By Omkar Godbole (All times ET unless indicated otherwise)

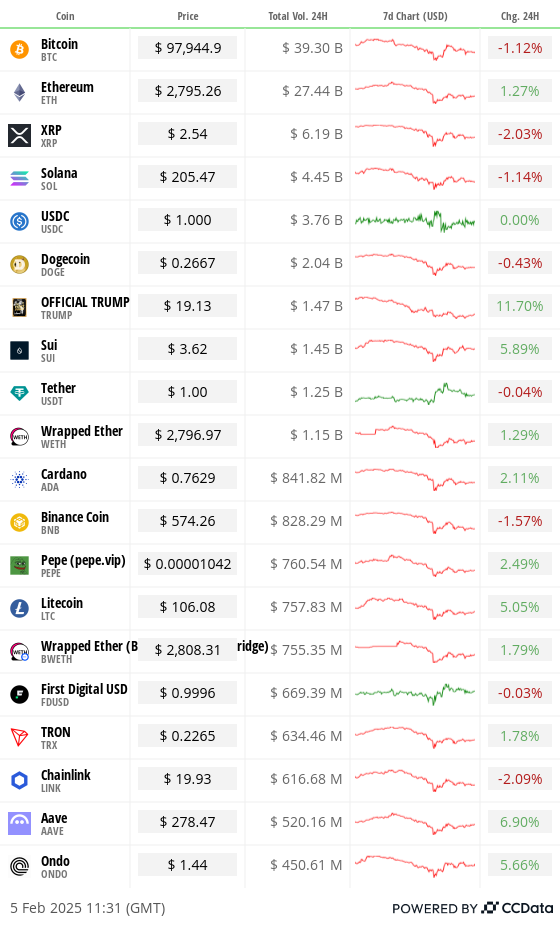

The crypto market has turned somber, with major cryptocurrencies such as bitcoin (BTC), ether (ETH), solana (SOL), Binance coin (BNB) and chainlink (LINK) trading as much as 3% lower, amid frustration over the slow progress on the creation of a U.S. strategic BTC reserve and signs of dollar liquidity tightening.

Geo Chen, a macro trader and author of the popular Substack-based newsletter Fidenza Macro, suggested the market has been held up by hopes Trump would step in and “buy everybody’s bags,” but that’s unlikely to materialize soon. Consequently, the market is vulnerable to risk aversion driven by ongoing tariff discussions.

“Crypto will not be spared in the ensuing risk-off volatility, and I expect many coins to draw down 50% or more from their January highs. I have limit orders to buy some of my favorite coins like SOL at lower than half price,” Chen wrote.

Speaking of SOL, Amberdata’s options block flow tracker revealed a sizable bear put spread involving a long position in the $200 put and a short position in the $120 put, both expiring on Feb 28. This strategy bets on a decline to at least $120 by month-end, reflecting an increasingly pessimistic outlook.

Sentiment remains bearish for ether, too. ETH has already fallen 15% this month and reached its lowest in four years against bitcoin. Joe McCann, founder and CEO of Asymmetric, pointed out that “Ethereum’s fundamental positioning has weakened. Solana’s ecosystem is expanding rapidly, offering higher throughput and stronger performance, making Ethereum’s historical valuation premium harder to justify.”

Ethereum’s layer-2 scaling solutions — Optimism, Arbitrum, and Polygon — are all down over 50% this year, he noted. “This signals broader struggles, as L2s were supposed to drive ETH adoption and usage, yet they’re failing to generate sustained momentum.”

On the macro front, investors are pivoting toward gold and U.S. Treasury notes amid the threat of a potential trade war, pushing gold to a new high of $2,877 per ounce, an impressive 10% gain for the year. Historically, a heightened preference for gold has not favored bitcoin.

As if that weren’t enough, rising yields on the 10-year Japanese government bond have hit their highest levels since April 2011. Additionally, the U.S. ADP employment report due today could inject further volatility into the market. It’s a time to stay alert!

What to Watch

Crypto:

Feb. 5, 3:00 p.m.: Boba Network’s Holocene hard fork network upgrade for its Ethereum-based L2 mainnet.

Feb. 6: Berachain (BERA) mainnet launch.

Feb. 6, 8:00 a.m.: Shentu Chain network upgrade (v2.14.0).

Feb. 13: Start of Kraken’s gradual delisting of the USDT, PYUSD, EURT, TUSD, UST stablecoins for EEA clients. The process ends March. 31.

Feb. 18, 10:00 a.m.: FTX Digital Markets, the Bahamas-based subsidiary of FTX, will start reimbursing creditors.

Macro

Feb. 5, 9:45 a.m.: S&P Global releases January’s US Services PMI (Final) report.

