World Liberty Financial Financial (WLFI), the crypto project backed by the family of U.S. President Donald Trump, has made another purchase of Tron’s TRX for its treasury on-chain data shows.

“As a strong advocate for blockchain technology and innovation in cryptocurrencies, I’m excited to see World Liberty Financial integrate TRON as a key part of its growing treasury. TRX’s inclusion as the fourth-largest asset in WLFI’s holdings highlights its trust in the Tron blockchain network,” Justin Sun, founder of Tron, said in a statement to CoinDesk.”

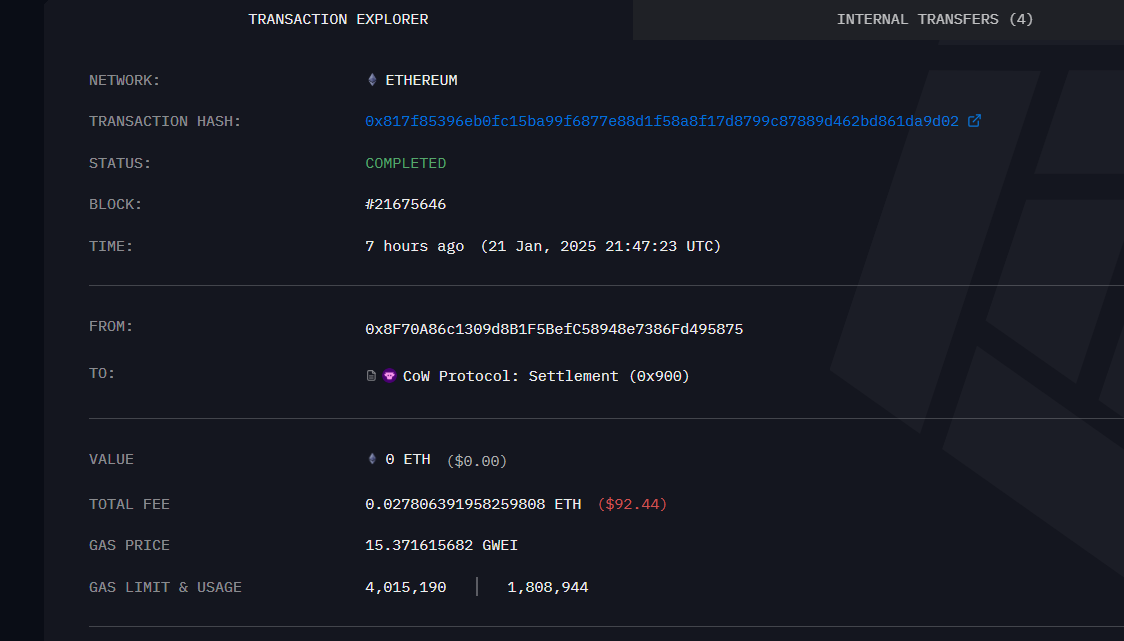

This most recent purchase was to the tune of $2.6 million and adds an additional 10.8 million TRX to the WLFI treasury. The total holdings of TRX now come in at $7.5 million.

“With WLFI leading efforts to bridge traditional finance and crypto and the Trump administration’s pro-crypto stance, the United States will become a major hub for innovation and cryptocurrency adoption,” Sun continued.

CoinDesk reported in mid-January that WFLI intended to purchase TRX and a Tron delegation attended Trump’s inauguration.

WFLI is also holding $182 million in ETH, $48 million in WBTC, $7.2 million in Tether’s USDT, $7 million in AAVE, and $6.7 million in Chainlink’s LINK according to on-chain data with most token buys coming in before the inauguration.

Sources close to the matter say WLFI will continue to increase their TRX holdings.