Crypto prices slipped Thursday after an unexpectedly hot PPI inflation print, but analysts said it’s just a pullback within the rally.

The CoinDesk 20 Index of largest cryptocurrencies fell 2.1% over the past 24 hours, with bitcoin (BTC) dropping 2.3%. XRP (XRP) lost 4.6% with ether (ETH) outperforming by edging down 0.7%.

“The pullback is, in my view, simply a recalibration in an otherwise bullish trend,” said David Siemer, co-founder and CEO of Wave Digital Assets. “Bitcoin remains firmly entrenched as the anchor of institutional crypto strategies.”

Bitcoin’s (BTC) rush to new all-time highs over $124,000 was fueled by rising expectations for Federal Reserve interest-rate cuts in September coupled with surging ETF inflows and institutional adoption.

The Thursday reversal to as low as $118,000 was “equally normal,” he said.

“After such a sharp rally, profit-taking tends to set in, and we saw short-term traders liquidate their positions and take gains,” Siemer said. “In addition, higher-than-expected inflation data, particularly around core consumer prices, has tempered some of the Fed optimism that drove the rally.

“It’s a healthy consolidation rather than a reversal,” he concluded.

Joel Kruger, market strategist of LMAX Group shared a similar view.

“It comes as no surprise to see a round of profit taking kick in following some impressive moves in crypto markets this week,” Kruger wrote in a morning note. “But overall, the outlook remains highly constructive and dips should be well supported.”

Looking ahead, key risks for crypto prices are potential overextension of valuations, geopolitical turbulence or economic data that could recalibrate Fed projections, Kruger added.

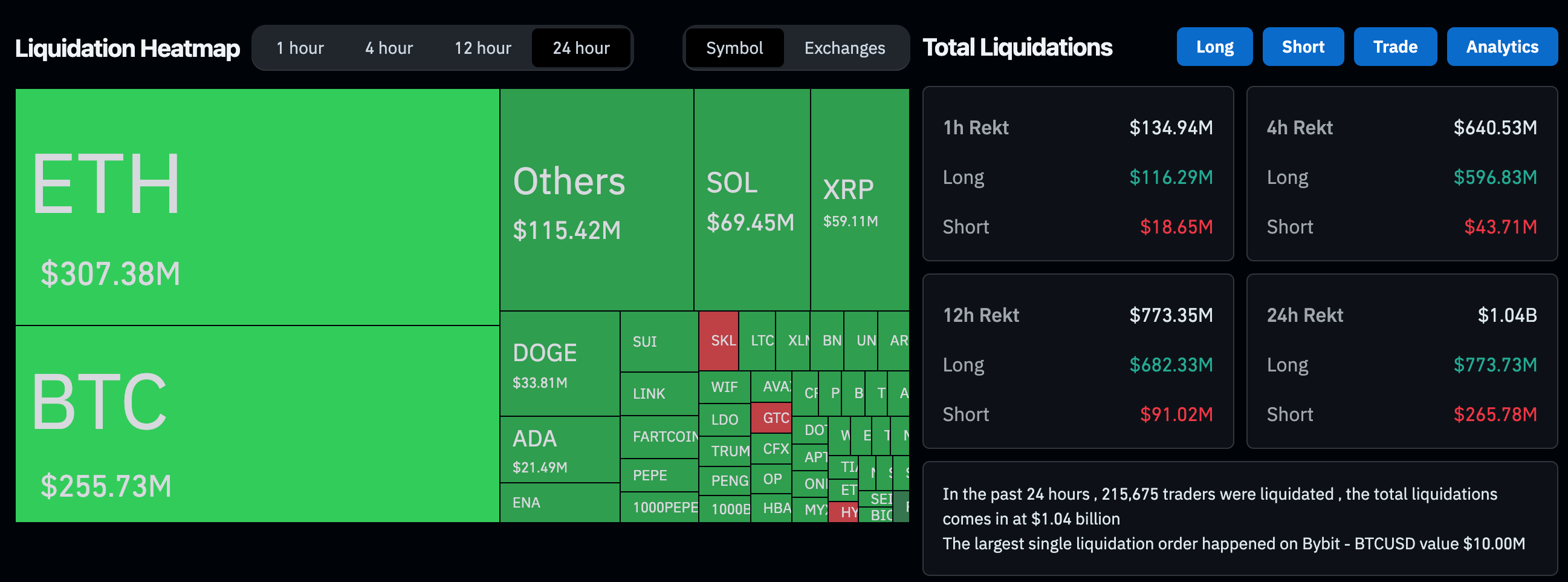

Still, late bulls were punished for their exuberance. The shakeout triggered a massive leverage flush, liquidating over $1 billion in leveraged trading positions across all crypto derivatives over the past 24 hours, mostly longs betting on rising prices, CoinGlass data shows.

That’s the largest long liquidation since at least the late July–early August plunge. That time, BTC dipped below $112,000 and many altcoins saw double-digit pullbacks, eventually carving out the local bottom for most of the digital asset market.

“The ‘I guess opening a 50x long after a 7-day 50% move was not the best idea’ type of shakeout here,” well-followed trader Bob Loukas said in an X post.

Read more: Bitcoin Hits $124K Record as 4 Tailwinds Align: Crypto Daybook Americas