Representatives from two protocols that have tokens held by the treasury of World Liberty Financial (WLFI), a crypto project backed by President Donald Trump and his family, are denying the existence of a token swap agreement that required a $10 million – $15 million buy-in to get included in the project.

A report from Blockworks on Monday alleged that representatives from WLFI had pitched protocol teams on a deal to get included in the project’s treasury. The deal was they could buy $10 million WLFI tokens plus a 10 percent fee, and WLFI will purchase the same amount of their protocol’s tokens.

“There is no token swap agreement,” a spokesperson from TRON told CoinDesk.

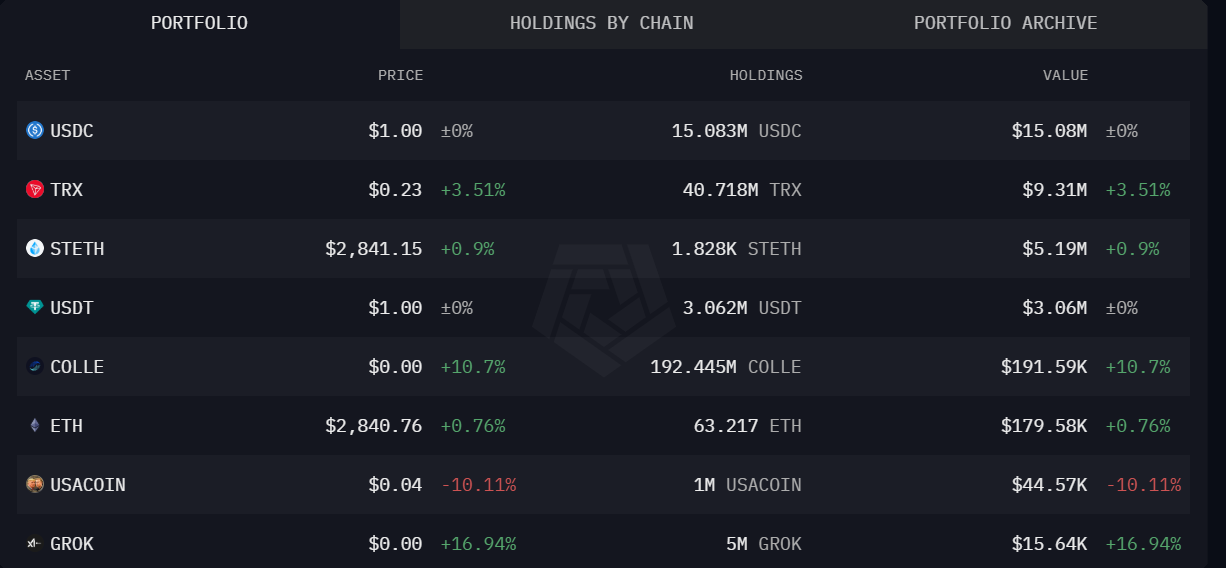

TRON’s TRX is the second largest holding in WLFI’s wallet, according to on-chain data curated by Arkham.

The WLFI wallet currently holds 40.7 million TRX worth $9.3 million. WLFI made these buys in tranches throughout January.

Movement Labs, which saw its MOVE token jump in late January when WLFI purchased $2 million of it, and rumors swirled that the team was in discussion with Elon Musk-led Department of Government Efficiency, also denied that there was a swap agreement in place.

Rushi Manche, co-founder of Movement Labs, told CoinDesk earlier that they did not send tokens to anyone including WLFI.

“There weren’t any deals — any back door deals. It was purely just market buying,” Manche told CoinDesk.