Thursday’s price pullback in major cryptocurrencies is probably the result of a long squeeze, or unwinding of leveraged bullish plays, rather than an outright bearish stance.

The CoinDesk 20 Index (CD20) of the largest, most liquid tokens has lost 6.8% in the past 24 hours, with bitcoin (BTC), the leading cryptocurrency by market value, falling almost 1% having failed to maintain gains above $120,000. Among major altcoins, ether (ETH) dropped 3%, XRP (XRP) 13% and Solana’s sol (SOL) 8%.

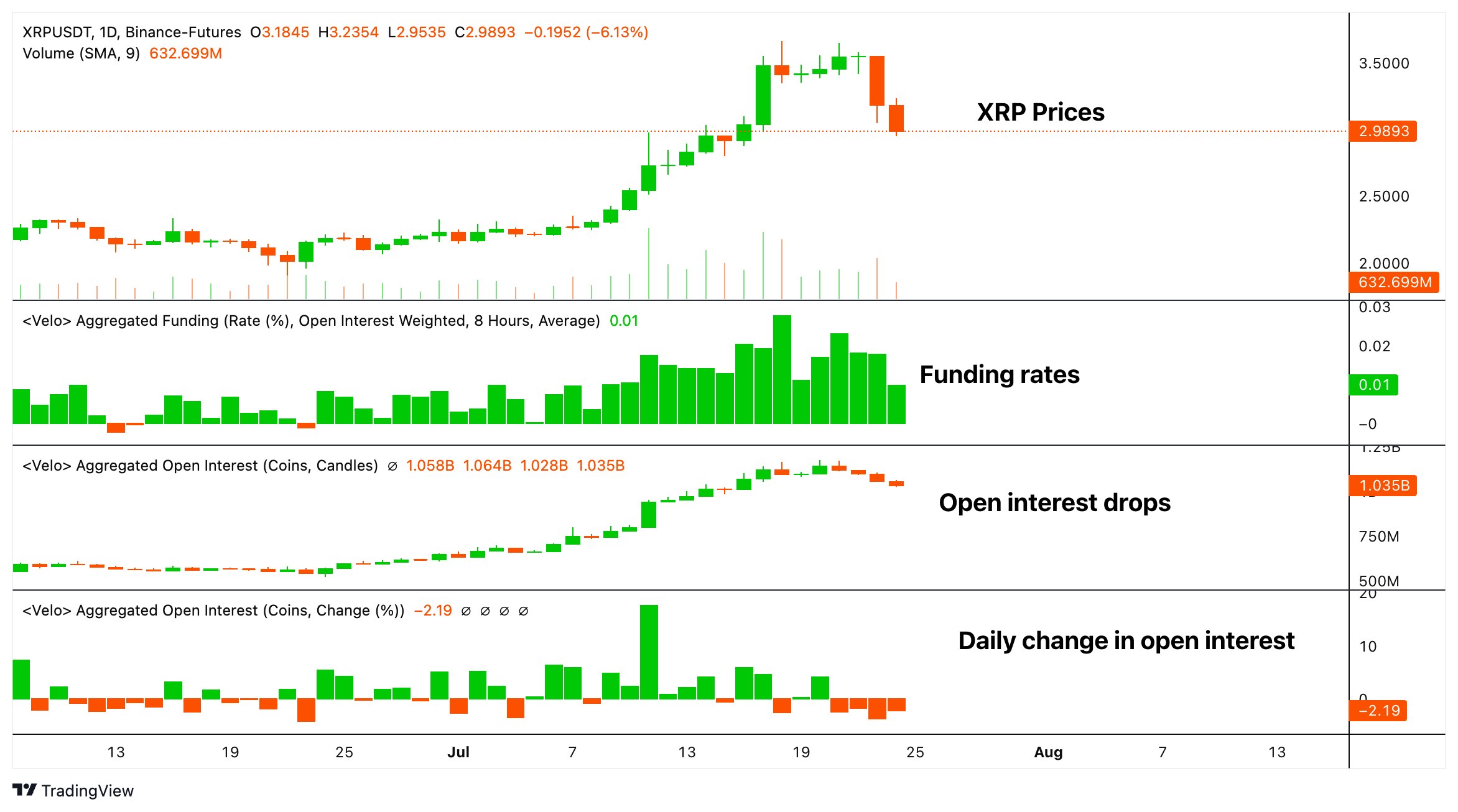

All the declines are consistent with the bearish signals from technical charts. They’re also characterized by falling open interest in the offshore perpetual futures market and positive funding rates.

For instance, open interest — the number of unsettled contracts in the futures market — for XRP has fallen more than 6% in two days, according to data source Velo. That’s a sign market participants are reducing their exposure and adopting less risky positions.

Open interest in SOL, BTC and ETH futures has declined by 5%, 1.5% and 2%, respectively. Velo tracks activity in dollar- and USDT-denominated perpetuals listed on Binance, OKX, Bybit and other exchanges.

Meanwhile, funding rates for the four tokens continue to be positive, indicating a net bias for bullish bets. Positive funding rates indicate that perpetuals are trading at a premium to the spot price, requiring a periodic payment by longs to shorts to keep their positions open.

A long squeeze is widely seen as a necessary and positive event because it “cleanses” the market by flushing out the excess leverage and over-optimistic long positions.

The combination of falling prices, lower open interest and positive funding rates suggests that bullish bets are being actively removed from the market.

It rules out the likelihood that the price decline is backed by investors taking new short, or bearish, positions because in that case the funding rate would have dropped into negative territory as the short holders would need to pay the longs.

Furthermore, the new shorts would have increased open interest as prices dropped, which is not the case either.

The decline in open interest suggests that traders are closing their positions, a characteristic of leveraged longs being liquidated or voluntarily exiting the market, rather than new shorts entering the market. Put together it signals that while the price is dropping, sentiment remains fairly robust.