By Omkar Godbole (All times ET unless indicated otherwise)

The crypto market quickly recovered from the late Wednesday swoon triggered by Fed Chair Jerome Powell’s hawkish comments.

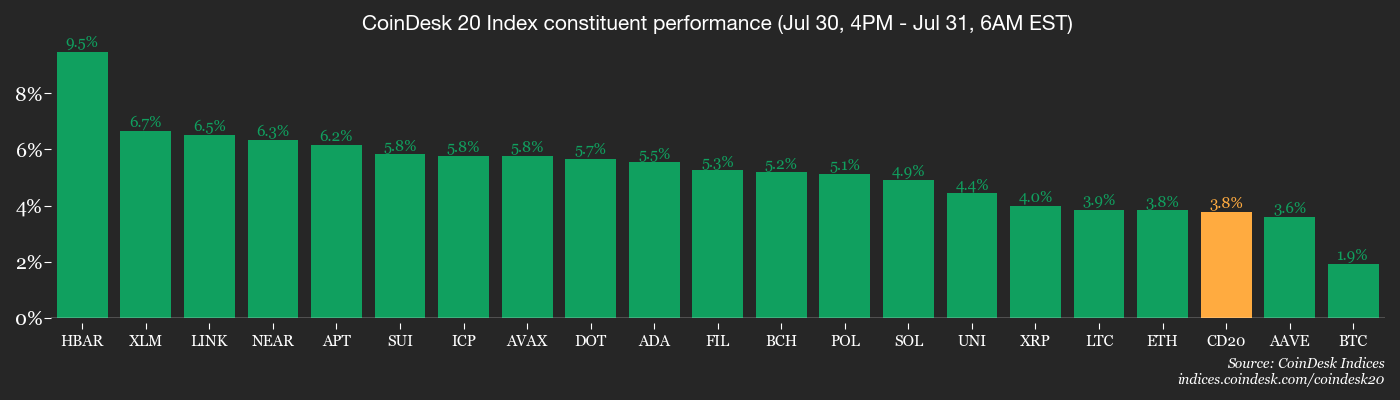

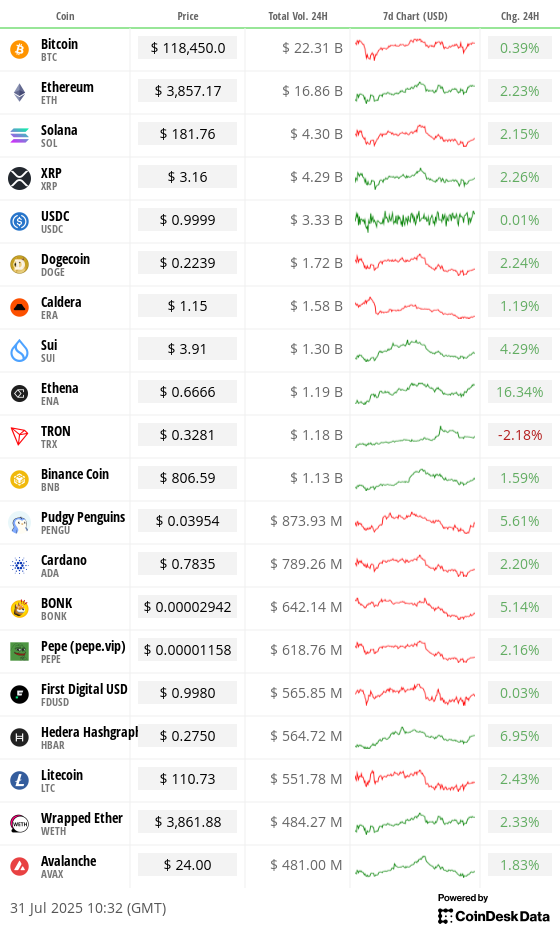

Bitcoin (BTC) bounced to $118,500 from $116,000, with ether (ETH), XRP (XRP) and other major altcoins following suit. The CoinDesk 80 Index traded over 2.5% higher on the day, outperforming the CoinDesk 20 Index, which suggests a stronger recovery in smaller tokens such as toncoin (TON) and memecoins including shiba inu (SHIB).

Still, the market overall stayed within recent price ranges, searching for catalysts to break through resistance.

Referring to bitcoin, Alex Kuptsikevich, the chief market analyst at FxPro, said: “The market still needs drivers to storm $120K. The U.S. White House report on the development of digital assets did not contain any details that could inspire new buyers, making the crypto market follow the trends of macroeconomics and traditional finance.”

The report, for example did not mention a strategic bitcoin reserve which, according to C.J. Burnett, chief revenue officer at Compass Mining, creates unnecessary uncertainty at a time when clarity is needed. “Silence on this front risks ceding influence to more aggressive actors abroad,” he said.

