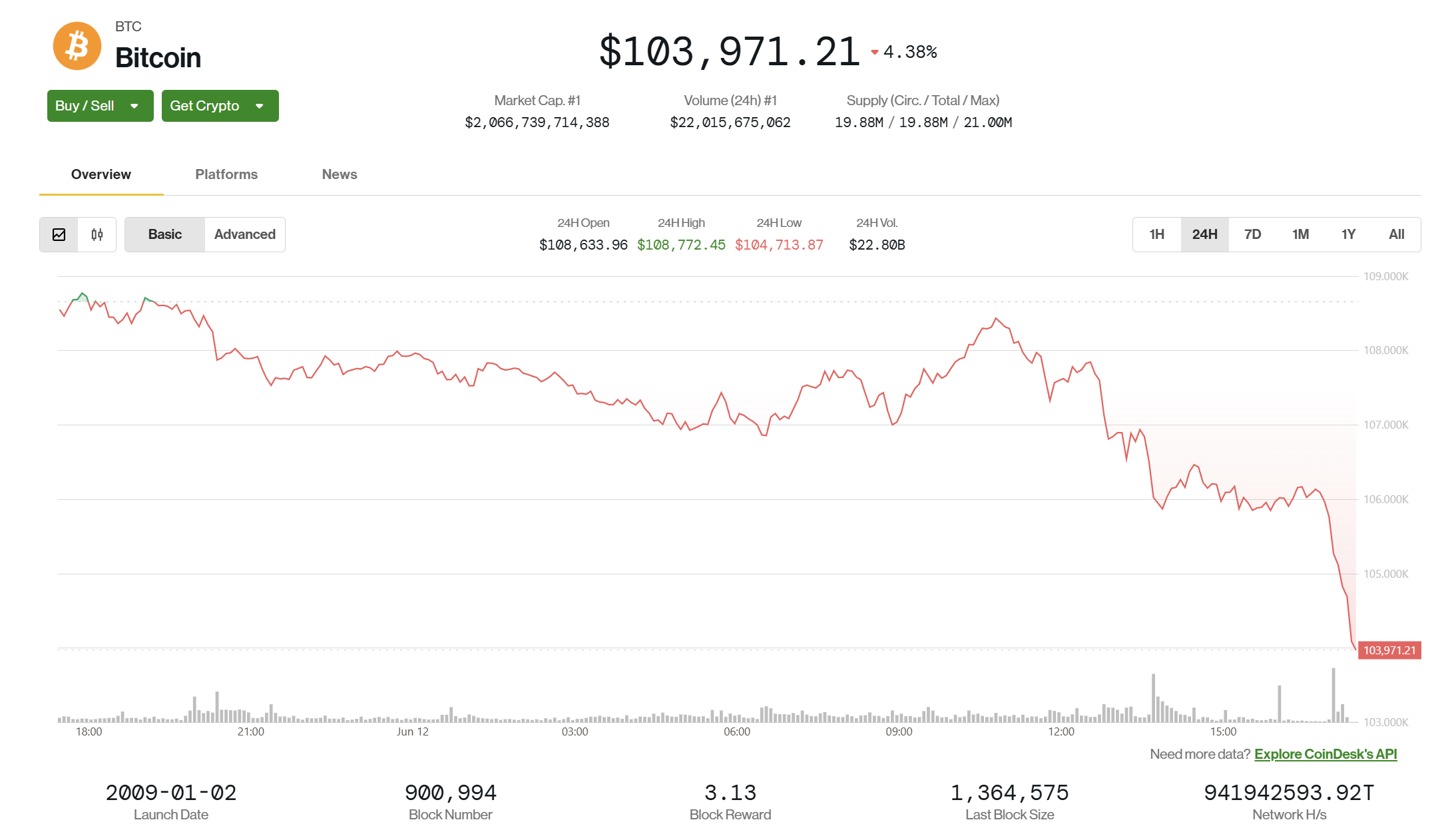

Bitcoin BTC has substantially added to earlier losses, now down more than 4% over the past 24 hours to $103,900 as Israeli forces have bombed targets in Tehran, the capital of Iran.

Axios first reported that Israel had conducted an operation inside Iranian airspace, citing unnamed sources, with Al-Jazeera later confirming that explosions were heard in Tehran.

Israeli President Benjamin Netanyahu said his country has attacked Iran’s nuclear program and ballistic missiles, and that the strikes will continue until the threat is removed.

This comes hours after the International Atomic Energy Agency said that Iran was not complying with restrictions on enriched Uranium for the first time in two decades.

NBC reported that Israel was considering a strike as a response. President Donald Trump told reporters that the U.S. would prefer a deal with Iran over a conflict, and an attack could lead to a “massive conflict.”

On Polymarket, bettors were unsure about the chance of a strike taking place with the likelihood of Israeli action against Iran by July being priced in at under 30 cents.

Traditional markets react

U.S. stock index futures are lower by about 1.5% across the board on the news. European market futures are down by roughly the same amount.

Moving higher are bond prices, gold and oil. The 10-year Treasury yield has dipped two basis points to 4.32% and gold has added about 0.75% in the past hour to $3,428 per ounce. Crude oil, meanwhile, has soared 9% to $74 per barrel.

The U.S. dollar is gaining against the euro and British pound, but losing ground versus the yen and Swiss franc.