Est. 52.8 vs. Prev. 56.8

Feb. 5, 10:00 a.m.: The Institute for Supply Management (ISM) releases January’s Services ISM Report on Business.

Services PMI Est. 54.3 vs. Prev. 54.1

Services Business Activity Prev. 58.2

Services Employment Prev. 51.4

Services New Orders Prev. 54.2

Services Prices Prev. 64.4

Feb. 5, 10:00 a.m.: U.S. Senate Banking Committee hearing on “Investigating the Real Impacts of Debanking in America,” featuring four witnesses including Nathan McCauley, co-founder and CEO of Anchorage Digital. Livestream link.

Feb. 5, 3:00 p.m.: Fed Governor Michelle W. Bowman is giving a speech titled “Brief Economic Update and Bank Regulation.”

Feb. 6, 7:00 a.m.: The Bank of England (BoE) releases Monetary Policy Summary and Minutes of the Monetary Policy Committee Meeting as well as the February Monetary Policy Report. The press conference is live-streamed 30 minutes later.

Interest Rate Decision Est. 4.5% vs. Prev. 4.75%

Feb. 6, 8:30 a.m.: The U.S. Department of Labor releases Unemployment Insurance Weekly Claims report for week ended Feb. 1.

Initial Jobless Claims Est. 213K vs. Prev. 207K

Nonfarm Productivity QoQ (Preliminary) Est.1.4% vs. Prev. 2.2%

Continuing Jobless Claims (January) Est. 1870K vs. Prev. 1858K

Jobless Claims 4-Week Average Prev. 212.5K.

Feb. 6, 2:00 p.m.: U.S. House Financial Services Committee hearing about “Operation Choke Point 2.0“: two of the witnesses are Paul Grewal, Chief Legal Officer of Coinbase, and Fred Thiel, CEO of MARA Holdings. Livestream Link.

Feb. 6, 2:30 p.m.: Fed Governor Christopher J. Waller is giving a speech on Payments at the Atlantic Council in Washington. Livestream link.

Earnings

Feb. 5: MicroStrategy (MSTR), post-market, $-0.09

Feb. 10: Canaan (CAN), pre-market, $-0.08

Feb. 11: HIVE Digital Technologies (HIVE), post-market, $-0.11

Feb. 11: Exodus Movement (EXOD), post-market, $0.14 (2 ests.)

Feb. 12: Hut 8 (HUT), pre-market, break-even

Feb. 12: IREN (IREN), post-market

Feb. 12 (TBA): Metaplanet (TYO:3350)

Feb. 12: Reddit (RDDT), post-market, $0.25

Feb. 12: Robinhood Markets (HOOD), post-market

Feb. 13: CleanSpark (CLSK), $-0.05

Feb. 13: Coinbase Global (COIN), post-market, $1.61

Token Events

Governance votes & calls

Lido DAO is discussing distributing rewards to LDO stakers based on the protocol’s net revenue, as well as the use of a percentage of its annual revenue to buyback LDO tokens.

Feb. 5, 10 a.m.: Livepeer (LPT) to hold a Treasury Talk on “SPE updates, governance, and treasury funding for AI video projects.”

Feb. 5, 11 a.m.: USDX and Arbitrum to hold an Ask Me Anything (AMA) session.

Feb. 6: Arbitrum to hold an open call about using AI to empower decentralized finance applications.

Unlocks

Feb. 5: XDC Network (XDC) to unlock 5.36% of circulating supply worth $81.58 million.

Feb. 5: Kaspa (KAS) to unlock 0.67% of circulating supply worth $17.29 million.

Feb. 9: Movement (MOVE) to unlock 2.17% of circulating supply worth $31.84 million.

Feb. 10: Aptos (APT) to unlock 1.97% of circulating supply worth $69.78 million.

Token Launches

Feb. 6: Berachain (BERA) to be listed on Bybit, BingX, MEXC, and KuCoin.

Conferences:

Day 1 of 2: The 14th Global Blockchain Congress (Dubai)

Feb. 6: Ondo Summit 2025 (New York).

Feb. 7: Solana APEX (Mexico City)

Feb. 13-14: The 4th Edition of NFT Paris.

Feb. 18-20: Consensus Hong Kong

Feb. 19: Sui Connect: Hong Kong

Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 25: HederaCon 2025 (Denver)

Token Talk

By Francisco Rodrigues

Solana memecoin juggernaut Pump.fun’s monthly revenue hit an all-time high in January, bringing in $121.3 million while the platform is said to be influencing the “destruction of the altcoin market.”

