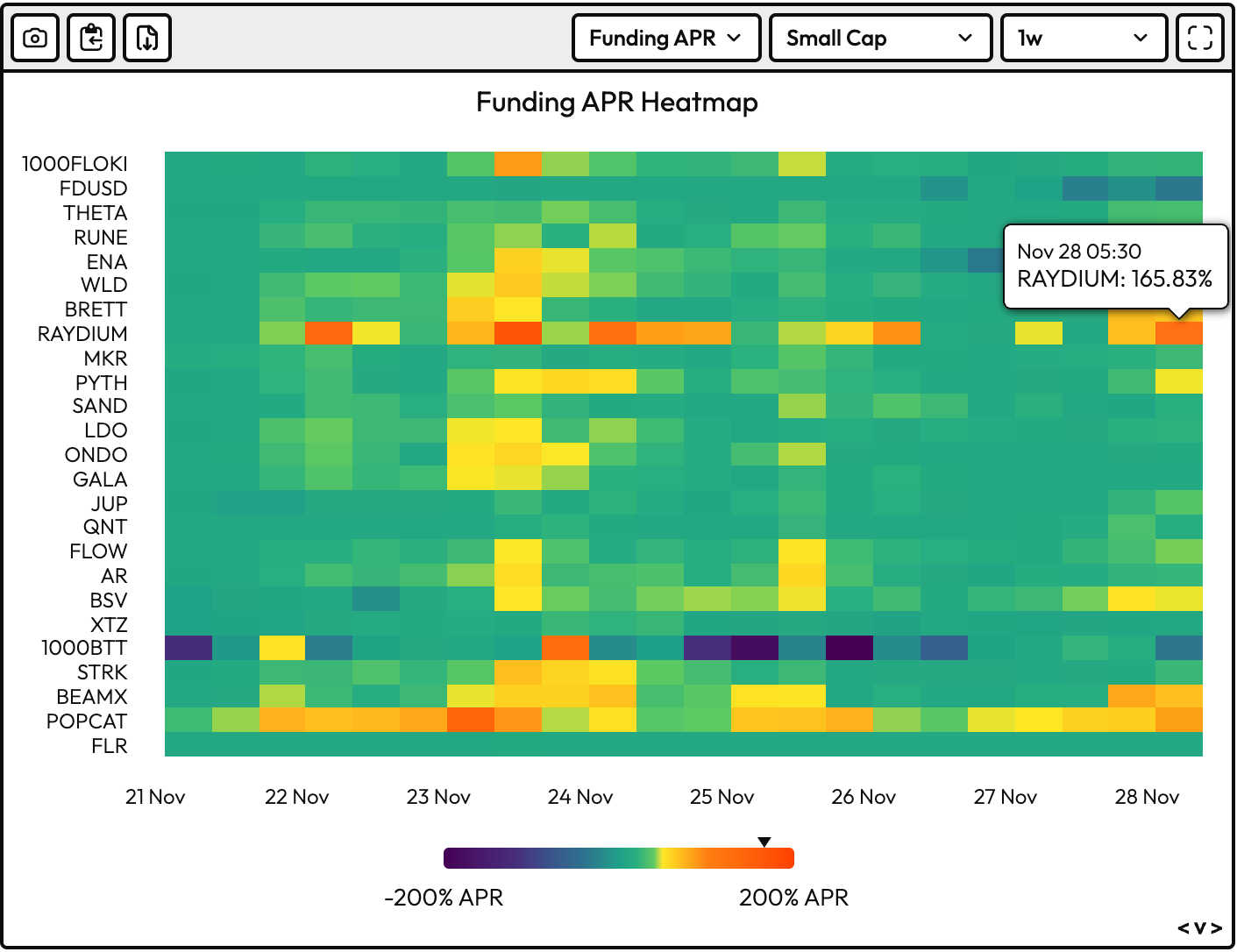

Annualized perpetual funding rates in small cap tokens after bitcoin’s (BTC) recent bullish pause has cooled jets in the broader market, shaking out over-leveraged positions and normalizing costs associated with betting on price rallies. One token, however, is still blazing hot: Solana-based decentralized exchange Raydium’s native cryptocurrency, RAY.

As the only coin with annualized perpetual funding rates still exceeding 160%, RAY stands out among the small, mid and large-cap tokens as the most overheated cryptocurrency, according to data from VeloData. The elevated rate suggests the market for RAY is overcrowded with long positions, with leverage skewed heavily toward the bullish side.

