Crypto bulls nursed at least $1.2 billion in losses over the past 24 hours as the market slump from Monday worsened during the Asian hours on Tuesday, driving bitcoin (BTC) to under $89,000, its lowest since mid-November.

Apart from Bybit, crypto exchanges report only one liquidation per second, meaning the overall losses are much higher than the recorded $1.35 billion across long and short trades.

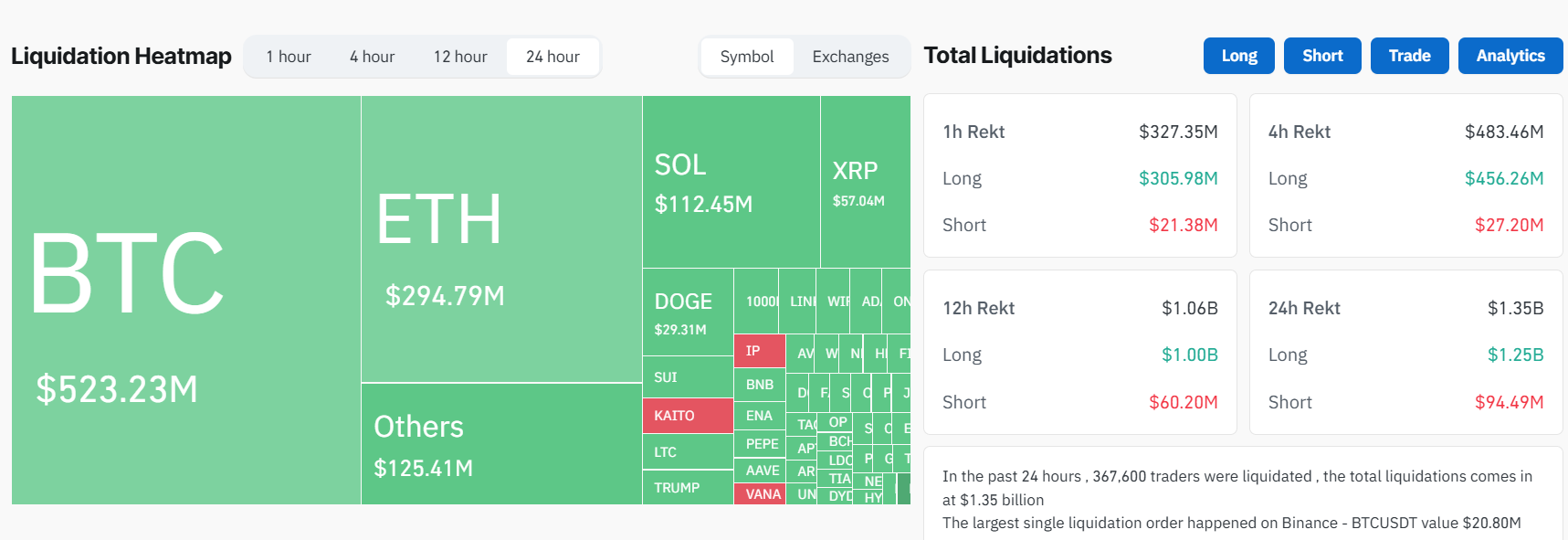

Futures tracking bitcoin registered over $530 million in liquidations, while ether (ETH) bets saw over $294 million evaporated. Solana (SOL) futures lost $112 million as the token slumped more than 15%, while a 14% dive in XRP and doge (DOGE) led to over $80 million in losses cumulatively.

Liquidations occur when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. It happens when a trader cannot meet the margin requirements for a leveraged position, that is, they don’t have enough funds to keep the trade open.

Crypto exchange Bybit — which has fully recovered assets after a $1.4 billion hack last week — led liquidation figures with over $600 million lost on the exchange, followed by Binance at $300 million and OKX at $147 million.

Nasdaq futures pointed to continued losses in technology stocks and strength in the Japanese yen sparked fears of an August-like risk aversion.

Investors tend to flock to the yen during economic uncertainty or market stress as it is seen as a safe haven, much like the U.S. dollar or gold. This risk-off sentiment usually pressures riskier assets — like bitcoin or equities — as investors pull money out of speculative investments and park it in safer bets.