This is a daily analysis of top tokens with CME futures by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

BTC/JPY: Focus on descending triangle

Bitcoin’s (BTC) dollar-denominated price continues to fluctuate below $120,000, hovering around major intraday moving averages, which provides little directional clarity. Hence, we are focusing on bitFlyer’s BTC/JPY pair, which displays a well-defined descending triangle at record highs, making it easier to analyze the trend.

Usually, the descending triangle is viewed as a bearish pattern. Its downward-sloping upper trendline, representing lower highs, indicates that sellers are progressively gaining strength. And hence, an eventual decisive breach of the horizontal support line is said to confirm a bearish trend reversal.

In the case of BTC/JPY, the horizontal support is identified at 17,160,000 JPY ($117,000). A move below that would strengthen the bear grip, shifting focus to the rising trendline support.

Conversely, a breakout from the triangle will likely bring new lifetime highs. The bullish case looks possible as traders are increasingly expecting more Fed rate cuts for 2026. Interest rate futures data show that traders are now pricing roughly 76 basis points of rate reductions for next year, up from 25 basis points priced in April.

Furthermore, the rising yields at the long end of the U.S. government bond market and those in other advanced nations point to expectations of continued fiscal support for economy and markets.

Keep an eye on USD/JPY

The outlook for yen against the dollar appears constructive, as the spread between 30-year U.S.-Japan bond yields has dropped to the lowest since August 2022, signaling JPY strength.

A yen rally could lead to a bout of broad-based risk aversion, potentially capping gains in risk assets, including BTC.

- AI’s take: BTC/JPY is consolidating within a descending triangle, raising immediate concerns for the pair despite the overarching bullish trendline from June. While rising Fed rate cut bets generally favor Bitcoin (in USD terms), the strengthening JPY due to the US-Japan 30-year yield differential could cap BTC/JPY gains or exacerbate a breakdown from the triangle

- Resistance: $120,000, $121,181.

- Support: $116,000, $115,739, $111,965.

