An oversold market and reactions to U.S. tariffs may be a thing of the past with traders now eying new economic data and rate cuts in the coming months — with expectations of a bitcoin bounce in the near term.

Crypto markets saw high volatility on Wednesday and Thursday in the run-up to the tariff announcement, where President Donald Trump levied a minimum 10% fee on all imports to the country.

Major tokens bitcoin (BTC), ether (ETH), Solana’s SOL, XRP (XRP), and others, zoomed ahead of the speech and slumped as global markets fell, reversing all gains from the start of the week.

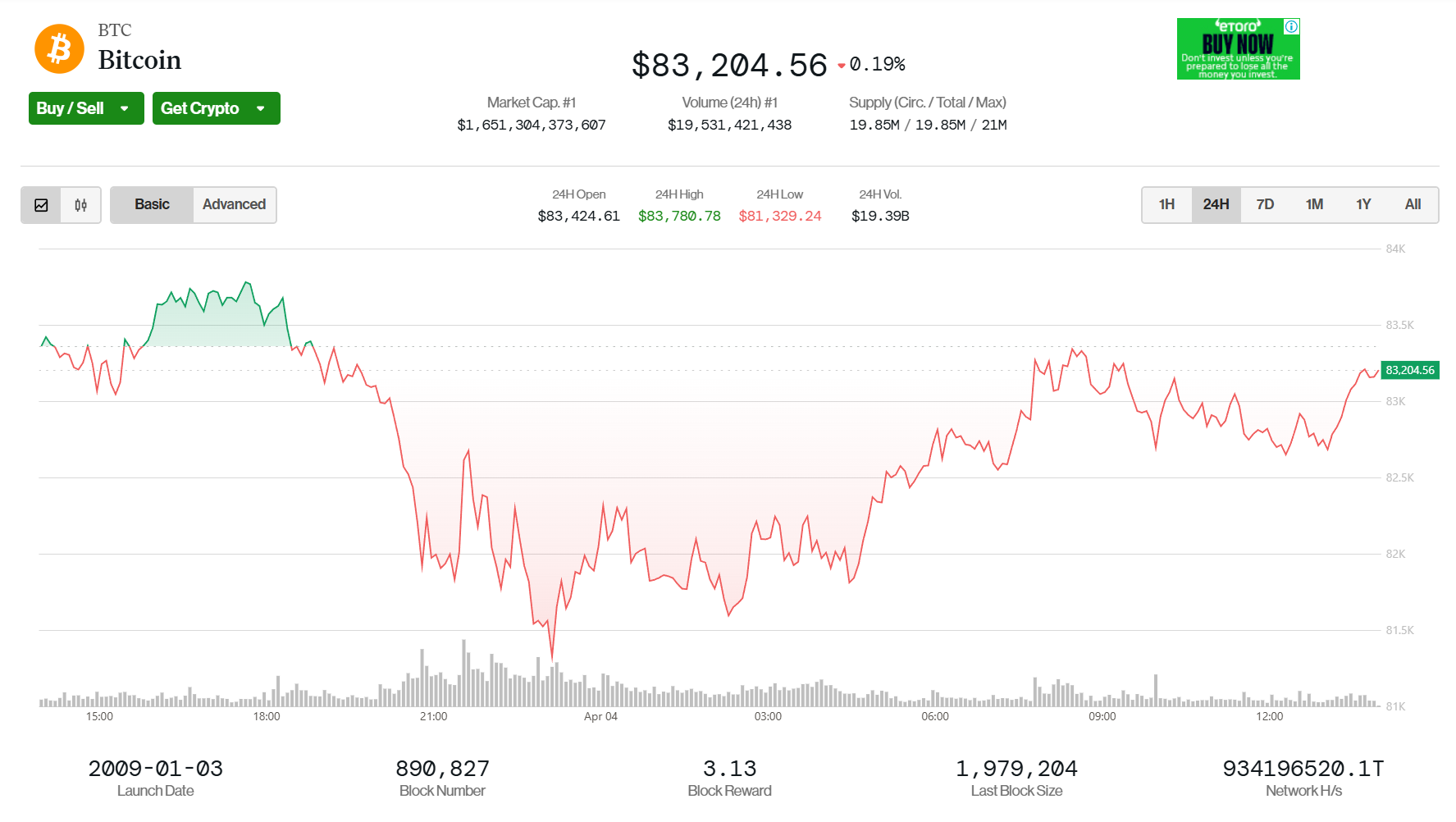

Markets have since shown an uptick in prices on Friday morning, with BTC steady above $83,100, ETH retaking $1,800 and XRP, SOL and ADA rising over 2%.