Speculative capital that would have poured into major altcoins during this cycle’s “alt season” was funneled into low-capitalization tokens launched on the platform, according to analysis by Miles Deutscher, who pointed out retail investors got “stuck into illiquid on-chain memes” that quickly lost most of their value.

Yet high-profile altcoin debuts also led to significant downturns given the risk and volatility of the sector. Lookonchain pointed to a trader who lost $2.6 million out of fear of missing out on Venice.ai’s VVV token, while another trader lost $21 million on Donald Trump’s memecoin.

Even the biggest altcoin by market capitalization, ether, saw supply return to pre-merge levels and has been significantly underperforming bitcoin, with the ETHBTC ratio dropping below 0.03 for the first time since 2021 this year.

Meanwhile, Pump.fun’s success remains, having recently surpassed Circle, the issuer of the second-largest stablecoin, USDC, in 24-hour revenue according to DeFiLlama data.

Derivatives Positioning

Perpetual funding rates for XLM, TON, SHIB, BCH and ONDO remain negative, hinting at a bias for shorts. These tokens could see a short squeeze should BTC surge, reviving risk-taking in the crypto market.

The OI-normalized cumulative volume delta for SHIB has flipped positive in the past 24 hours, hinting at underlying buying pressure.

BTC, ETH futures basis on the CME remains near 10%.

Front-dated BTC and ETH continue to show a bias for bearish put options. ETH puts continue to be pricier than BTC puts.

Market Movements:

BTC is down 0.35% from 4 p.m. ET Tuesday at $97,862.66 (24hrs: +1.08%)

ETH is up 2.4% at $2,2,783.87 (24hrs: +0.86%)

CoinDesk 20 is down 0.34% at 3,286.48 (24hrs: -1.41%)

CESR Composite Staking Rate is down 73 bps at 3.18%

BTC funding rate is at 0.0011% (1.21% annualized) on Binance

DXY is down 0.5% at 107.42

Gold is up 0.9% at $2,868.45/oz

Silver is up 0.15% at $32.37/oz

Nikkei 225 closed unchanged at 38,831.48

Hang Seng closed -0.93% at 20,597.09

FTSE is unchanged at 8,571.57

Euro Stoxx 50 is down 0.21% at 5,253.52

DJIA closed on Tuesday +0.3% at 44,556.04

S&P 500 closed +0.72% at 6,037.88

Nasdaq closed +1.35% at 19,654.02

S&P/TSX Composite Index closed +0.15% at 25,279.35

S&P 40 Latin America closed +1.06% at 2,401.76

U.S. 10-year Treasury is down 3 bps at 4.48%

E-mini S&P 500 futures are down 0.52% at 6,031.75

E-mini Nasdaq-100 futures are down 0.88% at 21,479.25

E-mini Dow Jones Industrial Average Index futures are down 0.18% at 44,615.00

Bitcoin Stats:

BTC Dominance: 61.24 (-0.21%)

Ethereum to bitcoin ratio: 0.02833 (1.43%)

Hashrate (seven-day moving average): 817 EH/s

Hashprice (spot): $56.3

Total Fees: 5.03 BTC / $509,298

CME Futures Open Interest: 168,549

BTC priced in gold: 33.9 oz

BTC vs gold market cap: 9.64%

Technical Analysis

The U.S. 10-year Treasury yield is on the verge of violating the five-month bullish trendline.

A continued slide could support risk assets.

Crypto Equities

MicroStrategy (MSTR): closed on Tuesday at $348.31 (+0.35%), down 0.9% at $345.05 in pre-market.

Coinbase Global (COIN): closed at $280.39 (-1.41%), down 0.14% at $280 in pre-market.

Galaxy Digital Holdings (GLXY): closed at C$27.67 (-1.25%).

MARA Holdings (MARA): closed at $17.65 (-1.67%), down 0.45% at $17.57 in pre-market.

Riot Platforms (RIOT): closed at $12.29 (+2.5%), down 0.41% at $12.24 in pre-market.

Core Scientific (CORZ): closed at $12.21 (-0.97%).

CleanSpark (CLSK): closed at $10.84 (+2.36%), down 0.65% at $10.77 in pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.57 (-0.53%).

Semler Scientific (SMLR): closed at $51.24 (+1.55%), down 2.01% in pre-market.

Exodus Movement (EXOD): closed at $56.77 (-4.73%), up 5.69% in pre-market.

ETF Flows

Spot BTC ETFs:

Daily net flow: $340.7 million

Cumulative net flows: $40.60 billion

Total BTC holdings ~ 1.173 million.

Spot ETH ETFs

Daily net flow: $307.8 million

Cumulative net flows: $3.15 billion

Total ETH holdings ~ 3.693 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

The dollar index (DXY), which tracks the U.S. currency’s value against major trading partners, seems to have peaked. The question is will bitcoin follow suit?

