Bitcoin’s (BTC) pullback from the $100,000 level after continuously hitting fresh new highs is only a temporary setback before eventually shooting past the barrier to even higher prices, crypto analytics firm CryptoQuant said.

According to a Wednesday report shared with CoinDesk, multiple blockchain data metrics suggest that the largest crypto has more room to run before topping.

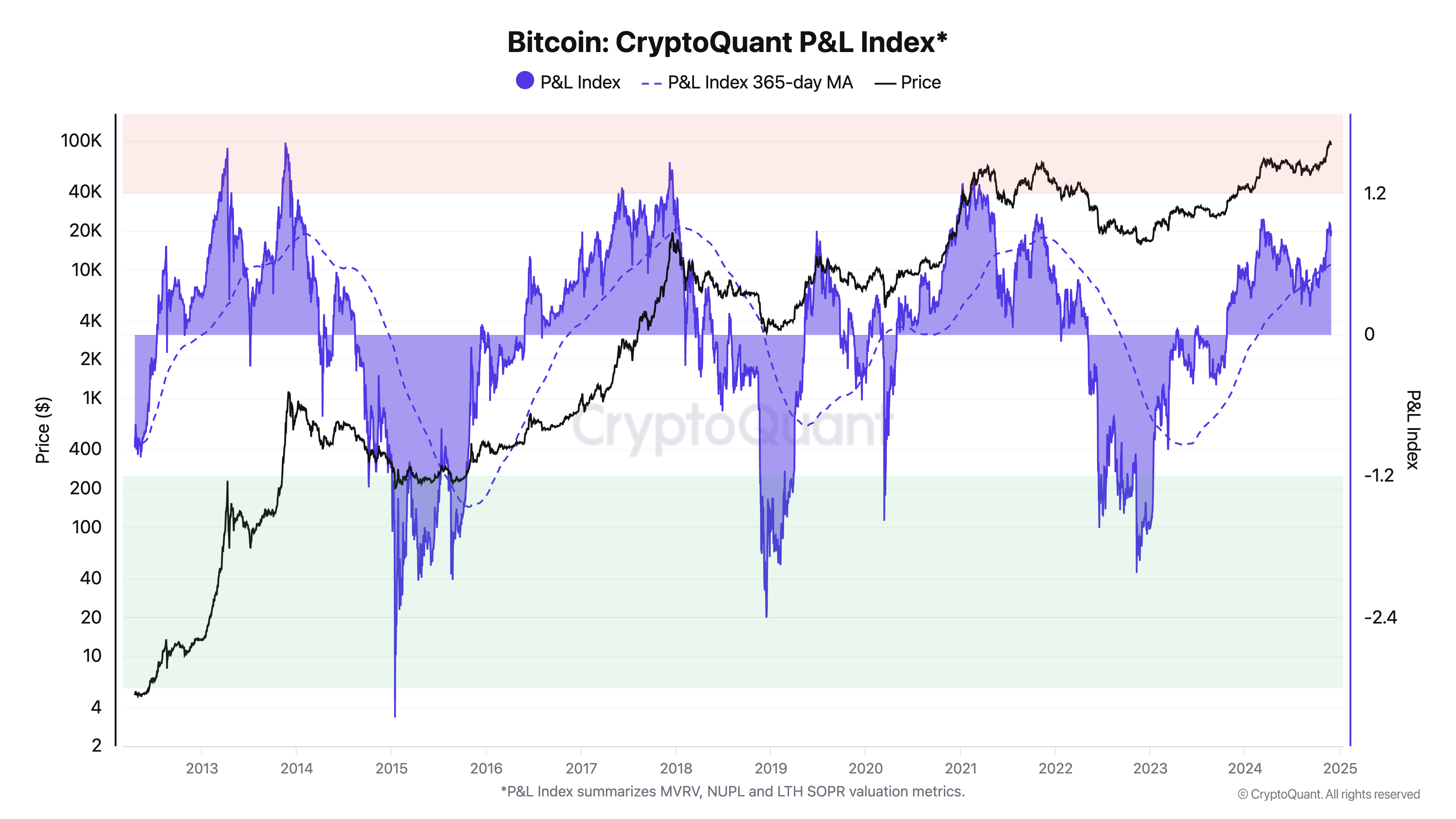

CryptoQuant’s custom P&L index, which combines several on-chain valuation metrics to signal whether BTC is overvalued or undervalued, shows that the asset is firmly in a bull market but far from the overvalued levels it reached at the previous market peaks in 2021, 2017 and 2013.

The firm’s Bull-Bear Market Cycle Indicator has only started to heat up after dipping slightly into bear market territory earlier this year as BTC corrected from March’s record $73,000 to $50,000. The metric is nowhere near the overheated levels seen at local tops at this March or other local tops.

Meanwhile, participation of retail investors is still muted, contrary to the typical buying frenzy observed around previous cycle tops. Per CryptoQuant data, retail sold 41,000 bitcoin since October lowering their holdings likely to take profits. Large investors, meanwhile, increased holdings by 130,000 BTC during the same period.

New investors aren’t rushing to enter the market either. The value of BTC held by new investors, or addresses holding the asset since less than six months ago, stands at 50% of the total value invested in bitcoin (Realized Cap). That’s far below the 80%-90% levels in 2017 and 2021.

