The profit-taking activity on the Bitcoin network intensified on Monday, keeping bitcoin’s (BTC) spot price under pressure on the final day of the second quarter.

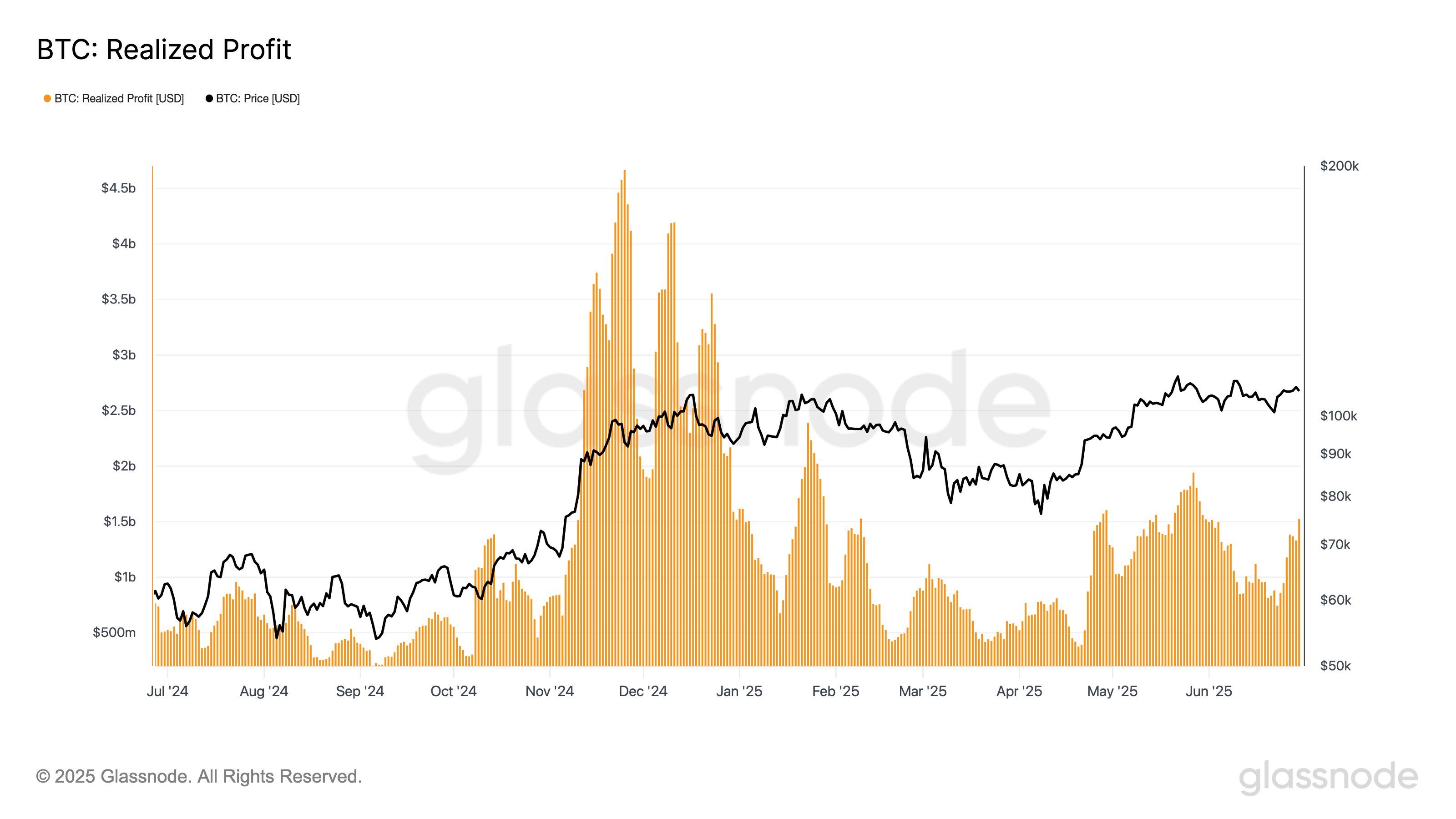

The total amount of realized profits on-chain rose to $2.4 billion, with its seven-day average climbing to $1.52 billion, the highest since the second half of May, according to data tracked by blockchain analytics firm Glassnode.

“That’s above the YTD average of $1.14 billion, but still well below the ~$4 billion-$5 billion peaks (7D SMA) seen in Nov–Dec 2024,” Glassnode said on X.

The realized profit metric represents the total USD value of all coins moved on-chain whose price at their latest movement was higher than the price at their previous movement.

Read: Who’s Selling Bitcoin Above $100K and Holding Back the Price Rally?

BTC’s spot price fell by 1% to $107,180 on Monday. Prices have steadied in the range of $100,000 to $110,000 since mid-May, with wallets known to hold coins for the long-term liquidating their holdings amid continued inflows into the U.S.-listed spot bitcoin exchange-traded funds (ETFs).