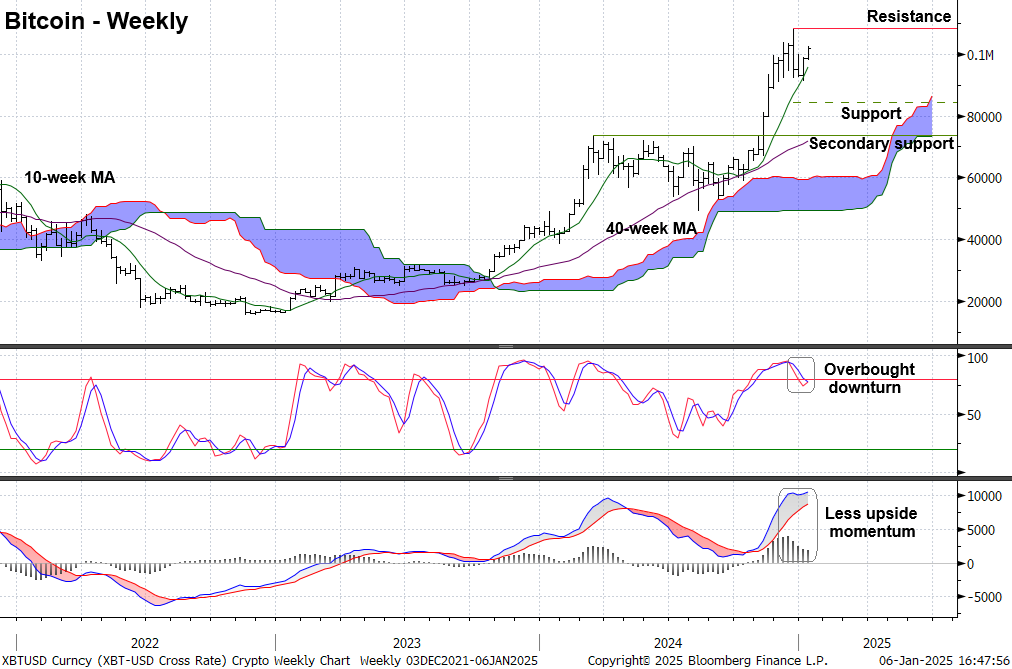

Bitcoin rounded out an exceptionally strong 2024 (up 120% yoy) with a whimper, logging the first overbought “sell” signal on its weekly bar chart since mid-April according to the stochastic oscillator, which is an indicator of trend exhaustion. The signal suggests bitcoin will remain range-bound, at least in the short term (roughly 2-6 weeks), as other risk assets (e.g., equities) continue to pull back.

Key technical levels to watch for bitcoin:

Minor resistance is at the most recent high, near $108K, above which is “uncharted” territory. A breakout would be a bullish development, but the momentum does not appear strong enough to generate a breakout at this time.

Initial support is near $84.5K, defined by the Ichimoku cloud model, which is a trend-following model based on historical prices. Recent deterioration in our intermediate-term indicators increases the chances that a pullback will deepen further, with secondary support near $73.8K, reinforced by the rising 200-day (~40-week) moving average.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Despite short- and intermediate-term bearish signals, the long-term outlook for bitcoin remains bullish from a technical perspective following the post-election breakout in November. The breakout to new highs marked emergence from a several-month downtrend channel, and it helped long-term momentum indicators like the monthly moving average convergence/divergence (MACD) reaccelerate. Thus, a correction for bitcoin in Q1 should present an opportunity to add exposure ahead of another upleg in bitcoin later in 2025.

