U.S. President-elect Donald Trump’s TRUMP token has made quite a splash in the crypto market, rapidly becoming the 21st largest digital asset with a market cap of $11 billion in just two days.

The TRUMP/USDT pair has emerged as the most-traded pair over the past 24 hours on the leading exchange, Binance, representing 13.3% of the total exchange volume, according to Coingecko.

While this activity is thrilling, the bulls and those looking to join the market ahead of Donald Trump’s inauguration might want to exercise caution, as a key derivatives market indicator has diverged bearishly from the token’s rising futures open interest.

Open interest in TRUMP perpetual futures has increased by 6% in the past 24 hours, according to data source Velo Data. Although prices have retraced from $70 to $58 since the Asian hours, they remain up by 3%.

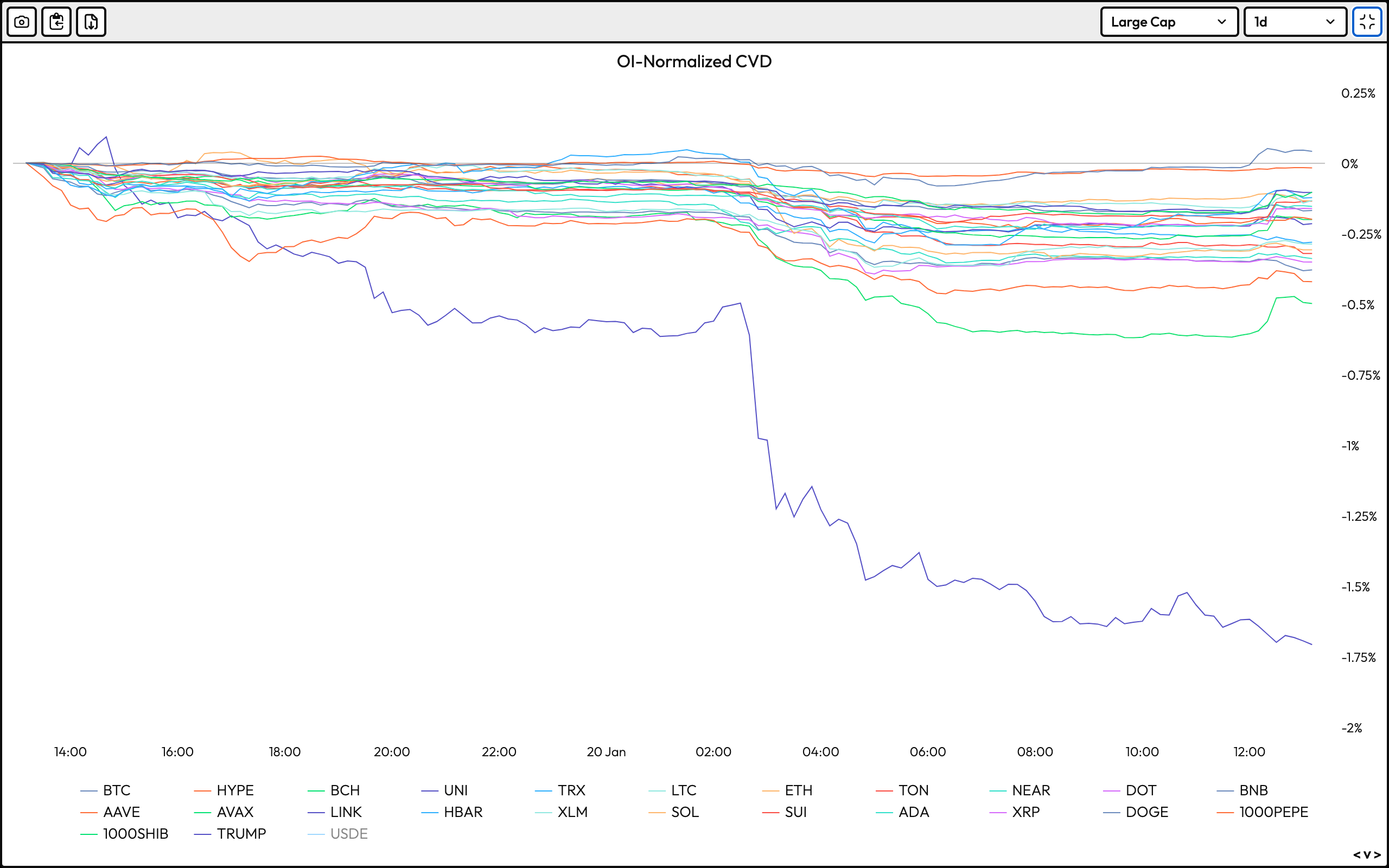

However, the perpetual futures cumulative volume delta, which reflects the difference between buying and selling volume, has dropped by over 1%, indicating a relative increase in selling volume. In other words, traders are either taking outright shorts or bearish bets or closing long positions.

Besides, the market for TRUMP looks overheated, with those holding long positions paying an annualized funding fee of over 170% to shorts to keep their positions open. If the market stops rallying, holding longs will become a burden, potentially spurring an unwinding of the bullish bets. That, in turn, could lead to a deeper price slide.

The chart shows most major cryptocurrencies have experienced a net selling in perpetual futures in the past 24 hours. Perhaps, market participants are fearing market-wide price losses in a classic “sell the fact” action following Trump’s inauguration.