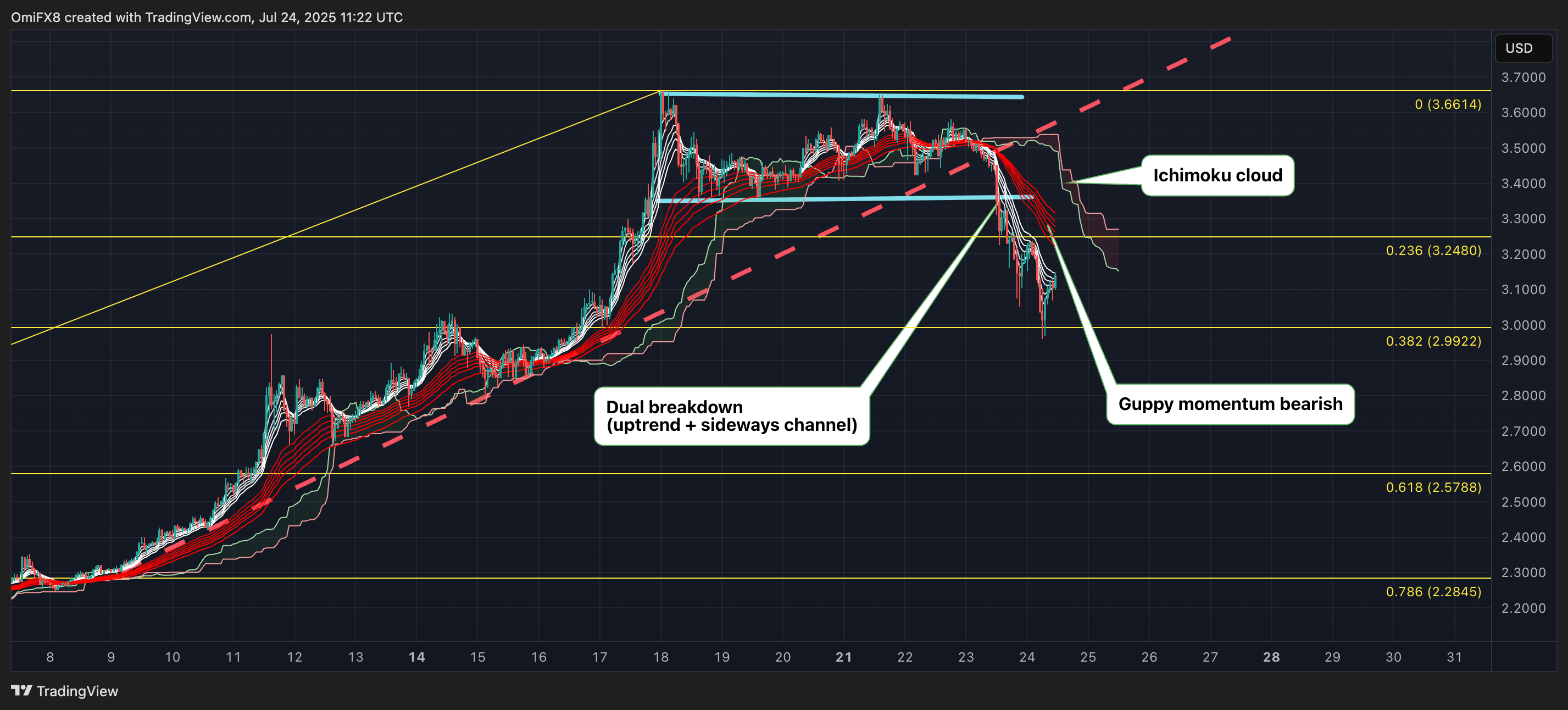

XRP: Focus on 38.2% fib retracement

XRP (XRP) has crashed over 10% in the past 24 hours, consistent with bearish signals from the price chart early Wednesday. The price sell-off found support at around $2.99 early Thursday, which corresponds to the 38.2% Fibonacci retracement of the significant rally from $1.9.

However, the subsequent recovery to $3.10 may not have legs as momentum, represented by the Guppy multiple moving average indicator, has flipped bearish. Further, both the Guppy averages and prices are now decisively in the bearish territory below the Ichimoku cloud.

Therefore, a re-test of $2.99 appears likely, which, if it fails to hold, could lead to prices sliding to $2.57, the 61.8% Fibonacci retracement. On the higher side, a move above $3.35 is needed to invalidate the bearish bias.

- AI’s take: The key takeaway from the XRP chart is that the dual breakdown of both its previous uptrend and sideways channel signals a confirmed bearish shift in momentum.

