By James Van Straten (All times ET unless indicated otherwise)

If there was any doubt that popular interest in bitcoin BTC is on the wane as the price treads water just below its record high, a quick peek at Google’s search trends provides the evidence.

Searches for the largest cryptocurrency now rank below 25, a sign of significant absence of retail interest, euphoria or speculative greed in the market with BTC holding between $102,000 and $110,000 for most of the past month. Compare that to the ranking of as high as 40 it hit during November’s rally, when bitcoin surged to nearly $100,000.

This subdued interest coincides with historically low volatility levels. The Bitcoin Volatility Index (DVOL) is hovering just above 40, one of the lowest readings in over two years, beaten only by trough of mid-2023.

Deribit’s implied volatility metrics further emphasize the market’s stagnation: The IV Rank, which shows how current implied volatility compares with the past year, is at just 2.3, close to its lowest point of the year, and the IV Percentile is at an astonishing 0.3, indicating that implied volatility has been lower than this level less than 1% of the time over the last 12 months.

This lack of movement has prompted Strategy (MSTR), a company heavily exposed to bitcoin’s price action, to issue new perpetual preferred equity rather than tapping its at-the-market offering of common stock, a strategy aimed at keeping its multiple net asset value (mNAV) above 1.

Meanwhile, the iShares Bitcoin Trust (IBIT) is benefiting from the reduced volatility, attracting more traditional and conservative investors who prefer stable exposure to bitcoin without the wild price swings.

All eyes now turn to the U.S. jobs report scheduled for Friday, which could serve as the next major market catalyst. Expectations are for the unemployment rate to hold steady at 4.2%, while non-farm payrolls are projected to come in at 130,000, the weakest figure since February. Any deviation from these estimates could spark renewed volatility across markets. Stay alert!

What to Watch

- Crypto

- June 4, 10 a.m.: U.S. House Financial Services Committee will hold a hearing on “American Innovation and the Future of Digital Assets: From Blueprint to a Functional Framework.” Livestream link.

- June 6: Sia (SC) is set to activate Phase 1 of its V2 hard fork, the largest upgrade in the project’s history. Phase 2 will get activated on July 6.

- June 9, 1-5 p.m.: U.S. SEC Crypto Task Force roundtable on “DeFi and the American Spirit”

- June 10, 10 a.m.: U.S. House Final Services Committee hearing for Markup of Various Measures, including the crypto market structure bill, i.e. the Digital Asset Market Clarity (CLARITY) Act.

- June 16 (market open): 21Shares executes 3-for-1 share split for ARK 21Shares Bitcoin ETF (ARKB); ticker and NAV remain unchanged.

- Macro

- June 4, 9 a.m.: S&P Global releases May Brazil data on manufacturing and services activity.

- Composite PMI Prev. 49.4

- Services PMI Prev. 48.9

- June 4, 9:45 a.m.: S&P Global releases (final) May U.S. data on manufacturing and services activity.

- Composite PMI Est. 52.1 vs. Prev. 50.6

- Services PMI Est. 52.3 vs. Prev. 50.8

- June 4, 10 a.m.: The Institute for Supply Management (ISM) releases May U.S. services sector data.

- Services PMI Est. Est. 52 vs. Prev. 51.6

- June 5, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended May 31.

- Initial Jobless Claims Est. 235K vs. Prev. 240K

- Continuing Jobless Claims Est. 1910K vs. Prev. 1919K

- June 4, 9 a.m.: S&P Global releases May Brazil data on manufacturing and services activity.

- Earnings (Estimates based on FactSet data)

- None in the near future.

Token Events

- Governance votes & calls

- Arbitrum DAO is voting on whether to adjust the 7 million ARB delegated to Event Horizon, following its pivot to AI-driven governance. Voting ends June 5.

- Uniswap DAO is voting on a proposal to fund the integration of Uniswap V4 and Unichain support in Oku. The goal is to expand V4 adoption, support hook developers, and improve tools for liquidity providers and traders. Voting ends June 6.