In other news, analysts at Glassnode noted that bitcoin is displaying euphoria similar to that observed at previous all-time highs, citing standard deviation studies based on a metric called unrealized profit as a percentage of market cap. A similar study showed potential for an ether rally to $4,900.

The number of ether locked in the DeFi protocol Ethena has risen 27% to 2.23 million ETH, taking the dollar value of the assets locked to a record $8.6 billion, according data source DeFiLlama.

Invesco and Galaxy Digital filed a proposal with the SEC for the creation of a spot solana exchange-traded fund. Early this week, the regulator approved in-kind redemptions for all BTC and ETH ETFs, unlocking major market efficiencies.

Solana-based decentralized exchange Jupiter unveiled Verify4, an upgrade that streamlines the token verification process with faster approvals and clearer guidelines, now including organic scores, social validation, and liquidity, along with an optional express 24-hour review for a 1,000 JUP burn.

In traditional markets, the dollar continued to strengthen with the Dollar Index nearing 100 for the first time since May 29. Copper registered its biggest single-day drop on record after President Donald Trump announced that a 50% tariff would not apply to refined metal but only to semi-finished metal product imports. Stay alert!

What to Watch

- Crypto

- July 31, 12 p.m.: A live webinar featuring Bitwise CIO Matt Hougan and Bitzenship founder Aleesandro Palombo discussing bitcoin’s potential to become a global reserve currency amid dedollarization trends. Registration link.

- Aug. 1: The Helium Network (HNT), now running on Solana, undergoes its halving event, cutting annual new token issuance to 7.5 million HNT.

- Aug. 1: Hong Kong’s Stablecoins Ordinance takes effect, introducing a licensing regime to regulate stablecoin activities in the city.

- Aug. 1: New Bretton Woods Labs will launch BTCD, which it says is the first fully bitcoin-backed stablecoin, on the Elastos (ELA) mainnet, a decentralized blockchain secured by merged mining with bitcoin and overseen by the Elastos Foundation.

- Aug. 15: Record date for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who meet pre-distribution requirements.

- Aug. 18: Coinbase Derivatives will launch nano SOL and nano XRP U.S. perpetual-style futures.

- Macro

- July 31, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases June unemployment rate data.

- Unemployment Rate Est. 6% vs. Prev. 6.2%

- July 31, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases June consumer income and expenditure data.

- Core PCE Price Index MoM Est. 0.3% vs. Prev. 0.2%

- Core PCE Price Index YoY Est. 2.7% vs. Prev. 2.7%

- PCE Price Index MoM Est. 0.3% vs. Prev. 0.1%

- PCE Price Index YoY Est. 2.5% vs. Prev. 2.3%

- Personal Income MoM Est. 0.2% vs. Prev. -0.4%

- Personal Spending MoM Est. 0.4% vs. Prev.-0.1%

- July 31, 11 a.m.: Colombia’s National Administrative Department of Statistics (DANE) releases June unemployment rate data.

- Unemployment Rate Est. 9.1% vs. Prev. 9%

- July 31, 2 p.m.: Colombia’s central bank, Banco de la República (BanRep), releases its monetary policy decision..

- Policy Rate Est. 9% vs. Prev. 9.25%

- Aug. 1, 12:01 a.m.: New U.S. tariffs take effect on imports from trade partners that failed to reach agreements by this date. For most countries, the baseline tariff will be in the 15%-20% range.

- Aug. 1, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases July employment data.

- Non Farm Payrolls Est. 110K vs. Prev. 147K

- Unemployment Rate Est. 4.2% vs. Prev. 4.1%

- Government Payrolls Prev. 73K

- Manufacturing Payrolls Est. -3K vs. Prev. -7K

- Aug. 1, 9 a.m.: S&P Global releases July manufacturing and services data for Brazil.

- Manufacturing PMI Prev. 48.3

- Aug. 1, 9:30 a.m.: S&P Global releases July manufacturing and services data for Canada.

- Manufacturing PMI Prev. 45.6

- Aug. 1, 9:45 a.m.: S&P Global releases (final) July manufacturing and services data for the U.S.

- Manufacturing PMI Est. 49.5 vs. Prev. 52.9

- Aug. 1, 10 a.m.: The Institute for Supply Management (ISM) releases July U.S. services sector data.

- Manufacturing PMI Est. Est. 49.5 vs. Prev. 49

- Aug. 1, 10 a.m.: The University of Michigan releases (final) July U.S. consumer sentiment data.

- Michigan Consumer Sentiment Est. 62 vs. Prev. 60.7

- Aug. 1, 11 a.m.: S&P Global releases July manufacturing and services data for Mexico.