In such conditions, even a slight dip in price can shake the confidence of over-leveraged bulls, especially late entrants, triggering a mass unwinding of long positions, which often exacerbates the price decline, leading to a more pronounced sell-off. Tokens with a market capitalization of less than $5 billion, such as RAY, are particularly vulnerable to shenanigans in the derivatives market.

It’s easy to see why bulls have thrown caution to the wind. Despite the recent 17% price pullback to $5.39, RAY is still up 67% for the month versus market leader BTC’s 35% surge, CoinDesk data show.

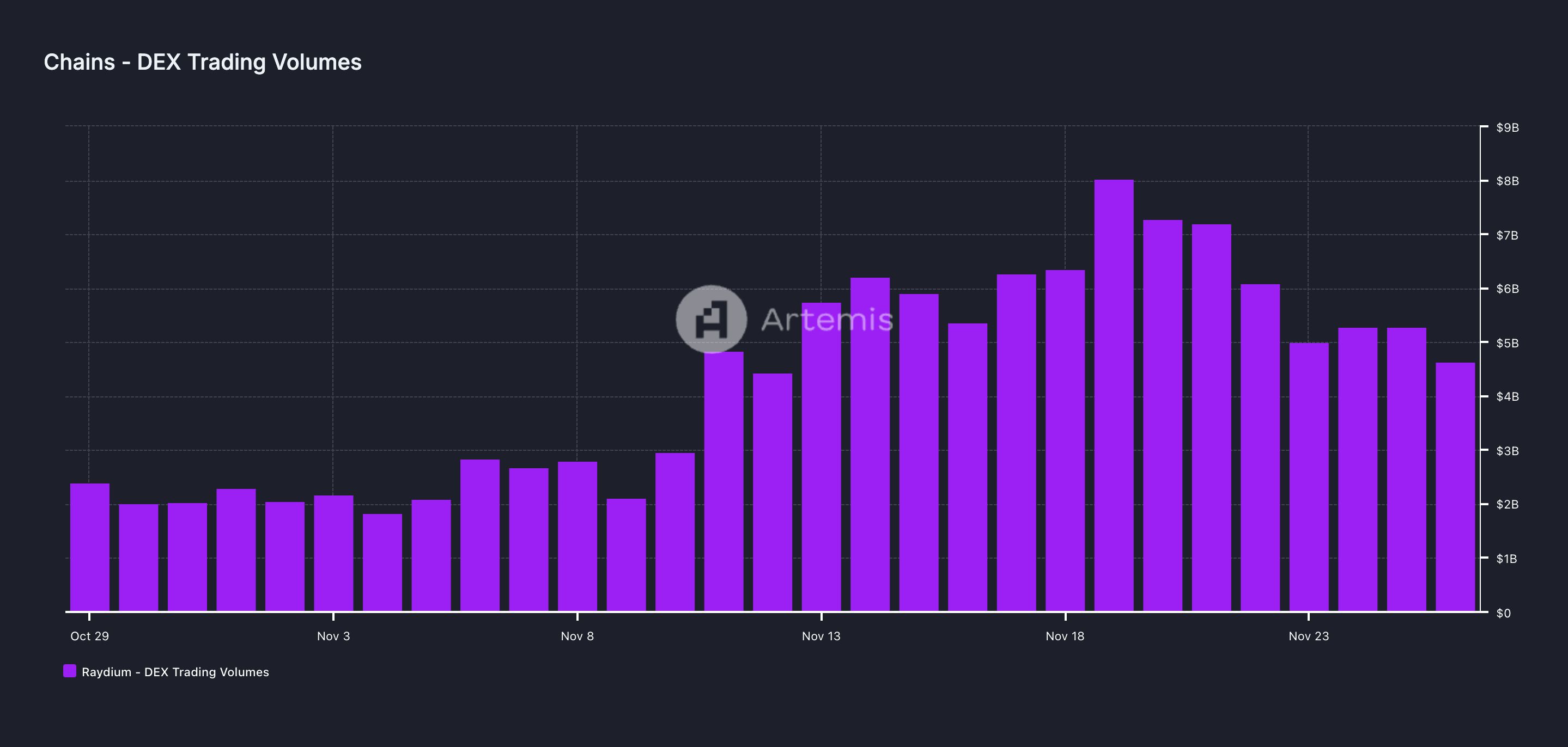

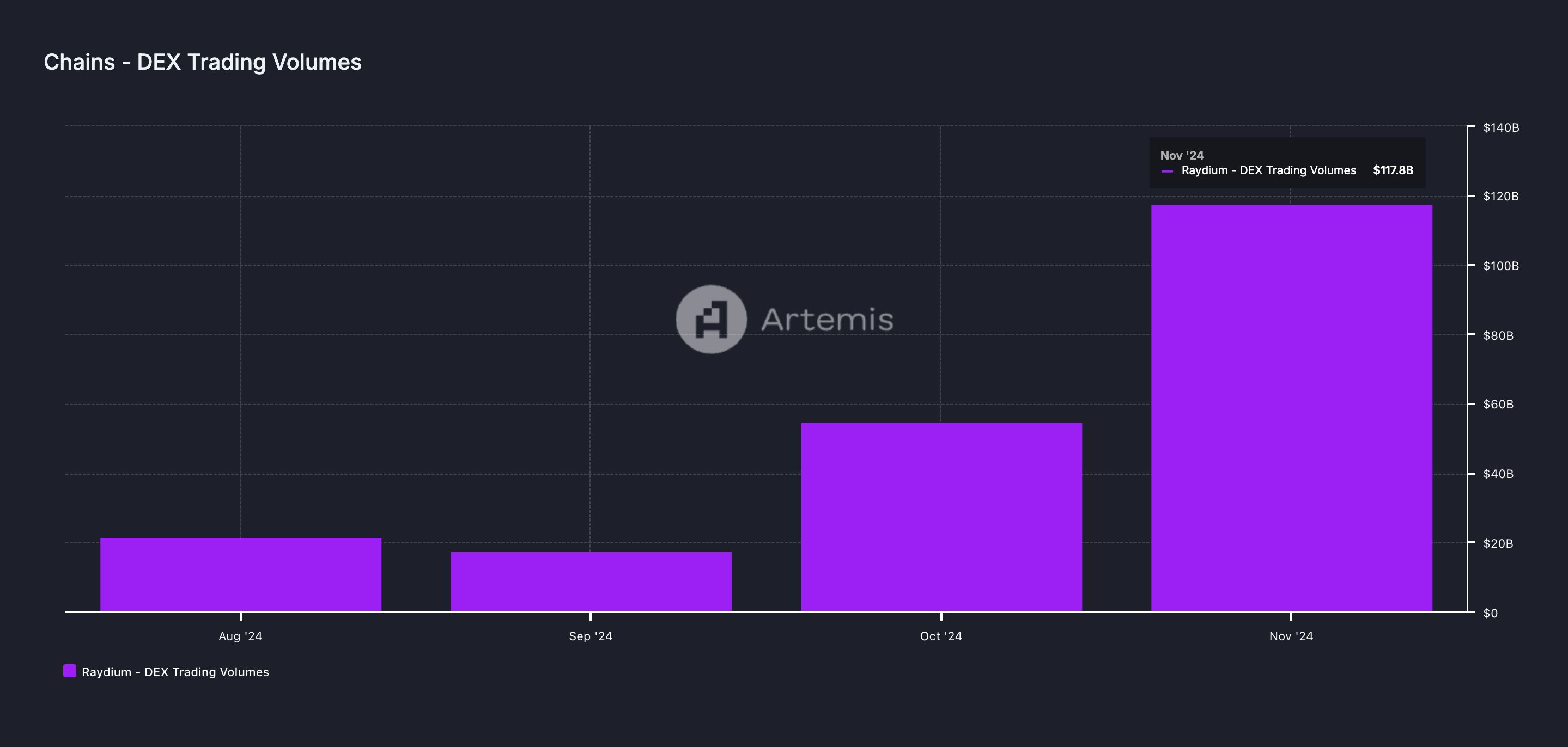

The market-beating rise comes amid record activity on Raydium. According to data source Artemis, Raydium has registered a trading volume of $117.8 billion this month, nearly twice the entire Ethereum-based DEX volume of $66.8 billion. Raydium has generated $175 million in fees versus Ethereum’s $168 million. Ethereum is the world’s largest smart contract blockchain.

Note that much of the record activity on Raydium occurred early this month, primarily driven by the memecoin frenzy, which propelled trading volumes to record highs, fueling significant interest in the RAY token. However, the frenzied momentum has begun to cool, weakening the underlying support for a sustained rise in the RAY token.