Volatility traders looking to capitalize on significant price swings may soon find opportunities. A key indicator suggests that bitcoin (BTC), currently above $100,000, resembles a coiled spring poised to release energy in either direction.

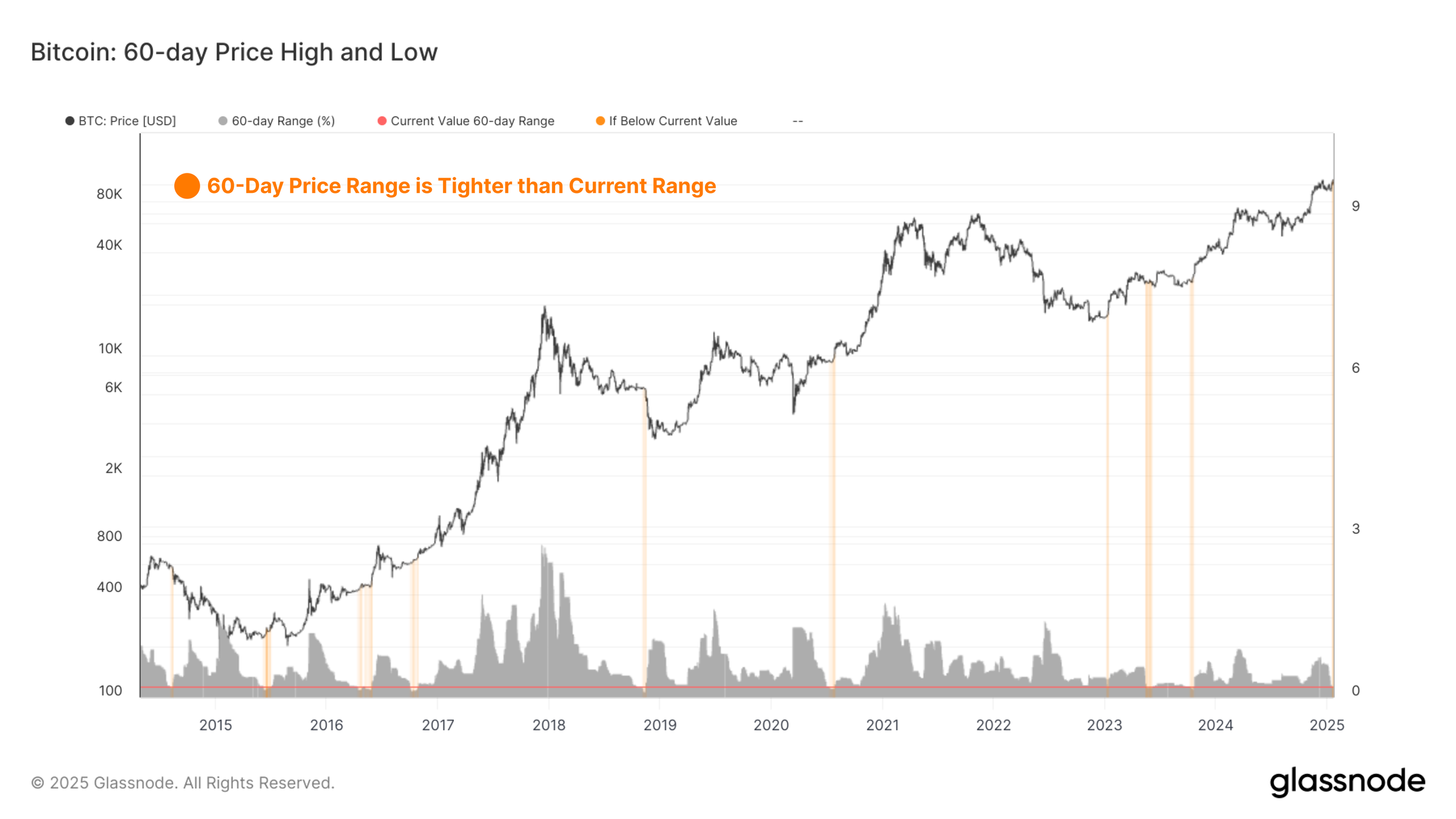

The indicator is the rolling 60-day price range, representing the variation in maximum and minimum price ticks in percentage terms. A tighter range implies stable market conditions characterized by range play and demand-supply equilibrium.

Analysis by Glassnode shows that bitcoin’s 60-day range is now tighter than the current trading range. Historically, such patterns have presaged volatility explosions.

“All of these instances have occurred prior to a significant burst of volatility, with the majority being in early bull markets or prior to late-stage capitulations in bear cycles,” Glassnode said in its weekly analysis report.

Volatility is mean-reverting, that is, it tends to oscillate around its lifetime average. Rapid price swings typically follow a low-volatility period and vice versa.

It is also price agnostic. Higher volatility means price fluctuations will become bigger and potentially more unpredictable. It does not say whether prices will surge or slump.

Recent flows, however, have been biased bullish, particularly on the Chicago Mercantile Exchange, where traders have been piling into call options. A similar bullish bias is apparent on Deribit and other exchanges.

“BTC futures continue to trend upward, especially on the front end, as the market’s net-long exposure from last week remains solid. Bullish bets currently outpace bearish ones by a ratio of approximately 20:1,” QCP Capital said in a Telegram broadcast.

If the positioning is a guide, it’s safe to say that market participants expect a bullish resolution to BTC’s multiweek consolidation between $90,000 and $110,000.