XRP XRP has staged one of the strongest rallies among crypto majors this cycle, but early retail holders are heading for the exit under the surface.

Now trading above $2 — more than thrice its pre-rally base from October 2024 — XRP has become one of the best-performing large-cap tokens over the past 8 months. Investors who bought below 60 cents are sitting on gains upward of 300%, prompting a sharp pickup in profit-taking.

According to on-chain data from Glassnode, the 7-day simple moving average (SMA) of realized profits from XRP wallets hit $68.8 million earlier this month, the highest in over a year. That’s a clear sign of distribution pressure, with early accumulators cashing out into strength as the token tests key resistance levels just below its 2021 peak.

That profit-taking pressure may help explain XRP’s failure to break above $2.20 in recent sessions, despite multiple bullish headlines and technical tailwinds.

Read more: XRP Drops 5% as High-Volume Selling Pressure Dominates Market

While the broader setup remains positive, supported by regulatory clarity in the U.S. and Ripple’s growing push into tokenized asset infrastructure, the near-term price action reflects a supply overhang from long-term holders.

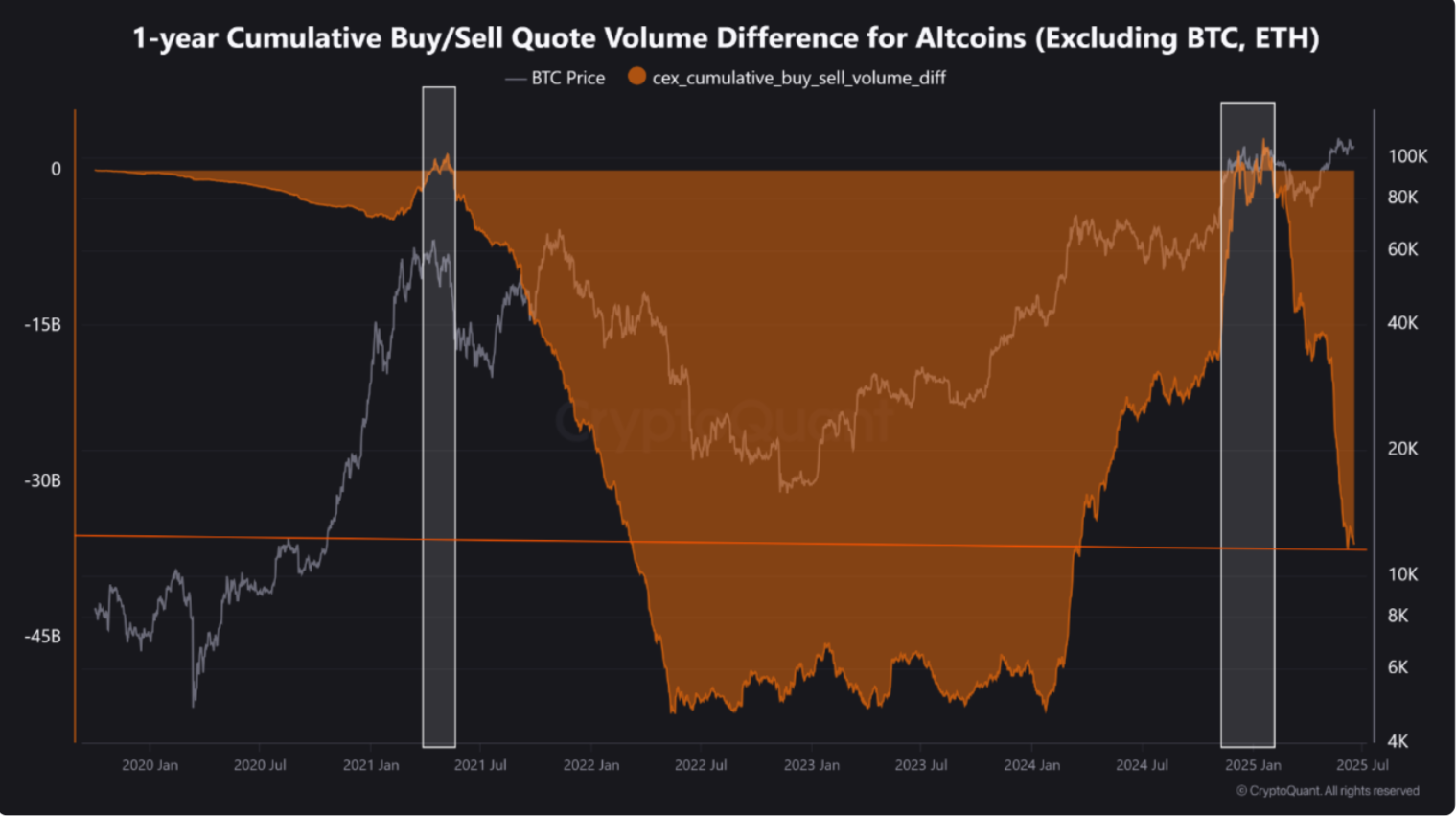

A recent CryptoQuant analysis showed that the 1-year cumulative buy/sell quote volume difference for altcoins (excluding BTC and ETH) — a proxy for net investor flows — currently stands at negative $36 billion. That’s a sharp reversal from December 2024, when the metric briefly flipped positive, marking a local top for altcoins.

Since then, it’s been a one-way bleed, with “altcoin investors MIA,” CryptoQuant independent analyst Burak Kesmeci said in a Thursday post.

Despite pockets of strength in XRP, SOL, and a few narrative tokens tied to real-world assets (RWAs), the broader altcoin ecosystem remains stuck in a bear market, he noted.

Unless risk appetite returns or capital flows back into Layer 1s, DeFi, and gaming, hopes of an “altseason” may continue to fade into the summer.

Read more: XRP Hits 12-Year Milestone With Over 2,700 Whales, Holding Over 1M XRP, Onchain Data Show