Digital Currency Group (DCG) owned mining pool Foundry has laid off 16% of its U.S.-based employees and a “small team in India.”

“We are continuously refining our strategy to ensure long-term success and growth in a dynamic market. We recently made the strategic decision to focus Foundry on our core business – operating the #1 Bitcoin mining pool in the world and growing our site operations business – while we supported the development of DCG’s newest subsidiaries, including Yuma and the spinout of Foundry’s successful self-mining business,” a DCG spokesperson said via email.

A spokesperson for the company said that DCG’s most recent shareholder letter already disclosed plans for this realignment.

“As part of this realignment, we made the difficult decision to reduce Foundry’s workforce, resulting in layoffs across multiple teams. We’re grateful for the contributions of all our employees, including those impacted by these changes,” the spokesperson continued.

Across the board, miners are under pressure to cut costs as the halving cuts the number of new bitcoins created per block in half, making mining less profitable.

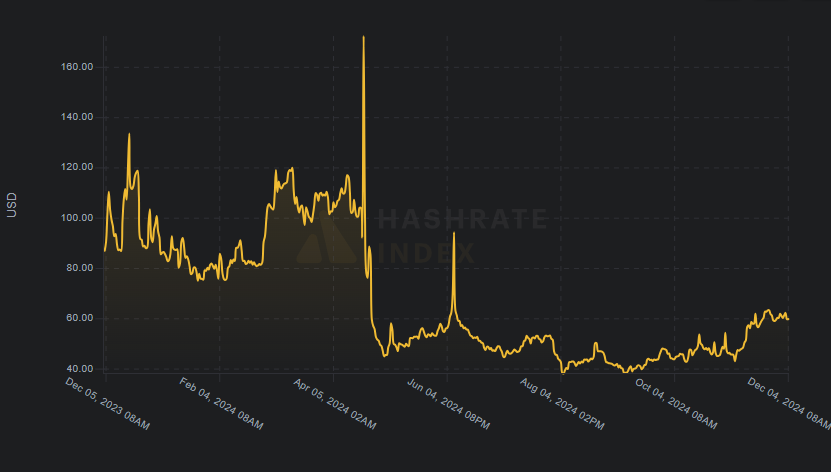

The bitcoin hashprice index, a measure of the earnings a miner can anticipate from a given amount of hashrate, is down significantly over the last year to roughly $60 per hash/day, down from an average of around $100 in December – however the price has ticked up in the last three months.

In a recent report, investment bank JPMorgan said that the notional value of all remaining bitcoin left to be mined is $74 billion given current bitcoin prices and the miners’ stocks have been underperforming.

Bitcoin is up over 130% in the last year, according to CoinDesk data.