- Resistance: $3.35, 3.65, $4

- Support: $2.99, $2.65, $2.57

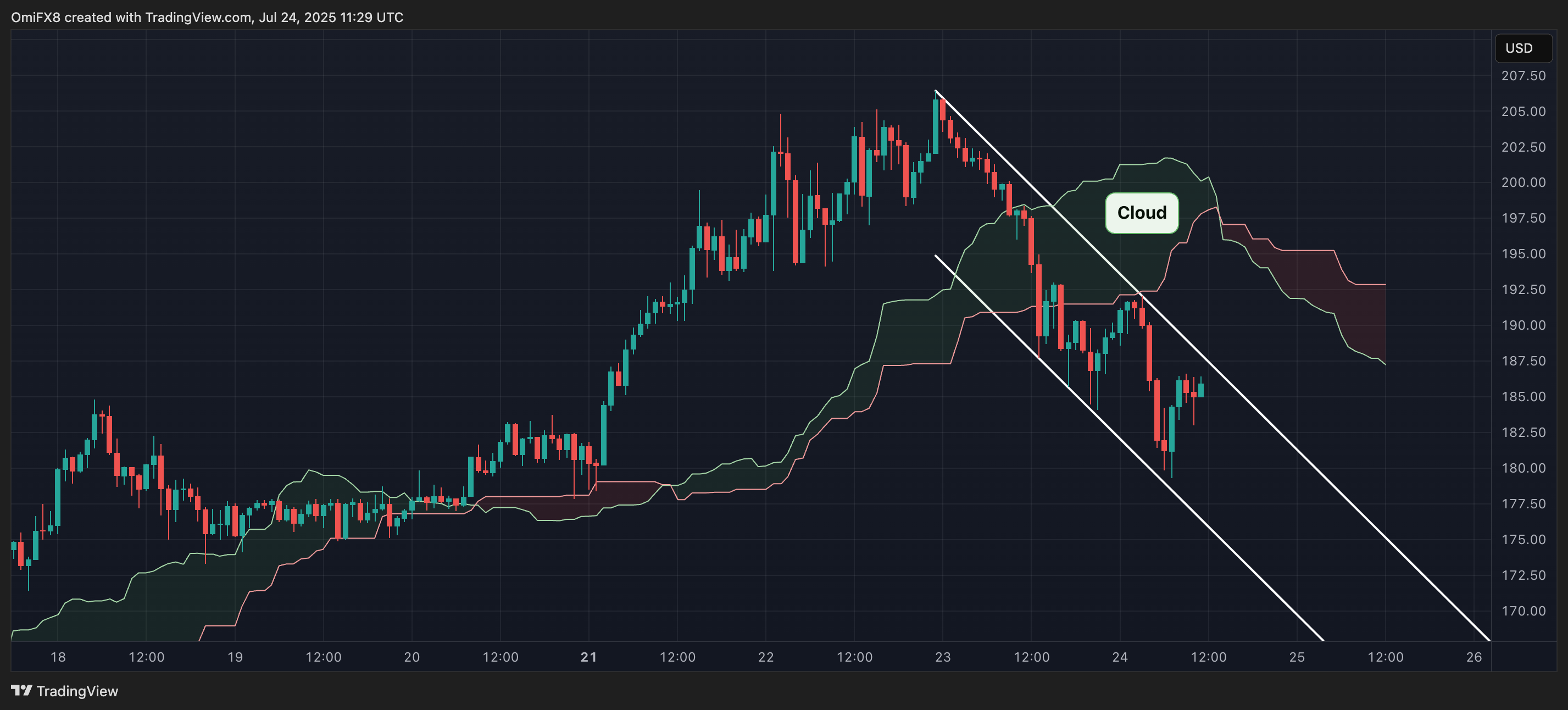

Ether: Moves lower through a descending channel

Ether (ETH) continues to print lower highs and lower lows on the hourly chart, establishing a downward-trending channel. The 50- and 100-hour SMAs have produced a bearish crossover and the 200-hour SMA is fast losing its bullish slope. In addition, prices have established a foothold below the Ichimoku cloud.

All things favor a continued slow and steady descent. Only a move above $3,740, which would take prices back above the cloud, would revive the immediate bullish outlook.

- AI’s take: Traders should eye the 200-hour SMA as crucial support; a break below it could signal an extended downtrend.

- Resistance: $3,740, $4,000, $4,109.

- Support: $3,593 (the 200-hour SMA), $3,480, $3,081.

Solana: Ether-like moves

SOL’s (SOL) hourly chart resembles ether’s, with prices moving through a downward-sloping channel, having established a foothold below the Ichimoku cloud. In addition, the Guppy indicator is now positioned decisively bearish. The immediate bias remains bearish as long as prices remain below the lower high of $192.

- AI’s take: Recovery rallies within this channel could meet resistance at the channel’s upper boundary and the underside of the cloud, indicating continued bearish pressure.

- Resistance: $192, $200, $218.

- Support: $179 (daily low), $163 (the 200-day SMA), $145.

Read more: Altcoin Season Hope Dim as Traders Unwind Bullish Bets: Crypto Daybook Americas