Gold has surged to a new all-time high, surpassing $3,025 per ounce to mark an increase of over 15% in since the turn of the year. Meanwhile, bitcoin is lagging (BTC), down 10% year-to-date.

Several factors have contributed to gold’s rally, including significant inflows into gold ETFs and its traditional role as a safe-haven asset during geopolitical uncertainty.

Additionally, discussions of new tariffs in the U.S. under President Trump have further fueled demand for U.S. equities. Gold’s historic rally has driven its price up 40% year-over-year, far outpacing Bitcoin’s 16% gain.

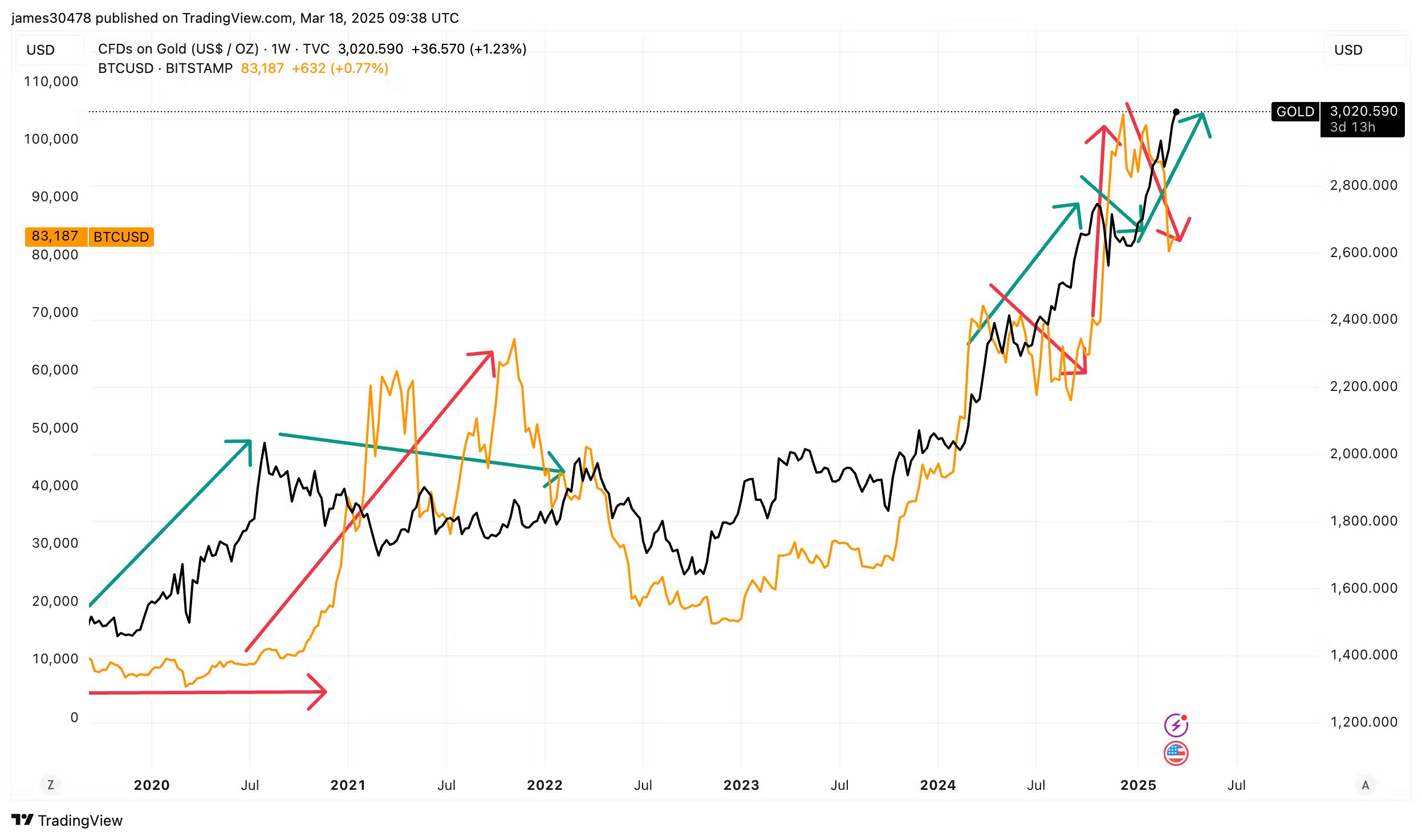

Historically, when gold enters a bull market, bitcoin often stagnates or declines. The two assets rarely move in tandem, though there are occasional periods when both rise or fall simultaneously.

Between 2019 and Q3 2020, gold experienced a strong rally while bitcoin remained largely flat, coinciding with the covid-19 pandemic. In contrast, bitcoin saw its bull run in 2021 while gold stagnated. By 2022, as global interest rates began to rise, both assets faced pressure before rebounding in 2023 and 2024. Now, in 2025, the market is witnessing a renewed divergence between the two.

ByteTree founder Charlie Morris has described this gold rally as a “proper gold rush”—something the market hasn’t seen since 2011.

“Gold above $3,000, silver above $24, and gold stocks gaining momentum—it struck me that the crypto crowd has never witnessed a true gold rush. The last time this happened was in 2011, when Bitcoin was just emerging at $20. They will now.”