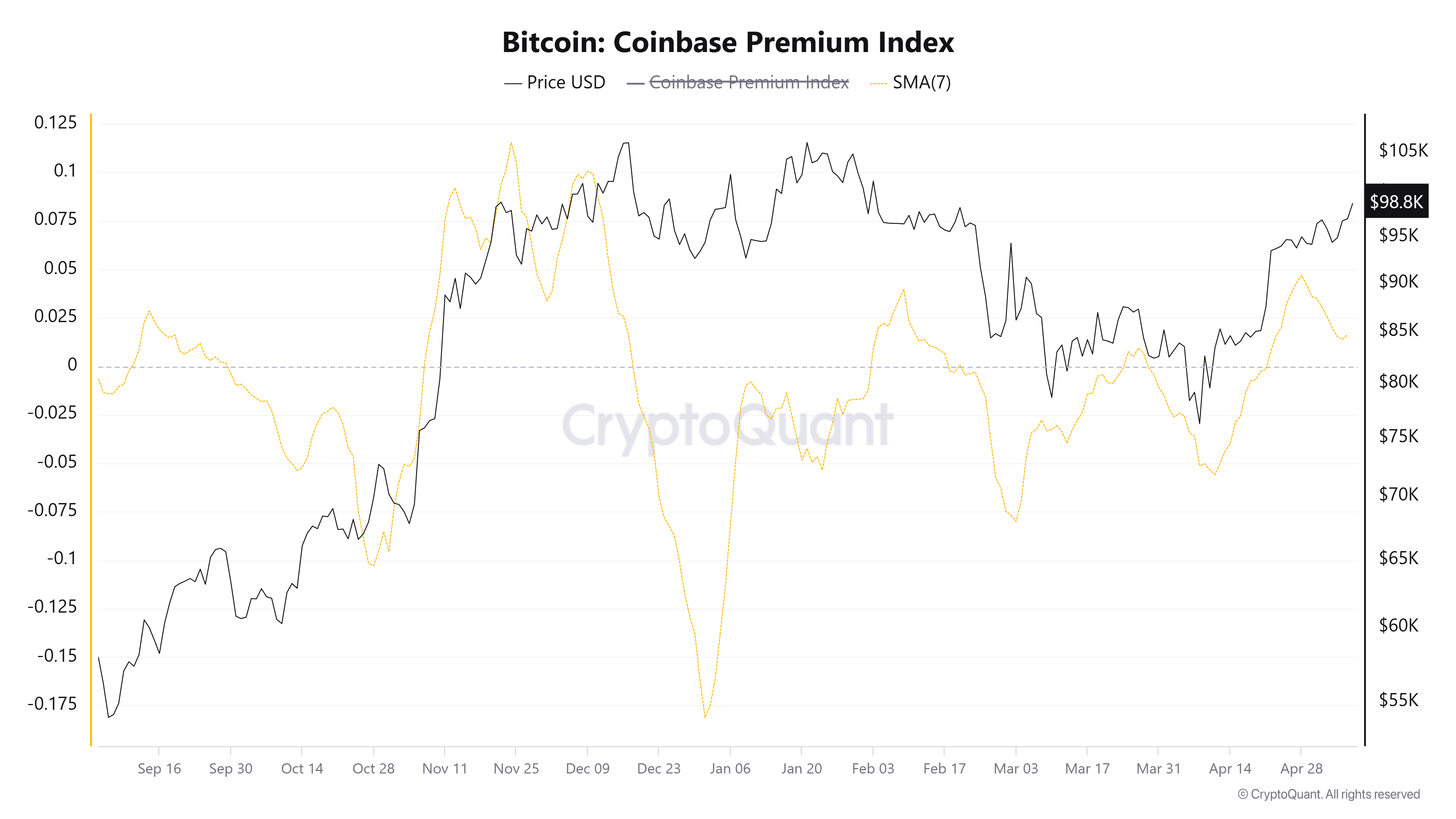

Coinbase premium indicator, which measures the spread between BTC’s dollar-denominated price on the Coinbase exchange and tether-denominated price on Binance, is widely seen as a proxy for demand from the U.S.-based investors.

In the past, sustained BTC bull runs have been characterized by an uptick in the Coinbase premium.

However, since late April, the seven-day moving average of the Coinbase premium has diverged bearishly from the price.

Bearish RSI divergence

While BTC set a new multi-week high during the Asian session, the 14-hour relative strength index, an indicator used to gauge momentum and overbought and oversold conditions, didn’t follow suit.

The resulting bearish divergence suggests the momentum may be weakening.