Bitcoin (BTC) and XRP (XRP) are trading sideways, which is likely being driven by a hidden force that’s keeping both cryptocurrencies anchored to key price levels.

However, the same “price magnets” might add to the ether (ETH) market volatility.

We are talking about market makers – entities tasked with creating liquidity in an exchange’s order book. These entities are always on the opposite side of traders/investors and make money from the bid-ask spread, while constantly striving to maintain a price-neutral exposure. Their hedging strategies in futures/spot markets often add to or curb volatility in the market.

In BTC’s case, options market makers are “long gamma” at strikes $108,000 and $110,000, according to Deribit-listed options activity tracked by Amberdata. The position indicates that market makers hold long options (calls and puts), which stand to benefit from potential volatility.

As such, market makers are likely trading against market movements – selling high and buying low – to maintain the direction-neutral book, effectively keeping BTC pinned in the $108,000-$110,000 range. BTC’s price has mostly traded the said range this month, according to CoinDesk data.

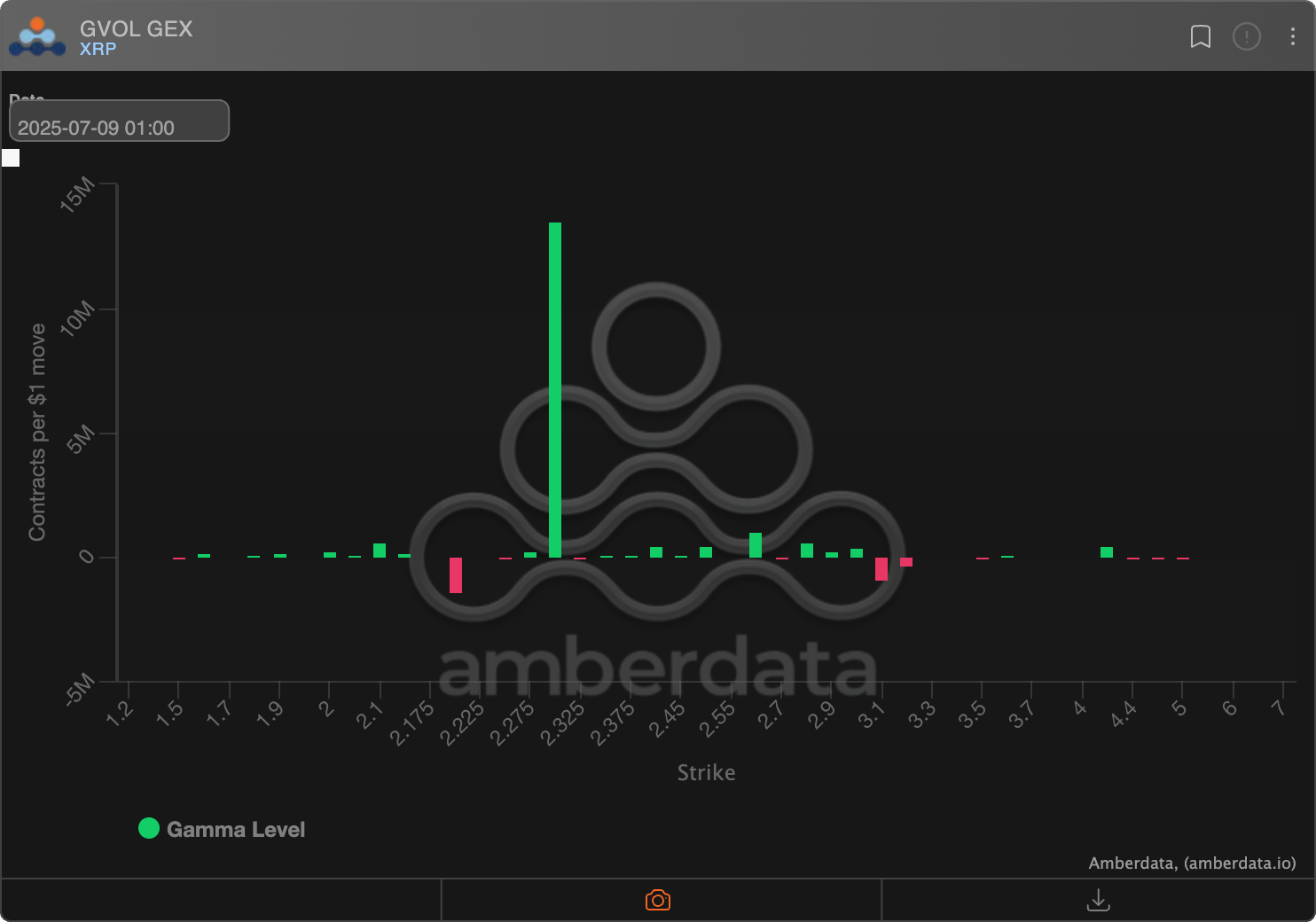

A similar dynamic seems to be playing out in the XRP market, where a large positive market maker gamma build up is observed at the $2.30 strike price. That calls for maker makers to buy low and sell high around that level capping volatility.

Ether prone to volatility

Ethereum’s native token ether, the second-largest cryptocurrency by market value, hit a high of $2,647 early today, the level last seen on June 16.

The move has pushed ether into a “negative market maker gamma” zone of $2,650-$3,500. When dealers hold negative gamma, they tend to trade in the direction of the market, exacerbating bullish/bearish moves.

In other words, their hedging activities could add to ether’s bullish momentum, exacerbating volatility, assuming other things being equal.