- June 4, 6:30 p.m.: Synthetix to host a community call.

- June 5, 10 a.m.: TON to host a builders call, decentralized finance edition.

- June 10, 10 a.m.: Ether.fi to host an analyst call followed by a Q&A session.

- Unlocks

- June 5: Ethena (ENA) to unlock 2.95% of its circulating supply worth $58.09 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $56.10 million.

- June 13: Immutable (IMX) to unlock 1.33% of its circulating supply worth $14.02 million.

- June 15: Starknet (STRK) to unlock 3.79% of its circulating supply worth $17.68 million.

- June 15: Sei (SEI) to unlock 1.04% of its circulating supply worth $11.10 million.

- Token Launches

- June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

Conferences

- Day 3 of 6: SXSW London

- Day 2 of 3: Money20/20 Europe 2025 (Amsterdam)

- Day 1 of 3 Non Fungible Conference (Lisbon)

- June 5-6: 2025 Crypto Valley Conference (Zug, Switzerland)

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26-27: Istanbul Blockchain Week

Token Talk

By Shaurya Malwa

- Leading Pump.fun-spawned memecoins, among them FARTCOIN, PNUT, MOODENG and GOAT, slipped as much as 6% intraday, erasing roughly $150 million in combined market value after reports circulated that the platform is planning to raise $1 billion in a token sale.

- Traders worry a new Pump token — reportedly seeking a $4 billion fully-diluted valuation — could siphon liquidity and add fresh supply, pressuring existing coins.

- The pullback comes weeks after Pump.fun began sharing 50% of PumpSwap fees (0.05% per trade) with token creators, a move meant to curb “dump on the community” incentives.

- Crypto Twitter praised Pump’s revenue haul but questioned why a firm already boasting approximately $700 million in earnings needs more capital, highlighting the tension between growth ambitions and community expectations.

Derivatives Positioning

- BTC options open interest on Deribit reached an all-time high of $38.95 billion on May 27, driven by strong activity around the 27 June expiry, which now holds $12.66 billion in notional value.

- Call-side dominance remains clear, with 195,928 contracts versus 110,259 puts, and the 24-hour put/call volume ratio falling to just 0.43.

- Upside strike interest on Deribit remains concentrated around the $100,000–$150,000 band, with the June 27 $108,000 and $110,000 calls trading notional volumes of $104.9 million and $104.8 million respectively. Open interest by strike also shows more than 15,000 calls open at the $120,000 level, worth over $1.6 billion in notional volume.

- According to Coinalyze, BTC continues to dominate derivatives markets, with $33.4 billion in aggregate open interest — by far the highest across tracked assets. ETH ranks second at $16.2 billion, followed by SOL ($3.4B), XRP ($1.8B), and DOGE ($1.1B), highlighting a clear concentration in BTC.

- Liquidation leverage maps by Coinglass show aggressive long exposure concentrated between $104,000 and $108,000, with $83.8 million in liquidation leverage built near $105,500 and a further $64.5 million around $104,500 . These zones now mark key levels to watch for forced unwind risk should price retrace.

