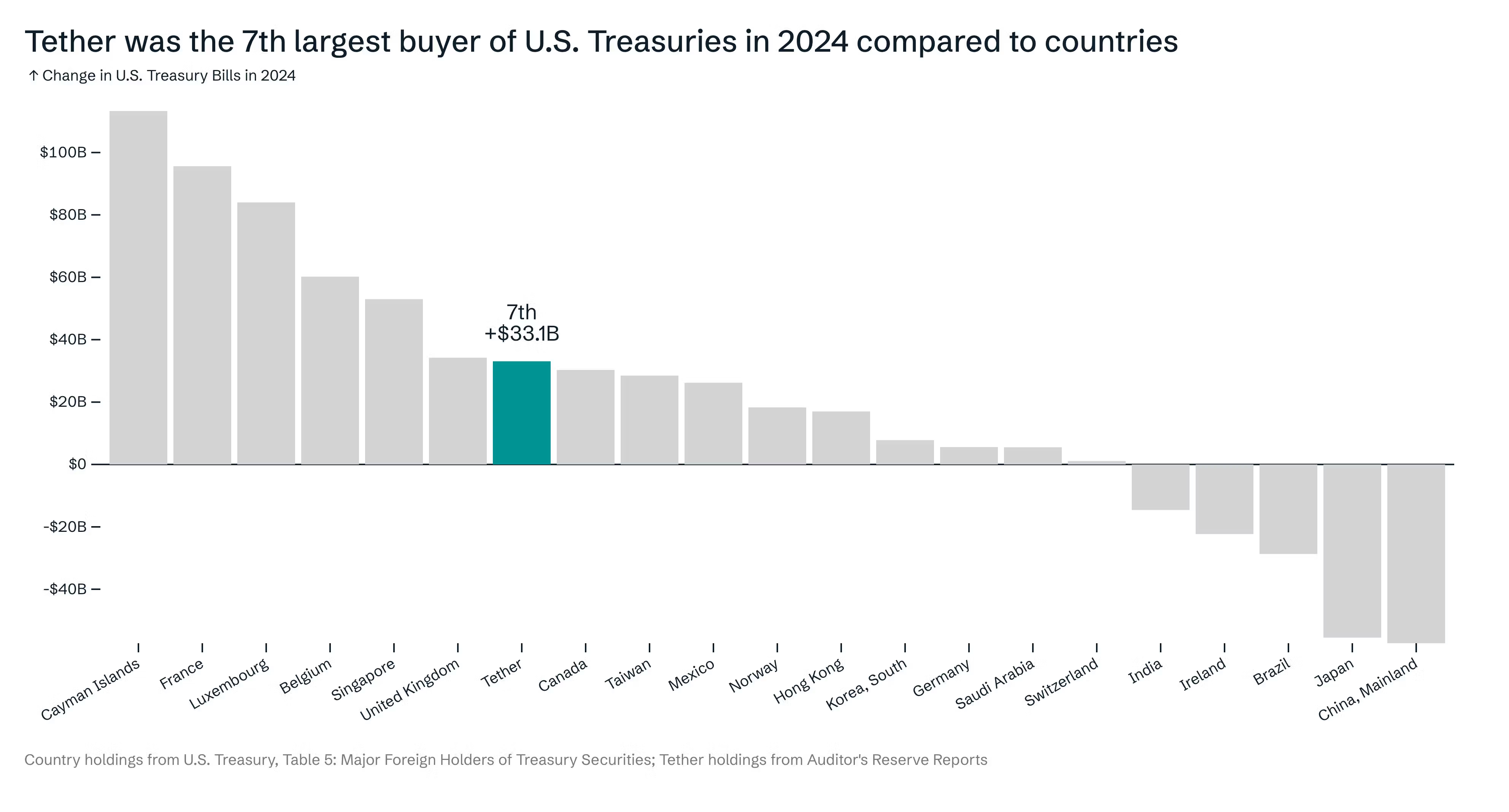

Tether, the crypto company behind the largest stablecoin USDT, said it would rank as the seventh largest net buyer of U.S. Treasury securities in 2024 among countries.

The firm purchased a net $33.1 billion worth of U.S. Treasury securities last year, according to a compilation posted on Thursday by CEO Paolo Ardonio using data from Tether’s reserve reports and the U.S. Treasury Department.

That puts the stablecoin issuer above countries like Canada, Mexico and Germany in the ranking, while Japan and China were net sellers by significantly reducing their U.S. Treasury holdings.

The data underscores the case of U.S. dollar stablecoins being a key force of demand in the U.S. government debt market. Treasury Secretary Scott Bessent said earlier this month that crypto and stablecoins are key to preserve the U.S. dollar’s global dominance. President Trump echoed the argument on Thursday at a pre-recorded message at the Digital Asset Summit.

Read more: Crypto Will ‘Expand Dominance of U.S. Dollar,’ Trump Says

Circle’s USDC, the second-largest stablecoin and fully backed by U.S. government securities, cash and other cash-equivalent assets, increased its market capitalization by $19 billion last year. USDT’s market cap, which is predominantly backed by U.S. government securities, grew by $45 billion during the same period.