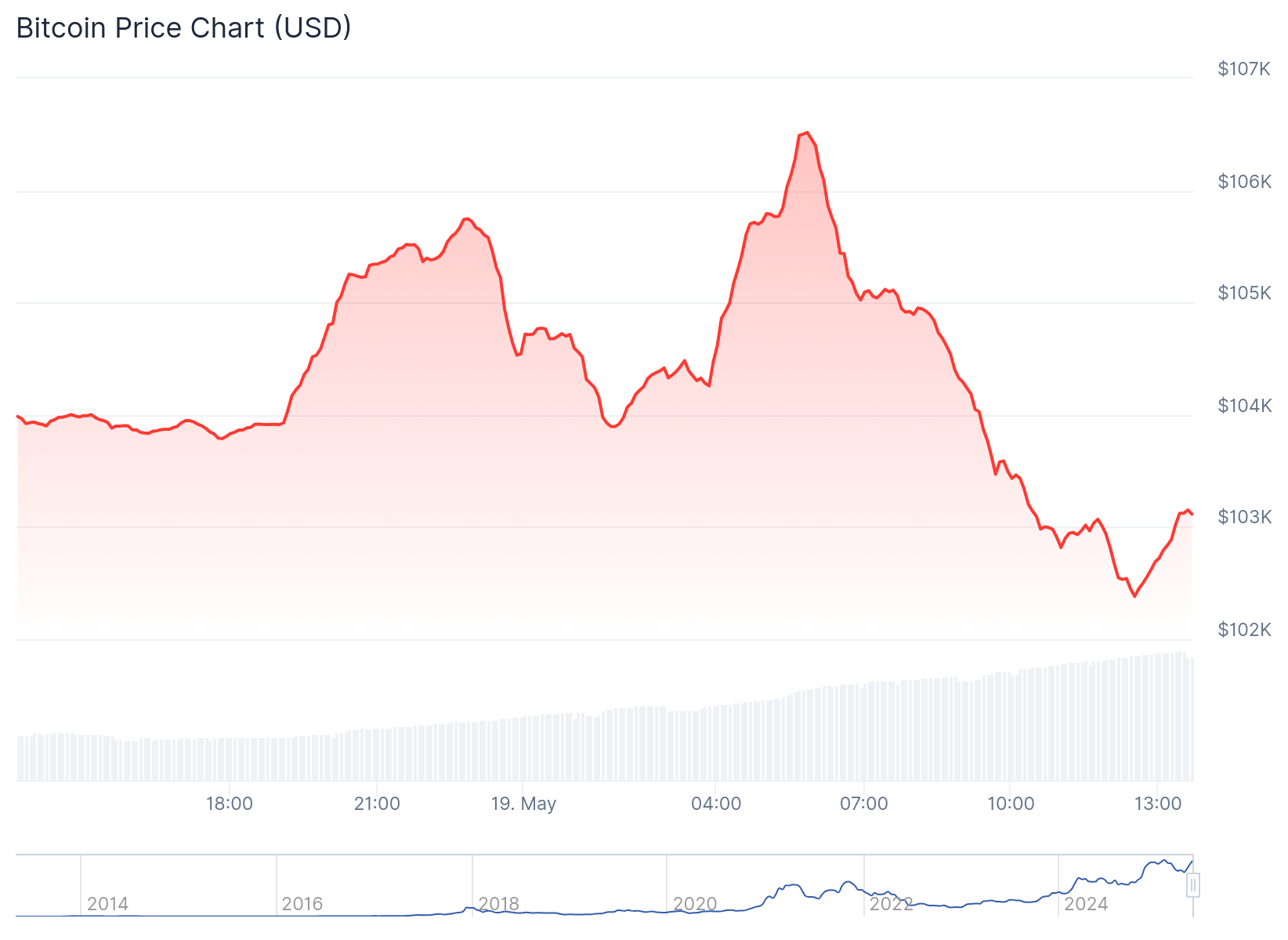

Over $600 million in crypto derivatives positions have been liquidated since late Sunday as bitcoin (BTC) staged a sharp rally past $106,000 in the wee hours, only to reverse course and dump back to near $103,000, catching both bulls and bears off guard.

The move began around 21:00 UTC on Sunday, when bitcoin spiked more than $2,500 in less than an hour — a pattern that can be attributed to thin weekend liquidity and potential algorithmic buying triggered by technical levels.

Such price action was a textbook short squeeze followed by aggressive profit-taking or stop-run. A short squeeze happens when traders betting against a price (short sellers) are forced to buy the asset as it rises, to cover their losses, which pushes the price even higher and often very quickly.

The sudden move wiped out over $460 million in long positions and $220 million in shorts, across futures tracking majors like ether (ETH), solana (SOL), and dogecoin (DOGE).

The liquidation wave was notable for occurring during traditionally quiet weekend hours, an unusual event that marks forced selling or buying activity by a major player.

SOL, DOGE and XRP prices are down more than 4% in the past 24 hours, data shows, with the broad-based CoinDesk (CD20) down more than 2%.

The volatility follows a week of macro uncertainty, with Moody’s cutting the U.S. credit rating on Friday and inflation fears resurfacing after mixed economic data. The downgrade also led to U.S. 30-year treasury yields breaching the 5% mark.

While crypto has broadly benefited from renewed institutional inflows and spot ETF momentum, traders remain cautious at current price levels, as reported.

Bitcoin is flat over the past week, but the recent failure to hold above $106,000 — a key psychological and technical level — may signal near-term resistance, FxPro’s Alex Kuptsikevich told CoinDesk last week.

Meanwhile, some traders anticipate higher volatility in the days to come in a warning sign for those looking to leverage their bets.

“Investors are shifting capital to Bitcoin as concerns grow over a pending US spending bill that could add trillions in debt and push for higher Treasury premiums,” Haiyang Ru, co-CEO of the HashKey Business Group, told CoinDesk in a Telegram message.

“But while bitcoin hovers just below new highs, we anticipate more market volatility as traders prepare for new trade deals and a final version of the fiscal policy,” Ru added.

Read more: U.S. 30-Year Treasury Yield Breaches 5% Amid Moody’s Rating Downgrade, Fiscal Concerns