Some issues never truly go away, and the U.S. debt ceiling, which limits the maximum amount the government can borrow, is one of them. It’s back in the spotlight, but past experience suggests it could be positive for bitcoin (BTC) and risk assets in general.

The U.S. will hit its roughly $36 trillion debt limit on Tuesday, meaning it cannot borrow more from the public to fund its operations.

“The debt limit does not authorize new spending, but it creates a risk that the federal government might not be able to finance its existing legal obligations that Congresses and Presidents of both parties have made in the past,” outgoing Treasury Secretary Janet Yellen said in an official announcement on Friday.

The very thought of the world’s largest economy unable to borrow more might scare investors, but note that a default and government shutdown won’t happen immediately. Yellen has said that the Treasury will implement “extraordinary measures” from Tuesday, buying time at least till March 14.

One potential measure could be running down the Treasury General Account (TGA), the government’s operating account at the Fed used to collect taxes, customs duties, proceeds from the sale of securities, and public debt receipts while facilitating government payments.

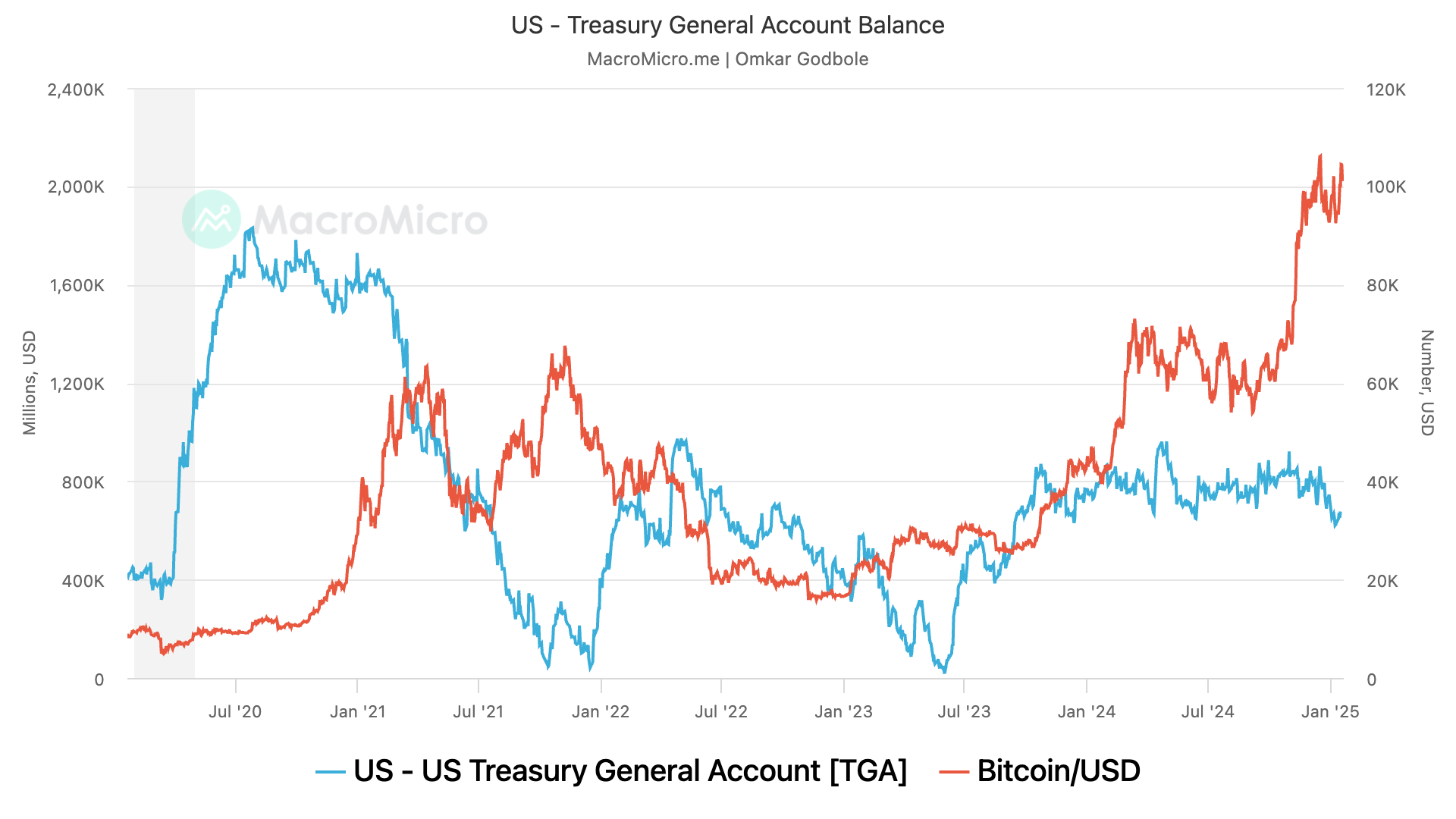

The previous debt ceiling episode of early 2023, which involved using TGA to meet expenses, positively impacted risk assets, including bitcoin.

That’s because when the government spends the TGA balance, the cash goes to bank accounts of various entities, like contractors, employers and others, at commercial banks. That boosts the amount of reserves held by commercial banks. With more reserves, they have a better capacity to lend money, potentially increasing lending or investment in the broader economy and financial markets.

As of Monday, the balance of the Treasury General Account was $677 billion.

The chart illustrates Bitcoin’s price alongside changes in the Treasury General Account (TGA) balance over the past five years.

Notably, drawdowns in the TGA have frequently coincided with bitcoin bull runs, suggesting the inverse correlation between the two.