“Price tops typically occur when new investors enter the market to buy at extremely high prices, which causes them to hold a large proportion of the total value invested,” the authors said. “Previous bull cycles have ended when retail investors buy aggressively, which is not the case today.”

Bitcoin’s peak target

Over the past week, BTC’s violent run-up after Donald Trump’s U.S. election victory was halted at the $100,000 barrier, sliding back as much as 9% from its latest record. On Thursday, CoinDesk data shows, it changed hands at around $95,000.

Despite the setback, surpassing the $100,000 barrier is only a matter of time, CryptoQuant analysts said.

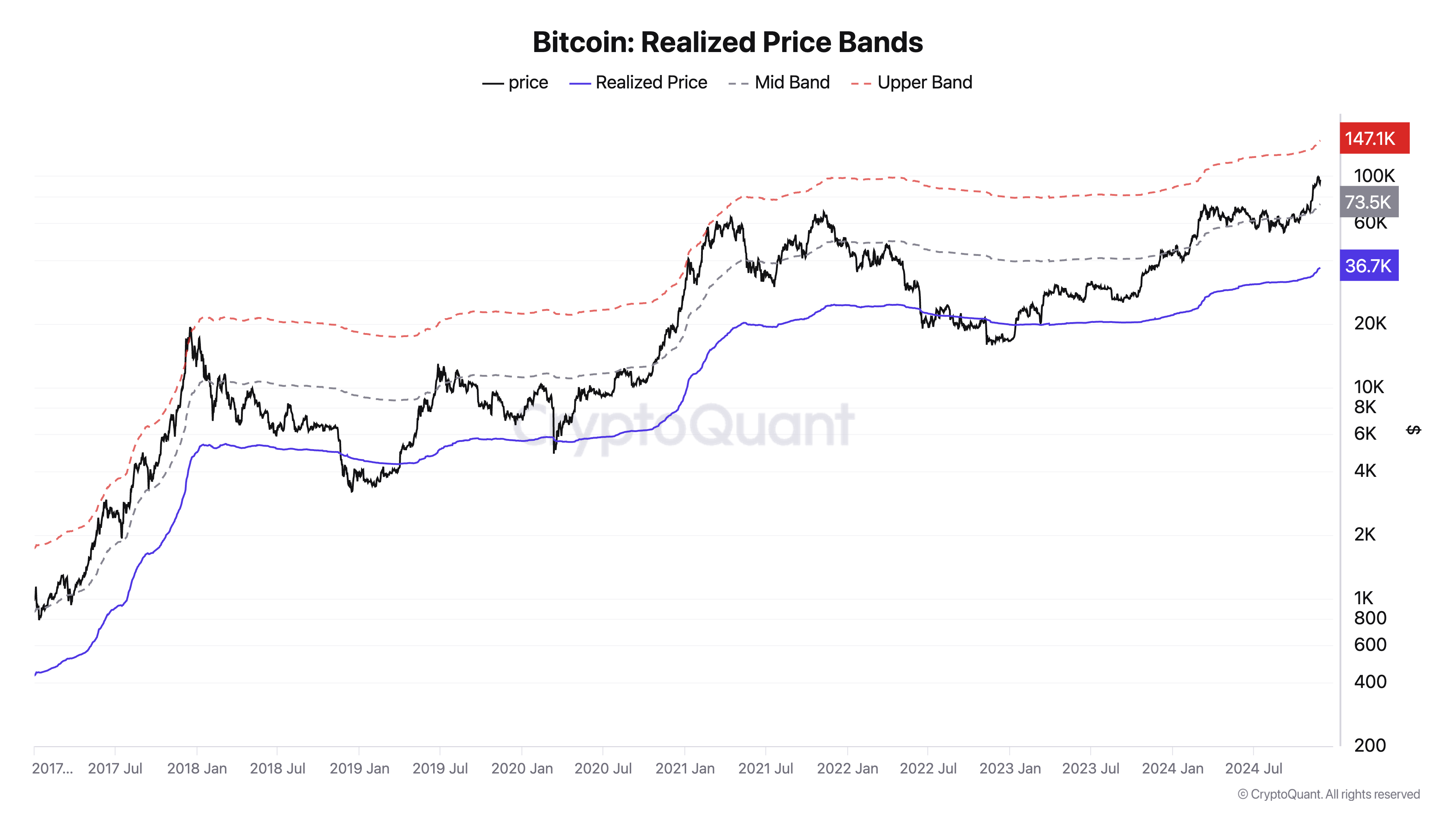

Previous bitcoin bull markets topped around the upper band of bitcoin’s realized price metric, set at four times the average price at which all BTC in circulation has been transferred for the last time. Data shows that the realized price is currently at $36,000-$37,000 and quickly rising, marking the upper band at $147,000.

If the pattern repeats, BTC could rally to at least $147,000 before reaching a market cycle top, per CryptoQuant.

CryptoQuant isn’t the only firm that is bullish on bitcoin’s rally. Recently, Galaxy Research said the price is expected to reach $100,000 in the near term and may run up higher, citing increasing institutional adoption and the potential for the creation of bitcoin nation-state reserves.

Read more: Bitcoin Bull Market Is Far From Over, Galaxy Research Says