Prices remain under pressure and sentiment is so weak one would think it’s 2022 all over again, but for the first time in nearly a year, bitcoin (BTC) whales are buying.

Following months of distribution as bitcoin surged to a record high above $109,000, so-called whales — wallets holding 10,000 BTC or more — are meaningfully accumulating as prices dip to just above $80,000, according to Glassnode data.

The last time whales were buying so aggressively was in August 2024 with bitcoin in the $50,000-$60,000 range as the yen carry trade was unwinding.

Often considered “smart money,” whales tend to buy during deep corrections and sell into strength — a pattern that has played out consistently over the past eight months.

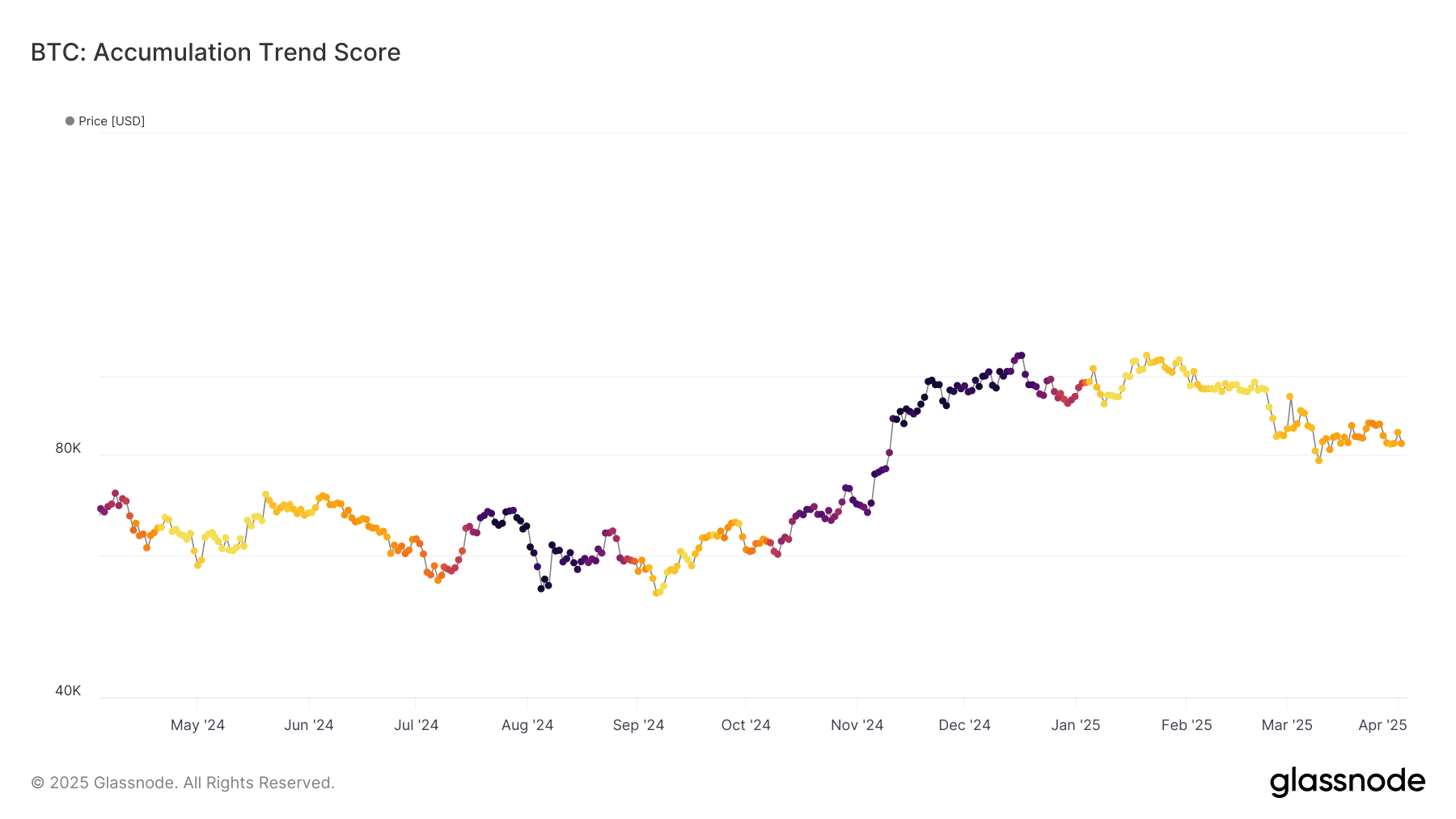

Despite this renewed whale activity, broader market behavior remains bearish, with bitcoin currently down 25% from its all-time high. Glassnode’s Accumulation Trend Score, which tracks the behavior of different wallet cohorts over a 15-day window, shows that most other investor groups are still in distribution mode.

A score closer to 1 signals accumulation, while a score near 0 indicates distribution. With an overall market score of just 0.15, selling pressure remains dominant. This suggests that while whales are starting to buy the dip, broader market sentiment continues to lean bearish, potentially putting further downward pressure on price—at least in the short term.