Market Movements

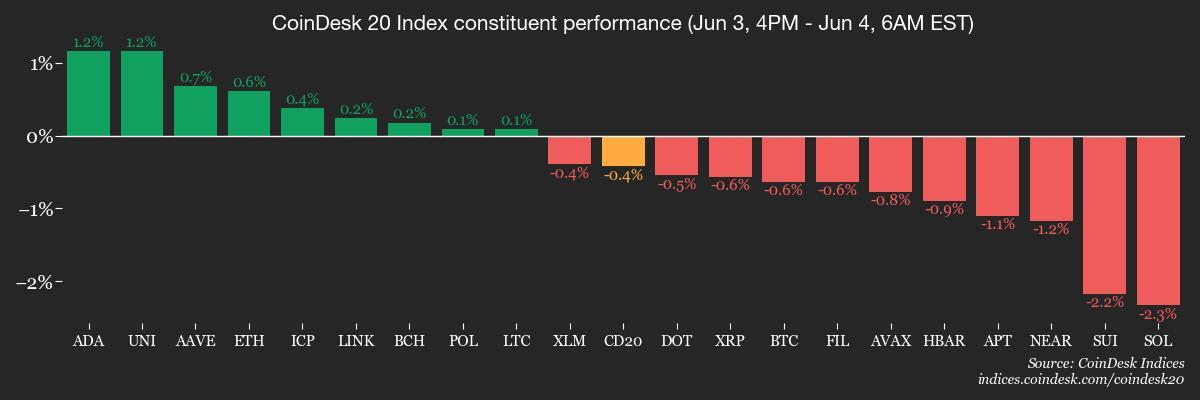

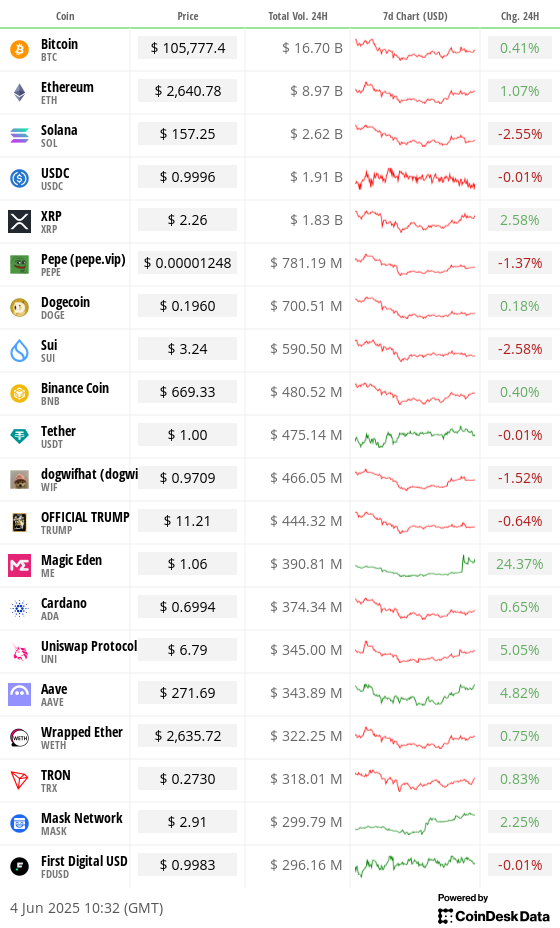

- BTC is unchanged from 4 p.m. ET Tuesday at $105,875.59 (24hrs: +0.53%)

- ETH is up 1.07% at $2,644.68 (24hrs: +1.3%)

- CoinDesk 20 is up 0.51% at 3,146.13 (24hrs: +0.81%)

- Ether CESR Composite Staking Rate is up 6 bps at 3.07%

- BTC funding rate is at 0.0041% (4.4545% annualized) on Binance

- DXY is unchanged at 99.18

- Gold is up 1.01% at $3015.9/oz

- Silver is up 0.48% at $34.67/oz

- Nikkei 225 closed +0.8% at 37,747.45

- Hang Seng closed +0.6% at 23,654.03

- FTSE is up 0.29% at 8,812.23

- Euro Stoxx 50 is up 0.88% at 5,422.97

- DJIA closed on Tuesday +0.51% at 42,519.64

- S&P 500 closed +0.58% at 5,970.37

- Nasdaq closed +0.81% at 19,398.96

- S&P/TSX Composite Index closed +0.14% at 26,426.6

- S&P 40 Latin America closed +0.43% at 2,578.93

- U.S. 10-year Treasury rate is down 1 bps at 4.46%

- E-mini S&P 500 futures are up 0.18% at 5,992.0

- E-mini Nasdaq-100 futures are up 0.14% at 21,737.00

- E-mini Dow Jones Industrial Average Index futures are up 0.11% at 42,645.0

Bitcoin Stats

- BTC Dominance: 64.03 (-0.22%)

- Ethereum to bitcoin ratio: 0.02500 (1.62%)

- Hashrate (seven-day moving average): 927 EH/s

- Hashprice (spot): $52.83

- Total Fees: 4.8 BTC / $508,729

- CME Futures Open Interest: 148,790 BTC

- BTC priced in gold: 31.2 oz

- BTC vs gold market cap: 8.85%

Technical Analysis

- Ether ETH has shown notable resilience over the past couple of weeks, holding its ground better than both bitcoin and Solana’s SOL.

