Hi. I’m Andy Baehr with the CoinDesk Indices team. Question: Bitcoin is stuck in a range. Is that a bad thing or a good thing?

Even casual BTC watchers will have noted the ten percent channel that has held for more than a month. As of today, in fact, it has been 40 days since we entered the ~$101K – ~$111K range, with no catalyst forcing a breakout through either boundary. Good or bad thing?

The macro muddle supports range-trading. Our anchor bitcoin macro factor remains expectations for future real interest rates–nominal rates minus inflation. Recent cross-currents create an unclear picture: inflation expectations from surveys have been elevated (though recent releases seem less concerning), while hopes for Fed relief were dim until the market began pricing in two 2025 cuts more assertively. Too muddled for a breakout. Bitcoin is doing what it should.

For the store-of-value thesis, range-trading is actually fine. As bitcoin accumulates more days of “not unexpected” behavior, it supports the narrative of relative independence from other risk assets and improved stability. (The S&P 500 has also kept an 8% range through the same 39 days, so bitcoin isn’t alone in this holding pattern, although recent news flows might have knocked a younger bitcoin off the track.)

But traders are getting restless. Bitcoin’s basement-level thirty-day realized volatility below 30% crimps opportunity. Implied vols are also down as option buyers grow fatigued and sellers grab yield more confidently. Like any market, a range that holds too long creates complacency—making the eventual exit more “exciting” than it would otherwise be.

The stalled mood is hurting breadth. Without bitcoin providing leadership, other digital assets are wilting. The CoinDesk 20 Index has trailed bitcoin by about 5% over the past month, as the lack of sentiment has stalled the late-April rally, even in ETH, which had bounced strongly.

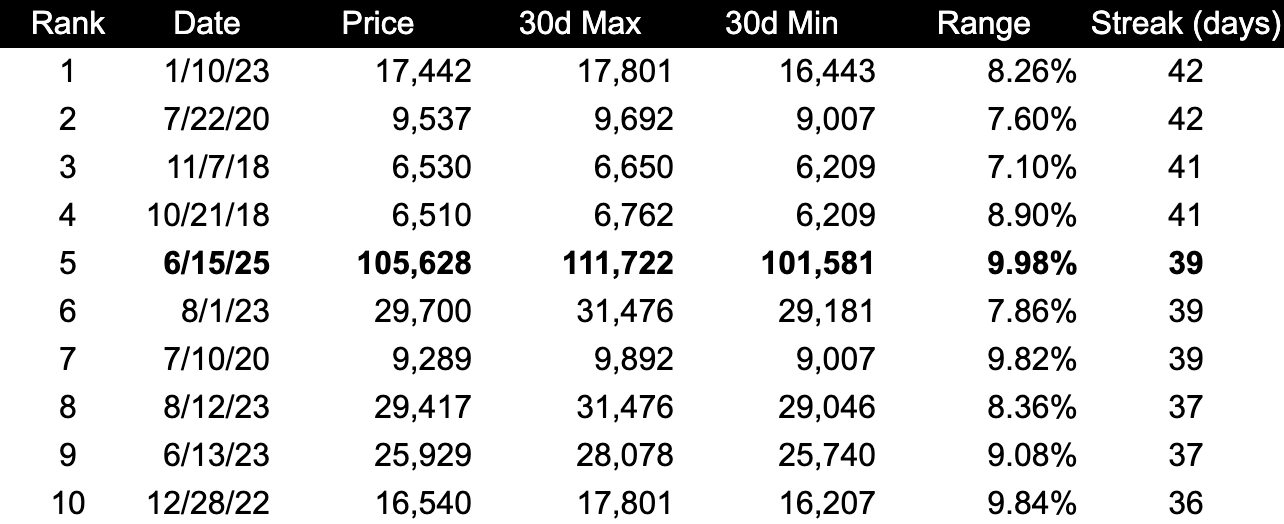

How does this compare historically? With some truly unattractive vibe coding (I take the blame), we studied bitcoin’s longest streaks of holding 10% ranges. The current 40-day stretch isn’t the longest—that was 42 days—but it’s close. Similar streaks occurred in 2018, 2020, and 2023. Given bitcoin’s evolved ownership structure (ETFs, MSTR) and more accessible spot and derivatives markets, would a 50-day streak surprise anyone? Not sure.