The market for alternative cryptocurrencies (altcoins) may see an extra dose of volatility this week, as the impending token unlock schedule will release billions of dollars worth of supply for several coins, including Ondo Finance’s ONDO token.

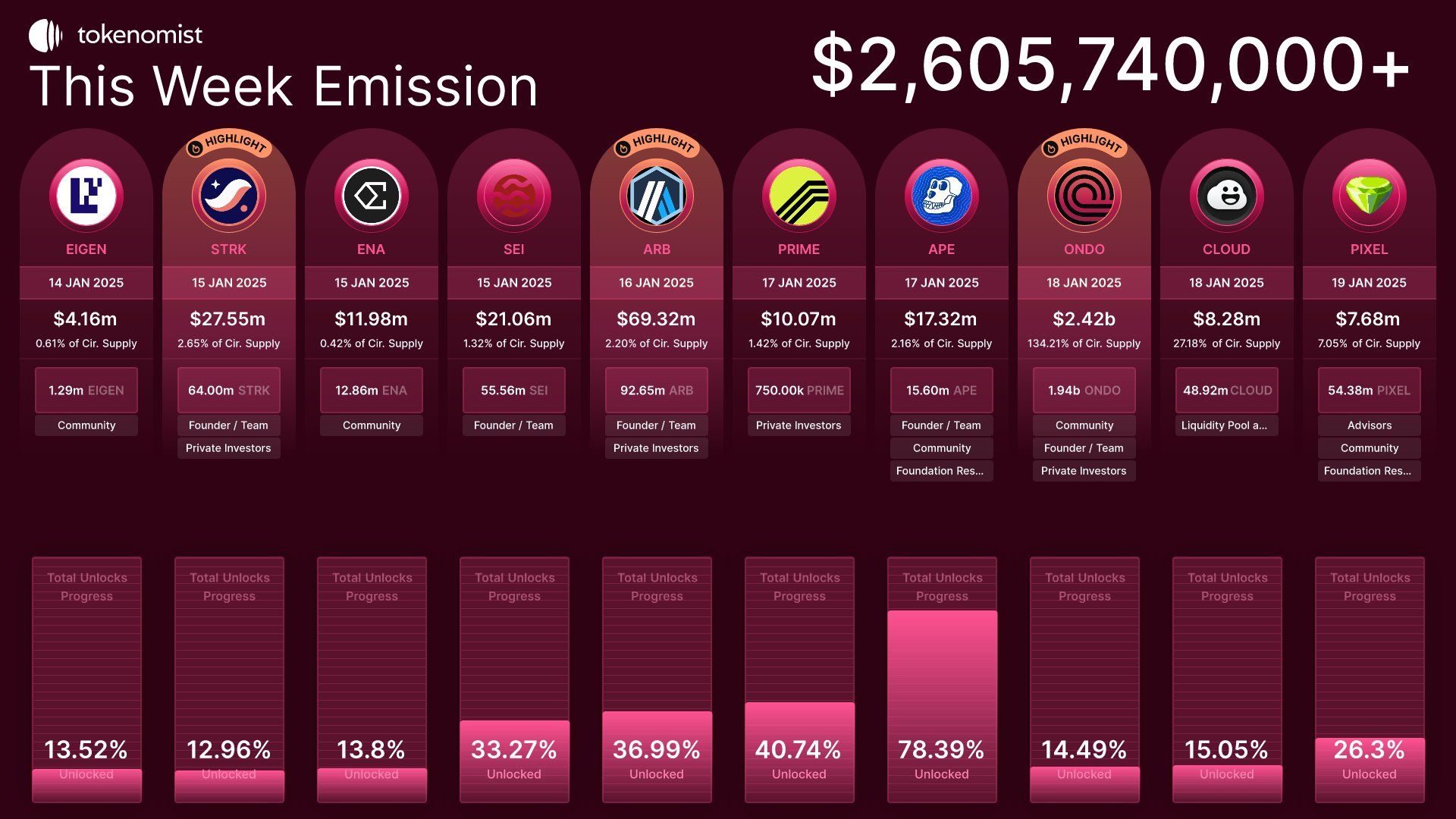

Data from Tokenomist show the weekly unlocks calendar, that includes names like ONDO, ARB, STRK SEI and others, is worth $3 billion – the largest amount since November.

Decentralized tokenization-focused platform Ondo Finance’s ONDO accounts for a giant share of the tally.

On Jan. 18, the project will free up 1.94 billion ONDO worth $2.23 billion, equating to over 130% of the token’s circulating supply of around 1.4 billion. ONDO’s impending unlock is also several times bigger than its daily trading volume, which has recently ranged between $250 million to $300 million.

Unlocks are staggered releases of tokens initially frozen to prevent early investors and project team members from liquidating coins at once. The gradual release helps avoid rapid price swings and market instability.

Yet, occasionally, we get to see ONDO-like unlocks that are bigger in terms of the circulating supply of the token or the coin’s average daily volume, threatening to inject volatility into the market. Per Research by The Tie, tokens facing unlocks equivalent to 100% of the average daily volume experience volatility in the lead-up to and following the event.

ONDO changed hands at $1.14 at press time, the lowest since Dec. 2, representing a 5% loss for the day and a nearly 15% month-to-date decline. Prices have been in a free fall since hitting record highs above $2.10 on Dec. 16, TradingView data show.