- Manufacturing PMI Prev. 46.3

- Aug. 1 p.m.: Peru’s National Institute of Statistics and Informatics releases July consumer price inflation data.

- Inflation Rate MoM Prev. 0.13%

- Inflation Rate YoY Prev. 1.69%

- July 31, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases June unemployment rate data.

- Earnings (Estimates based on FactSet data)

- July 31: Coinbase Global (COIN), post-market, $1.39

- July 31: Reddit (RDDT), post-market, $0.19

- July 31: Strategy (MSTR), post-market, -$0.10

- July 31: Sequans Communications (SQNS), pre-market

- Aug. 5: Galaxy Digital (GLXY), pre-market, $0.19

- Aug. 4: Semler Scientific (SMLR), post-market, -$0.22

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: Coincheck (CNCK), post-market

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 8: TeraWulf (WULF), pre-market, -$0.06

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

Token Events

- Governance votes & calls

- NEAR Protocol is voting on potentially reducing NEAR’s inflation from 5% to 2.5%. Two-thirds of validators must approval the proposal for it to pass, and if so it could be implemented by late Q3. Voting ends Aug. 1.

- Venus DAO is voting on a 12-month renewal with Chaos Labs for the BNB Chain deployment at a cost of $400,000, focused on expanding the Risk Oracle system for real-time, automated risk parameter updates. Voting ends Aug. 1.

- Compound DAO is voting to select its next Security Service Provider (SSP). Delegates are choosing between ChainSecurity & Certora, and Cyfrin. Voting ends Aug. 5.

- Unlocks

- Aug. 1: Sui (SUI) to unlock 1.27% of its circulating supply worth $172.46 million.

- Aug. 2: Ethena (ENA) to unlock 0.64% of its circulating supply worth $27.48 million.

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating supply worth $13.9 million.

- Aug. 12: Aptos (APT) to unlock 1.73% of its circulating supply worth $52.14 million.

- Aug. 15: Avalanche (AVAX) to unlock 0.39% of its circulating supply worth $39.97 million.

- Aug. 15: Starknet (STRK) to unlock 3.53% of its circulating supply worth $16.13 million.

- Aug. 15: Sei (SEI) to unlock 0.96% of its circulating supply worth $17.86 million.

- Token Launches

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through Aug. 31.

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

- Aug. 11: Paraguay Blockchain Summit 2025 (Asuncion)

- Aug. 11-13: AIBB 2025 (Istanbul)

- Aug. 11-17: Ethereum NYC (New York)

- Aug. 13-14: CryptoWinter ‘25 (Queenstown, New Zealand)

- Aug. 21-22: Coinfest Asia 2025 (Bali, Indonesia)

Token Talk

By Oliver Knight

- Token generator platform Pump.fun released its native PUMP token earlier this month, debuting with a value of $1.6 billion market cap.

- The token slumped 60% over the following two weeks as the introduction was greeted with a wave of sales requests.

- Now, however, the highly anticipated project is showing signs of life. The price has risen 27% in the past 24 hours as buying interest increases.

- Popular trader Matter posted a PUMP long position on Telegram, adding that “$PUMP strength is obvious relative to the market.”

- Part of Thursday’s move to the upside can be attributed to Pump’s decision to conduct a buyback program, which involves using 100% of daily fees to purchase PUMP tokens on the open market.

- The token is also publicly backed by a number of traders including Machi Big Brother, who maintained a $13.3 million position despite nursing $4.47 million in unrealized losses.

Derivatives Positioning

- ENA, LINK and XRP have seen the most growth in futures open interest among major coins in the past 24 hours.

- BTC and ETH global open interest in coin terms remains elevated near record highs

- However, the negative 24-hour open interest-adjusted cumulative volume delta for both coins and other major tokens points to net selling pressure in the market, raising a question about the sustainability of the recovery from the late Wednesday decline.

- On Deribit, ETH call bias weakened across the board while BTC risk reversals continued to show a bias for puts at the front end.

- Block flows on OTC network Paradigm featured August expiry BTC calendar spreads and demand for August expiry ether puts.

