The U.S. is likely to hit the maximum it’s legally allowed to borrow at some point between Jan. 14 and Jan. 23, Treasury Secretary Janet Yellen said in a Friday letter to the speaker of the House of Representatives, Mike Johnson. After that, the Treasury will take “extraordinary measures” to cut borrowing.

“I respectfully urge Congress to act to protect the full faith and credit of the United States,” she wrote. In June 2023, Congress suspended the debt limit until Jan. 1, 2025.

Risk assets weakened into the market close, just before the letter was publicized. U.S. equities fell, with the S&P 500, Nasdaq 100 and Dow Jones Industrial Average all losing about 1%. Bitcoin dropped as much as 4% from its intraday high.

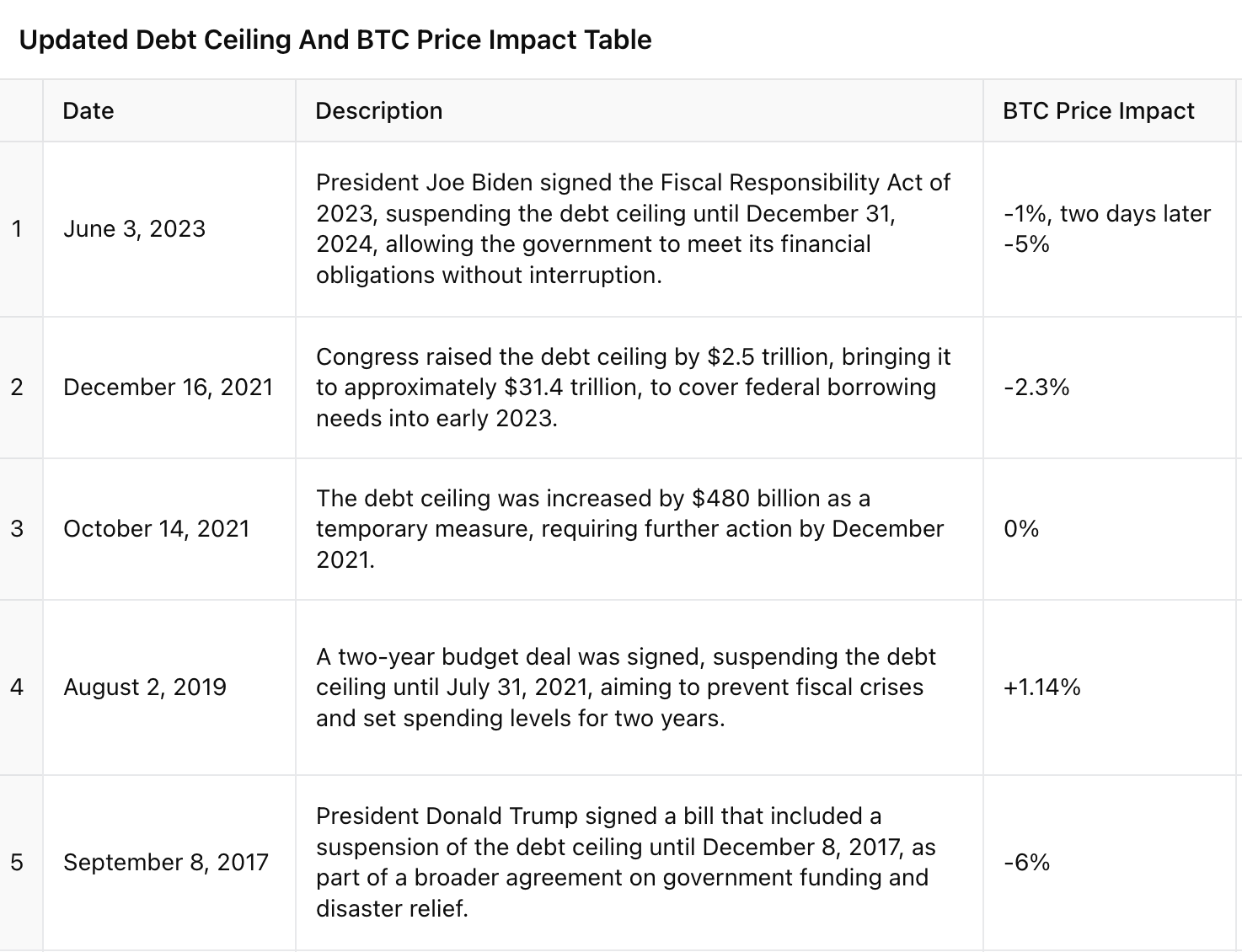

Raising the debt ceiling has historically been a negative signal for the largest cryptocurrency, which has dropped or underperformed during the following days on the past five occasions.

This December has not been a strong month for bitcoin, which is down 3% and on track for its first red month since August.

To add to the political and economic uncertainty, President-elect Donald Trump’s inauguration will occur on Jan. 20, between the dates Yellen highlighted.

According to Zerohedge, Congress first established a debt limit of $45 billion back in 1939 and has raised it 103 times as government spending continues to outpace tax receipts. The U.S. national debt is now over $36.2 trillion.

Another influence on the bitcoin price is its parallel to previous cycles. Since the cycle low that occurred during the FTX collapse in November 2022, BTC has been aligned with the previous two cycles.

It is now just shy of a 500% return, similar to the two previous cycles at the same point in the cycle. That’s not a good sign for the bulls.

The 2018-2022 and 2015-2018 cycles both saw significant drawdowns at this point in the cycle, highlighted by the red box in the chart below. It’s just possible Trump’s inauguration date of Jan. 20 could signal a bottom for bitcoin.