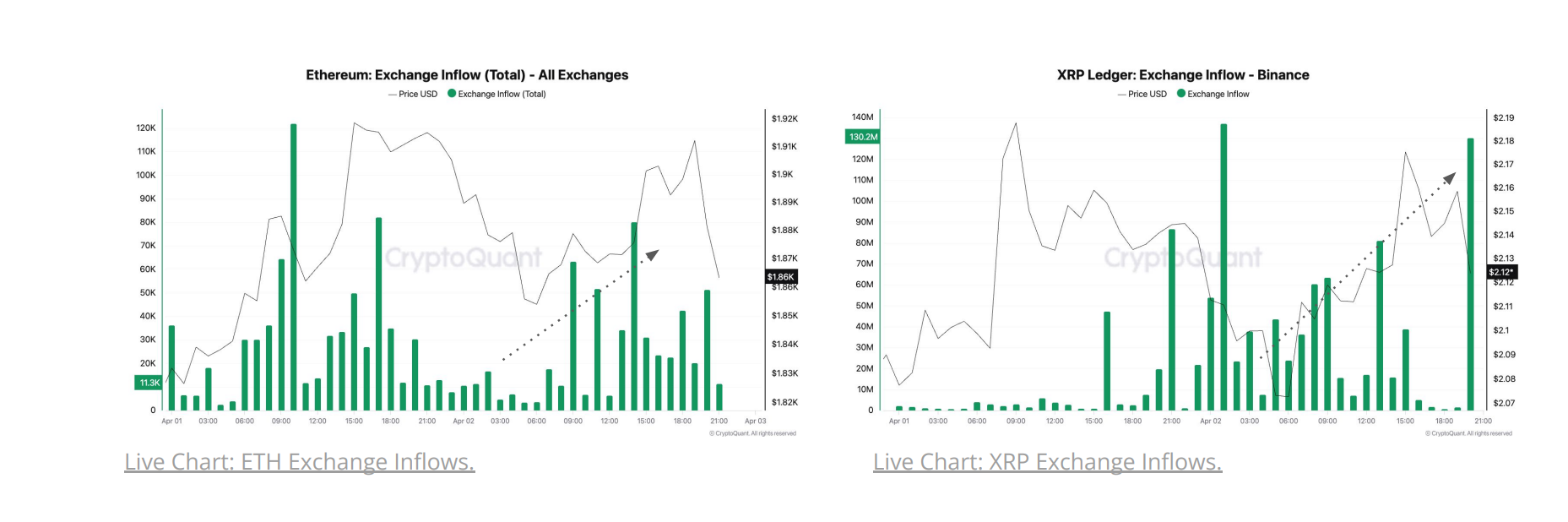

Ahead of Trump’s speech, investors transferred larger volumes of Bitcoin, ETH, and XRP into exchanges, suggesting a growing intent to sell, per a CryptoQuant note shared with CoinDesk on Thursday. Bitcoin transactions surged to as much as 2,500 BTC in a single block just hours after Trump began speaking.

In the U.S., Coinbase also saw a rise in bitcoin deposits, particularly from large holders.

Similarly, ETH inflows into exchanges spiked to an hourly peak of approximately 80,000 ETH. XRP transfers into Binance jumped to 130 million in one hour, up from under 10 million XRP per hour throughout most of the previous day.

These rising exchange inflows reflected investor willingness to exit positions amid growing economic uncertainty, CryptoQuant said, with demand for Bitcoin and ETH declining in the perpetual futures market as traders closed their long positions to take profits.

But with headwinds behind and a new economic data set to be released later Friday could provide the impetus for a short-term relief in markets.

Attention is on the non-farm payroll report scheduled for a Friday release. The monthly U.S. economic indicator released by the Bureau of Labor Statistics shows the change in employment, reflecting job creation, unemployment trends, and wage growth, offering insight into economic health.

“Investors are bracing for signs of softness in the U.S. labour market,” Singapore-based QCP Capital said in a Telegram broadcast earlier Friday. “ A weaker-than-expected print would bolster the case for further Fed rate cuts this year, as policymakers attempt to cushion a decelerating economy.”

Data shows markets are pricing in four rate cuts in 2025 — 0.25 bps each in June, July, September and December. Rate cuts occur when a central bank, like the Federal Reserve, lowers interest rates to stimulate economic growth by making borrowing cheaper.

Bitcoin, and the broader market, tend to react positively to rate cuts, as lower rates reduce the appeal of traditional investments like bonds, driving investors toward alternatives like BTC. Additionally, a weaker dollar can enhance BTC’s value as a hedge against inflation or currency devaluation.

QCP Capital said it continues to observe elevated volatility in the short term, with more buyers of downside protection.

“That said, with positioning now light and risk assets largely oversold, the stage may be set for a near-term bounce,” the fund said.