Market Movements

- BTC is up 1.24% from 4 p.m. ET Wednesday at $118,592.59 (24hrs: +0.42%)

- ETH is up 2.49% at $3,863.55 (24hrs: +2.27%)

- CoinDesk 20 is up 2.46% at 4,023.37 (24hrs: +1.54%)

- Ether CESR Composite Staking Rate is up 1 bp at 2.94%

- BTC funding rate is at 0.0136% (14.892% annualized) on KuCoin

- DXY is unchanged at 99.82

- Gold futures are up 0.18% at $3,358.70

- Silver futures are down 2.45% at $36.81

- Nikkei 225 closed up 1.02% at 41,069.82

- Hang Seng closed down 1.60% at 24,773.33

- FTSE is up 0.37% at 9,170.69

- Euro Stoxx 50 is down 0.10% at 5,387.83

- DJIA closed on Wednesday down 0.38% at 44,461.28

- S&P 500 closed down 0.12% at 6,362.90

- Nasdaq Composite closed up 0.15% at 21,129.67

- S&P/TSX Composite closed down 0.62% at 27,369.96

- S&P 40 Latin America closed down 0.68% at 2,582.10

- U.S. 10-Year Treasury rate is up 4 bps at 4.368%

- E-mini S&P 500 futures are up 0.96% at 6,457.50

- E-mini Nasdaq-100 futures are up 1.30% at 23,785.75

- E-mini Dow Jones Industrial Average Index are up 0.34% at 44,786.00

Bitcoin Stats

- BTC Dominance: 61.33% (-0.43%)

- Ether to bitcoin ratio: 0.03260 (0.84%)

- Hashrate (seven-day moving average): 898 EH/s

- Hashprice (spot): $59.02

- Total Fees: 4.19 BTC / $493,795

- CME Futures Open Interest: 139,740 BTC

- BTC priced in gold: 35.8 oz

- BTC vs gold market cap: 10.12%

Technical Analysis

- The dollar index (DXY) has triggered a dual bullish signal, marked by an inverse head-and-shoulder breakout followed by a crossover above the Ichimoku cloud.

- The pattern points to further gains ahead, which could potentially cap upside in BTC.

Crypto Equities

- Strategy (MSTR): closed on Thursday at $395.04 (+0.1%), +1.97% at $402.84 in pre-market

- Coinbase Global (COIN): closed at $377.48 (+1.63%), +2.87% at $388.30

- Circle (CRCL): closed at $190.5 (+4.88%), -0.19% at $190.13

- Galaxy Digital (GLXY): closed at $28.9 (+8%), +4.33% at $30.15

- MARA Holdings (MARA): closed at $16.55 (-0.36%), +1.27% at $16.76

- Riot Platforms (RIOT): closed at $13.52 (-0.59%), +1.48% at $13.72

- Core Scientific (CORZ): closed at $13.05 (-1.02%), +3.1% at $13.46

- CleanSpark (CLSK): closed at $11.42 (-2.64%), +1.14% at $11.55

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.71 (-0.8%)

- Semler Scientific (SMLR): closed at $35.91 (-1.89%), 1.73% at $36.53

- Exodus Movement (EXOD): closed at $29.08 (-8.06%)

- SharpLink Gaming (SBET): closed at $19.56 (+2.52%), +5.88% at $20.71

ETF Flows

Spot BTC ETFs

- Daily net flows: $47.1 million

- Cumulative net flows: $55.08 billion

- Total BTC holdings ~1.3 million

Spot ETH ETFs

- Daily net flows: $5.8 million

- Cumulative net flows: $9.64 billion

- Total ETH holdings ~5.73 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The total supply of stablecoins on Coinbase’s layer-2 blockchain Base has flatlined above $4 billion.

- In other words, new capital is no longer flowing onto the chain.

While You Were Sleeping

- Trump Escalates Trade War With Canada Following Palestine Stance (Reuters): President Trump said a trade deal with Canada looks unlikely after it backed Palestinian statehood, with 35% tariffs set to hit non-USMCA goods if no agreement is reached.

- Trump Escalates Fight With Brazil, Taking Aim at Its Economy and Politics (The New York Times): Angered by conservative censorship and what he calls political persecution of former President Bolsonaro, Trump imposed 50% tariffs on Brazil starting Aug. 6, though key exports like aircraft and orange juice are exempt.

- Strategy’s Market Hints at Strongest Downside Risk Since April (CoinDesk): Put option demand on MSTR hit its highest level in three months, with Strategy shares down over 14% in two weeks and closing below their 50-day moving average.

- Crypto Exchange Kraken’s Earnings Fell 6.8% Year-Over-Year to $79.7M in Q2 (CoinDesk): Kraken blamed weaker earnings on seasonal trading patterns and a crypto sell-off triggered by U.S. tariffs, which helped push BTC to a 2025 low near $76,000 in April.

- The Ether Machine Begins ETH Treasury Deployment With $57M Purchase (CoinDesk): The firm bought nearly 15,000 ETH, launching a long-term treasury strategy tied to its SPAC listing, with over $400 million still earmarked for future acquisitions.

- Donald Trump Slams India and Russia as ‘Dead Economies’ After Tariff Stand-Off (Financial Times): India’s top trading partner is the U.S., but it remains heavily reliant on Russian arms and oil. A 25% U.S. tariff on Indian goods is scheduled to begin Aug. 1.

In the Ether