- The 200-day exponential moving average continues to act as a firm support level on the daily chart, reinforcing the bullish structure. For upside momentum to continue, bulls will be looking for ETH to maintain this support and break above the daily order block that has capped price action over the past month.

- With ether outperforming other major digital assets, sustained strength in the broader market could pave the way for a move beyond $3,000 in the short to medium term.

Crypto Equities

- Strategy (MSTR): closed on Tuesday at $387.43 (+4.07%), +0.12% at $387.91 in pre-market

- Coinbase Global (COIN): closed at $258.91 (+4.94%), +1.07% at $261.67

- Galaxy Digital Holdings (GLXY): closed at C$26.24 (+3.31%)

- MARA Holdings (MARA): closed at $15.33 (+6.75%), -0.26% at $15.29

- Riot Platforms (RIOT): closed at $9.03 (+6.49%), +0.55% at $9.08

- Core Scientific (CORZ): closed at $11.8 (+7.96%), +1.02% at $11.92

- CleanSpark (CLSK): closed at $9.21 (+6.97%), -0.22% at $9.19

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $17.92 (+4.19%)

- Semler Scientific (SMLR): closed at $35.58 (-0.03%), +0.62% at $35.80

- Exodus Movement (EXOD): closed at $29.85 (+12.47%), unchanged in pre-market

ETF Flows

Spot BTC ETFs

- Daily net flow: $375.1 million

- Cumulative net flows: $44.46 billion

- Total BTC holdings ~ 1.20 million

Spot ETH ETFs

- Daily net flow: $109.5 million

- Cumulative net flows: $3.25 billion

- Total ETH holdings ~3.69 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- June has historically been a muted month for bitcoin performance. Since 2013, the average return for BTC stands at -0.28%, making it the second-worst performing month of the year.

- Only September is worse, on average.

While You Were Sleeping

- U.S. President Donald Trump’s Social Media Firm Truth Social to Launch Spot Bitcoin ETF (CoinDesk): NYSE Arca submitted paperwork for a bitcoin fund backed by Yorkville America Digital and Trump Media, with Foris DAX Trust Company named as custodian if the product receives SEC approval.

- MARA Sets Post-Halving Record With Highest Bitcoin Production Since January 2024 (CoinDesk): The firm produced 950 BTC last month, up 35% over April. CEO Fred Thiel credited the company’s vertically integrated model for improving operational control and cost-efficiency.

- Bitcoin Profit Taking Speeds Up Post Golden Cross, Hourly BTC Cashouts Top $500M, Blockchain Data Show (CoinDesk): Bitcoin’s 50-day moving average crossed above the 200-day measure on May 22, coinciding with a stretch of unusually high realized profits that suggests active repositioning during the rally.

- A New Era of Trade Warfare Has Begun for the U.S. and China (The New York Times): The U.S. is tightening tech exports while China curbs rare earths, escalating tensions beyond tariffs and disrupting industries like aerospace, electric vehicles and defense.

- Putin’s War Economy Roars Ahead and the Rest of Russia Struggles (Bloomberg): Defense-linked factories are booming thanks to state orders, while most other industries face slumping demand, rising costs and tighter credit as sanctions and inflation bite.

- Higher Metals Tariffs Kick In as Deadline for ‘Best’ Offers Arrives (Reuters): Trump’s 50% tariffs took effect Wednesday, hitting Canada and Mexico hardest as they supply much of the U.S.’s imported steel and aluminum.

In the Ether