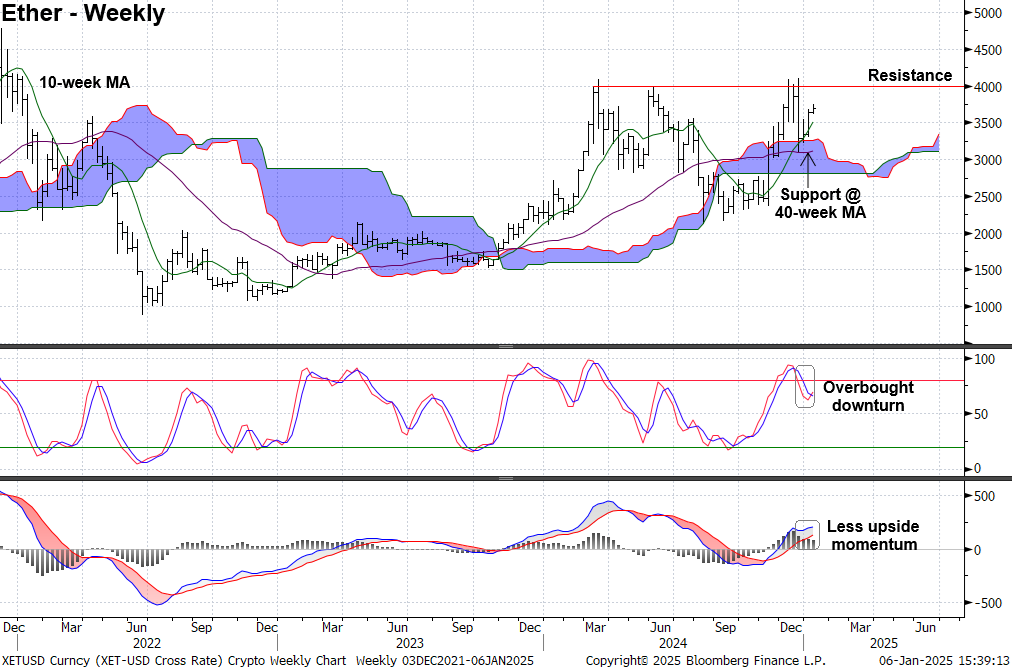

Ethereum: resistance near $4000 is a hurdle for early 2025

Like bitcoin, ether has flashed an overbought “sell” signal, which comes after a rejection at important resistance near $4000. The “sell” signal has intermediate-term implications, supporting a corrective phase over the next couple of months. Ether also has initial support at the daily Ichimoku cloud model, near $3226, above which it has stabilized. We expect a correction in Q1 to lead to a breakdown and test of the 200-day (40-week) moving average. However, our long-term indicators still point higher, albeit less convincingly, compared to bitcoin. A breakout above the $4000 level would likely result in improved long-term metrics like the monthly MACD.

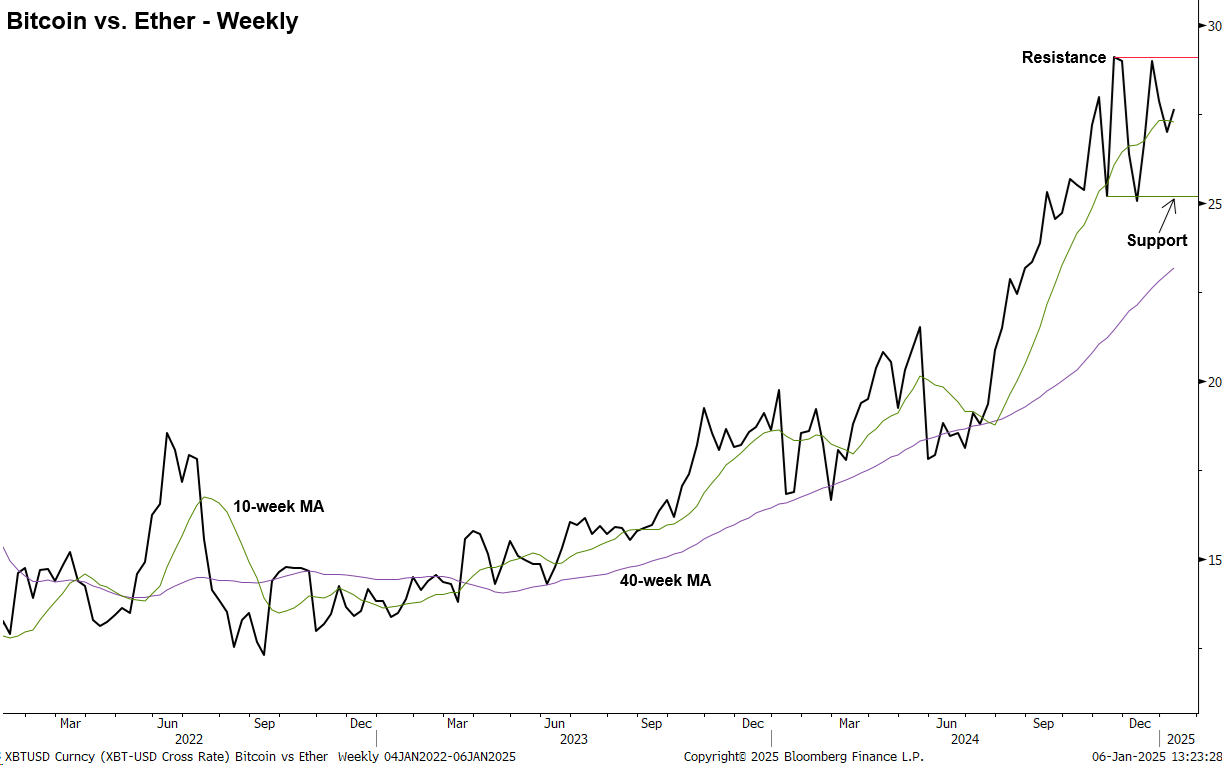

Bitcoin vs. ether: 2024 outperformance by bitcoin gives way to volatility

In 2024, bitcoin outperformed ether by 74%, a trend that can be clearly seen in the bitcoin/ether ratio. Since early November, relative performance has become more fickle between the two largest cryptocurrencies, evidenced by the wide trading range that has taken hold of the ratio.

During a crypto market correction, bitcoin normally outperforms ether since it is usually deemed as “safer.” However, all cryptocurrencies are likely to trade lower in absolute terms when risk assets are undergoing a correction, noting that correlations tend to go up when markets go down. Nevertheless, a bullish long-term outlook suggests that Q1 volatility may present an opportunity to add exposure with a more favorable risk/reward profile, ideally waiting for the intermediate-term indicators to turn up again.