Both assets surged in the weeks leading up to and following the U.S. election held in early November.

While You Were Sleeping

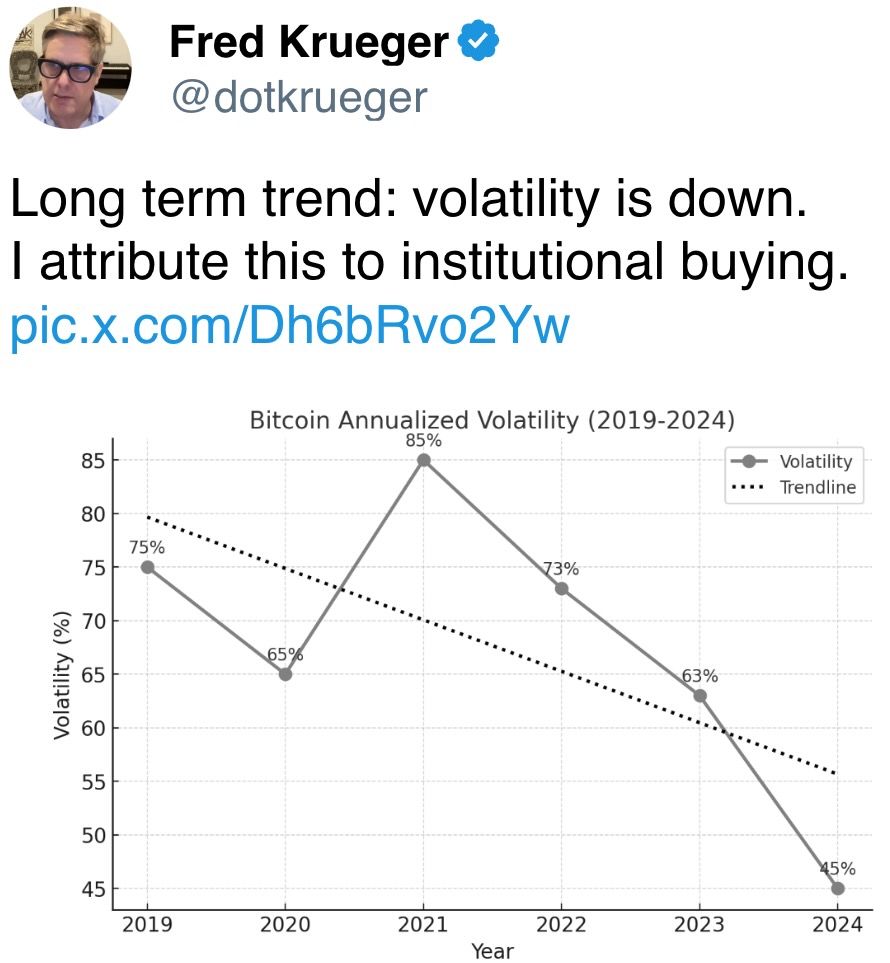

Equities-Crypto Relationship Is Likely to Weaken in the Long Term, Citi Says (CoinDesk): Crypto’s correlation with stocks is likely to decline, with institutional adoption and upcoming U.S. regulation helping to lower volatility for bitcoin.

Bitcoin Risks Losing the $90K- $110K Range as These 3 Development Could Put the Brakes on the Next Bull Breakout (CoinDesk): Bitcoin’s consolidationfaces headwinds from tightening dollar liquidity, the Trump administration’s cautious approach to a BTC reserve and signals of weakening bullish momentum.

Ondo Finance Unveils Tokenization Platform to Bring Stocks, Bonds, and ETFs Onchain (CoinDesk): Ondo Finance, a leader issuer of tokenized real-world assets unveiled a tokenization platform that aims to do for U.S. publicly traded securities what stablecoins did for dollars.

World’s Demand for Gold Hit Another Record High Last Year; Appetite for Bullion in 2025 Remains Firm (CNBC): As gold prices hit record highs, the World Gold Council reports that global demand reached 4,974 tons in 2024, driven by central bank purchases and strong demand for gold ETFs and bullion.

EU Prepares to Hit Big Tech in Retaliation for Donald Trump’s Tariffs (Financial Times): Officials say the EU could retaliate against potential U.S. tariffs with its ‘anti-coercion instrument,’ introduced during Trump’s first term, though the bloc is unlikely to be able to respond as quickly as Canada and Mexico.

U.S. Postal Service Suspends Shipments of China Parcels (Wall Street Journal): The U.S. Postal Service said it will not accept inbound parcels from mainland China and Hong Kong until further notice, a move likely to impact Chinese online merchants such as Shein and Temu.

In the Ether