It may be a coincidence, but the recent decline in the Nasdaq and bitcoin (BTC) coincides with a sharp rise in Japanese government bond yields and the strengthening of the safe-haven Japanese yen (JPY), reminiscent of the market dynamics seen in early August.

There could be a causation here, as, for decades, the low-yielding yen propped up global asset prices. The ongoing rise in the Japanese yen may have had a hand in the recent risk aversion on Wall Street and in the crypto market.

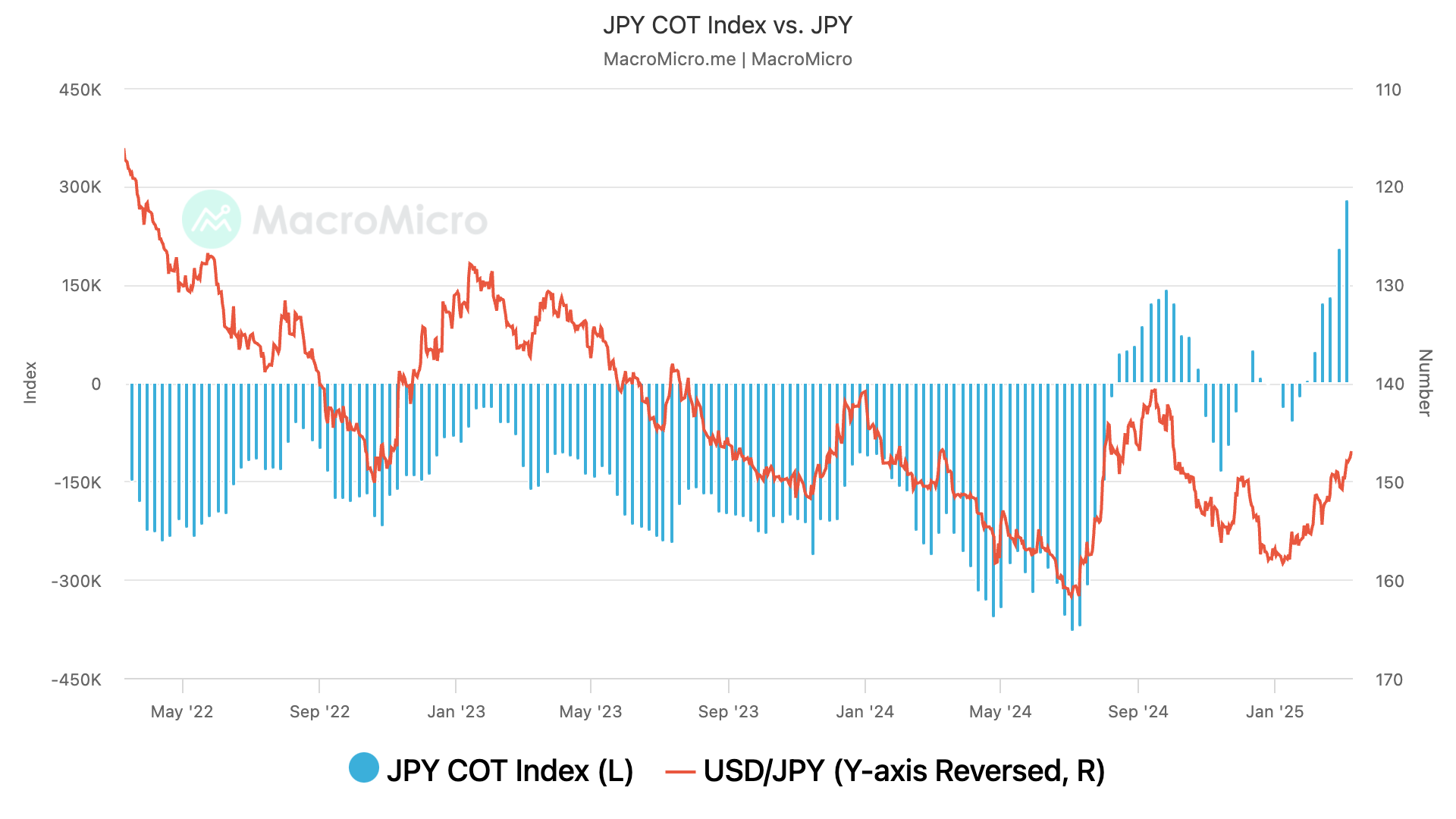

That said, the bullish positioning in the Japanese yen looks overstretched, with speculators holding record longs last week, according to the CFTC data tracked by MacroMicro. Such extreme bullish positioning, representing a collective belief in a continued move higher in the asset, sets the stage for disappointment, following, which a mass unwinding of longs unfolds, leading to a quick bearish reversal.

In other words, the yen’s rise could stall for now, offering relief to risk assets, including Nasdaq and bitcoin.

“We are now cautious on chasing further JPY strength, given stretched speculative positioning as well as strong dip-buying appetite from the domestic community,” Morgan Stanley’s G10 FX Strategy team said in a note to clients late Friday.

Strategists explained that many Japanese investors use the Nippon Individual Savings Account (NISA) scheme to snap up foreign assets during risk-off, inadvertently slowing the pace of JPY appreciation. Additionally, the public pension system tends to go against the trend, rebalancing out of JPY assets.

“Indeed, such scenario happened in last August after a sharp appreciation of the JPY and the pronounced sell-off in equities,” strategists noted.

Let’s see if history repeats itself, triggering a renewed risk-on sentiment for Nasdaq and bitcoin. The USD/JPY pair turned up following the July and early August slide to 140, eventually rising to 158.50 by January. BTC turned up as well from the early August crash to $50,000, rising to new record highs above $108,000 in January.

At press time, bitcoin traded near $80,300, representing a month-to-date decline of nearly 5%, extending February’s 17.6% slide. At one point early Tuesday, prices dipped to $76,800, according to CoinDesk data.

Meanwhile, USD/JPY traded at 147.23, having put in a five-month low of 145.53 early Tuesday, TradingView data show.

Temporary respite?

While the stretched bull positioning and institutional flows suggest relief ahead, these factors may do little to alter the broader bullish outlook for JPY, which is backed by a narrowing U.S.-Japanese bond yield differential.

So, risk asset bulls need to be vigilant for signs of volatility in the yen and the broader financial markets.

The chart shows the spread between yields on the 10-year U.S. and Japanese government bonds.

The spread has narrowed to 2.68% in a JPY-positive manner, reaching the lowest since August 2022. Plus, it has dived out of a macro uptrend, suggesting a major bullish shift in the JPY outlook.